In 2025, the landscape of RWA collectibles is being transformed by a phenomenon few could have predicted: the tokenization of Pokémon cards. Once the province of childhood nostalgia and niche collector circles, these iconic trading cards are now at the heart of a trillion-dollar movement to bring real-world assets on-chain. The result? A vibrant, liquid market for on-chain trading cards, where authenticity, security, and global access are all powered by blockchain technology.

The Mechanics Behind Tokenized Pokémon Cards

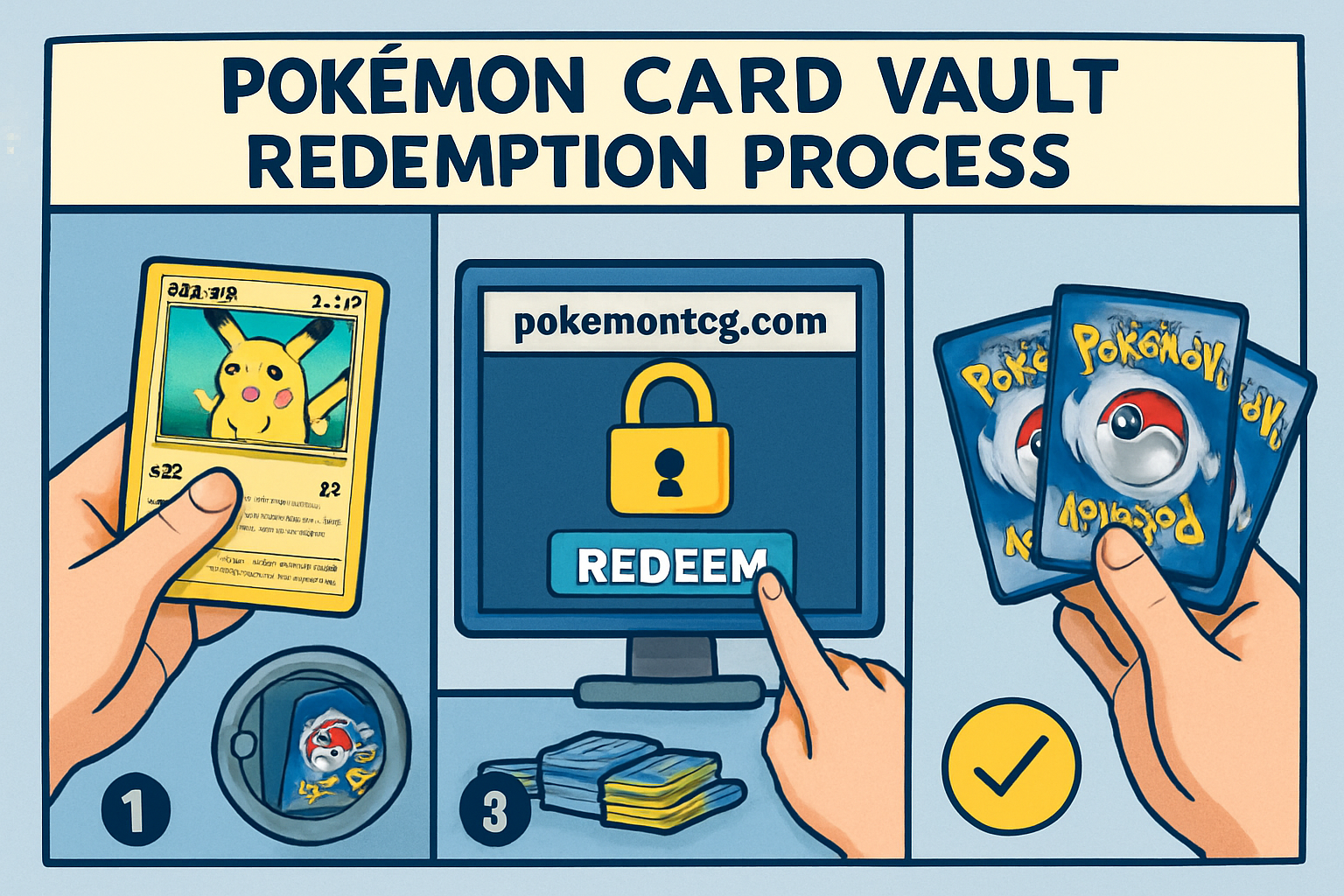

The process begins with professional grading, ensuring each card’s condition and legitimacy. Once verified, physical Pokémon cards are securely vaulted in specialized facilities, often in Japan or the US, before being tokenized as NFTs. Each digital token is backed 1: 1 by its physical counterpart, creating a tamper-proof record of ownership on blockchains such as Polygon and Solana.

This new infrastructure rests on three pillars:

The Three Pillars of Tokenized Pokémon Card Infrastructure

-

Professional Grading: The foundation of tokenized Pokémon cards begins with expert authentication and grading by recognized services. This process ensures each card’s condition and authenticity, providing a trusted baseline for collectors and investors before tokenization. Graded cards are typically assigned a score and sealed, making them ready for secure storage and on-chain representation.

-

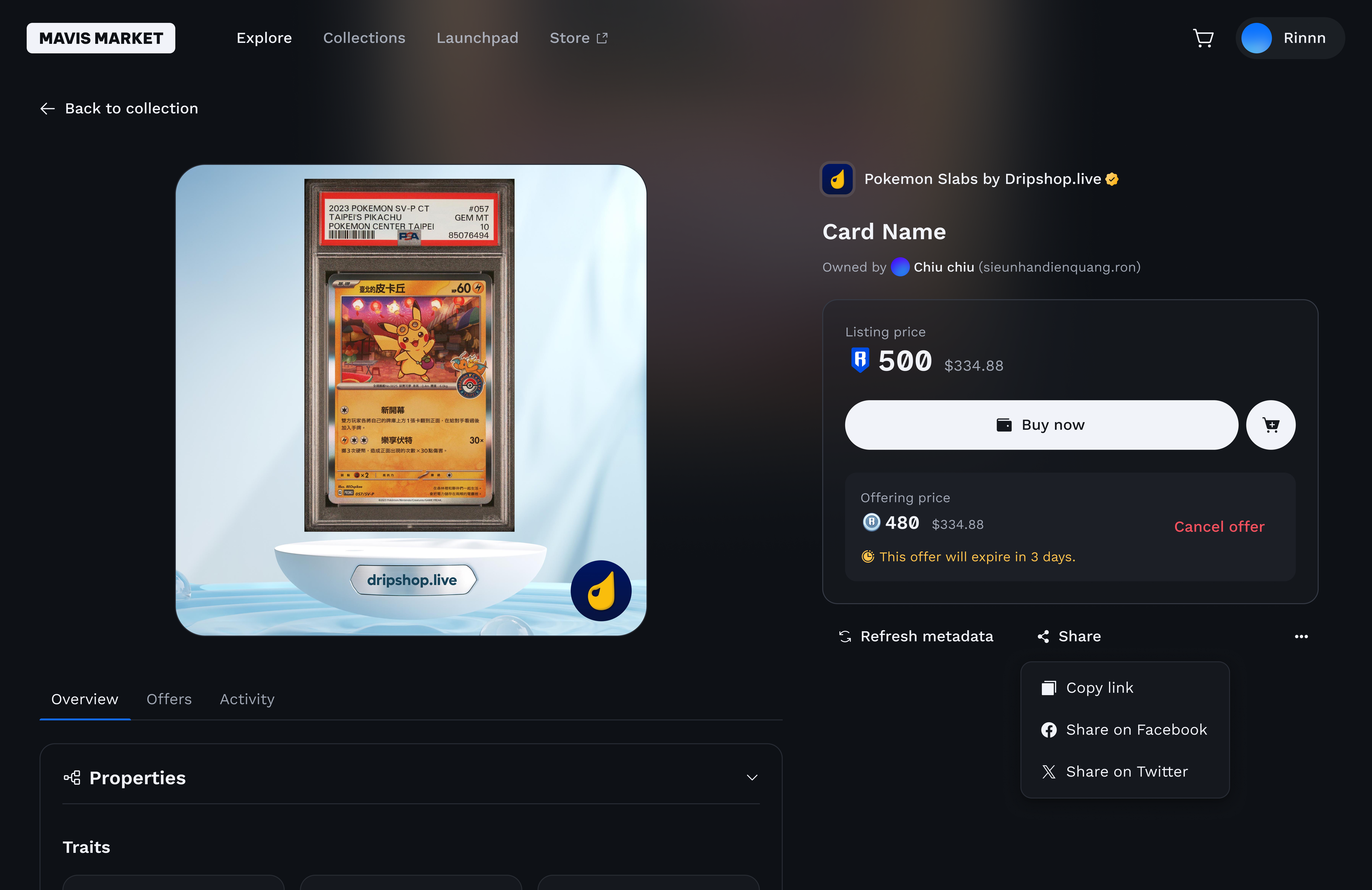

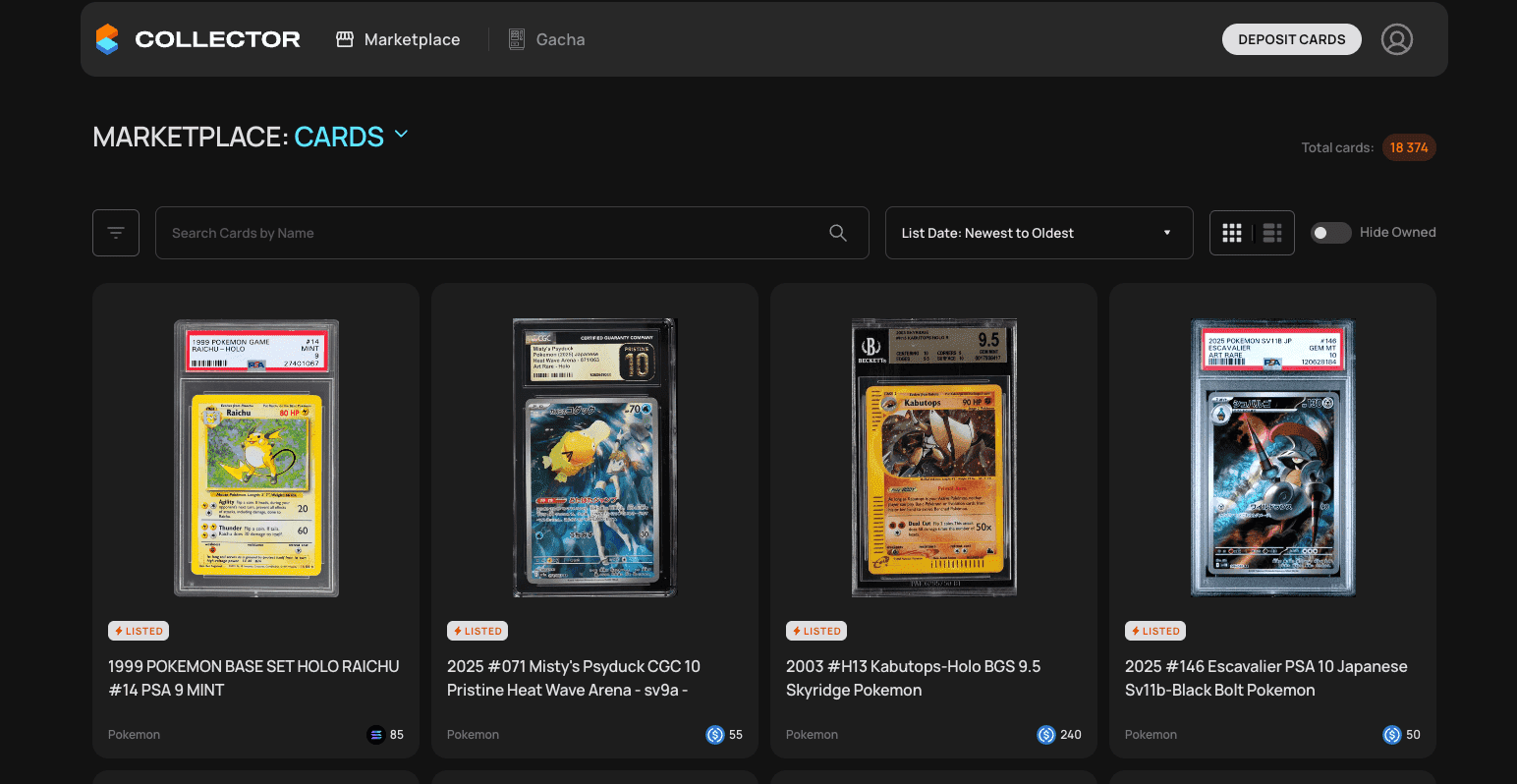

NFT Minting: The final pillar is minting NFTs that represent ownership of the physical cards. Platforms such as Collector Crypt on Solana and Courtyard on Polygon create blockchain-based tokens that can be traded globally. These NFTs are redeemable for the underlying physical cards, ensuring both liquidity and verifiable provenance on-chain.

Platforms like Holos, Courtyard, and Collector Crypt have emerged as leaders in this space. Holos converts collectibles into blockchain-verified tokens redeemable for their physical versions at any time. Courtyard mints NFTs for cards stored in secure vaults, while Collector Crypt leverages Solana’s speed to back its native $CARDS token with pools of real Pokémon cards.

The Market Surge: Over $100 Million in Monthly On-Chain Trading Volume

The numbers speak volumes about collector appetite. In a recent month, on-chain trading volume for tokenized Pokémon cards surpassed $100 million. This surge is not merely speculative; it reflects genuine demand from enthusiasts who value instant liquidity, transparent provenance, and borderless access to rare assets.

This liquidity stands in stark contrast to traditional collectible markets, which are often hampered by slow shipping times and opaque authentication processes. Now collectors anywhere can buy or sell high-value graded cards, sometimes worth millions, at the click of a button.

Why Tokenization Matters: Security, Access, and Authenticity

The benefits extend far beyond convenience. By leveraging blockchain’s immutable ledger for grading verification blockchain, platforms dramatically reduce counterfeiting risks, a longstanding issue in the collectibles world. Every transaction is transparently recorded, providing an auditable chain of custody from initial grading through every subsequent trade.

- Enhanced Liquidity: Trade assets 24/7 without waiting for physical delivery.

- Global Accessibility: Anyone with an internet connection can participate in auctions or direct sales.

- Tamper-Proof Provenance: Blockchain records ensure transparent ownership history and authenticity checks.

This convergence of security and accessibility is attracting not just die-hard collectors but also crypto investors seeking exposure to non-correlated alternative assets. As platforms refine their models, balancing regulatory compliance with user experience, the case for owning NFT Pokémon cards as RWAs grows stronger each quarter.

Perhaps the most compelling innovation is fractional trading collectibles. Tokenization allows a single high-value Pokémon card to be divided into smaller, tradable shares. This unlocks access for a broader range of collectors and investors, democratizing ownership of cards that previously would have been out of reach for all but the wealthiest buyers. The implications for market liquidity and price discovery are profound, as collective demand can now be expressed through micro-transactions on blockchain-based marketplaces.

Challenges and Future Outlook for On-Chain Trading Cards

Yet, the evolution of tokenized Pokémon cards is not without hurdles. The sector faces dual risks: volatility in collector sentiment and the ever-present specter of regulatory scrutiny. Platforms like Courtyard must navigate complex legal frameworks to ensure compliance as they bridge physical assets with digital tokens. Meanwhile, collectors must remain vigilant about platform credibility and custodial security, given that the value proposition hinges on the integrity of vaulting and grading partners.

However, these challenges are spurring innovation rather than stifling it. As tokenized RWAs gain traction, we see a push toward interoperability, where assets can move seamlessly between blockchains, and enhanced insurance solutions to protect against loss or theft. The market’s resilience is further underscored by continued growth: with $100 million in monthly trading volume now routine, platforms are scaling up infrastructure to handle increased demand while maintaining robust security standards.

Risks & Innovations in Tokenized Pokémon Card Markets

-

On-Chain Ownership & Tamper-Proof Records: Tokenization creates a verifiable digital record of ownership on blockchains like Polygon and Solana, enhancing transparency and reducing counterfeiting in the collectibles market.

-

Instant Liquidity & Global Trading: With platforms such as Collector Crypt leveraging Solana’s AMM infrastructure, collectors can trade Pokémon card NFTs 24/7, unlocking $100 million+ in monthly on-chain trading volume and enabling worldwide participation.

-

Regulatory & Compliance Challenges: As tokenized Pokémon cards blur the line between collectibles and securities, platforms like Courtyard face evolving regulatory scrutiny, especially amid the rapid $30.1T RWA tokenization growth projection.

-

Redemption & Physical Asset Risk: While token holders can redeem NFTs for physical cards, risks remain around vault security, shipping logistics, and custodial transparency, making robust operational practices essential for market trust.

For many collectors, this new paradigm represents more than a financial opportunity; it’s a way to engage with beloved cultural artifacts in an entirely modern context. Ownership now comes with digital proof, instant tradability, and global reach, qualities that were unimaginable just a few years ago.

How to Join the Tokenized Collectibles Revolution

If you’re looking to participate in this next wave of RWA collectibles, start by researching reputable crypto trading card platforms. Understand their grading standards, vaulting procedures, and redemption policies before committing capital. For those interested in hands-on guidance through this process, from choosing cards to minting NFTs, explore our comprehensive walkthrough at How to Tokenize Your Pokémon Cards as RWAs: Step-by-Step Guide for Collectors.

Which feature matters most to you when buying tokenized Pokémon cards?

Tokenized Pokémon cards are transforming the collectibles market by offering instant trading, global access, and secure, blockchain-verified ownership. As a collector or investor, which feature is most important to you when considering these digital assets?

As institutional investors begin eyeing exotic RWA categories like graded trading cards, expect competition, and innovation, to intensify. The ability to securely trade rare Pokémon cards as blockchain-backed assets is already reshaping how we define both collectibles and investments. For those willing to adapt early and invest with patience, as always, the rewards may extend far beyond nostalgia.