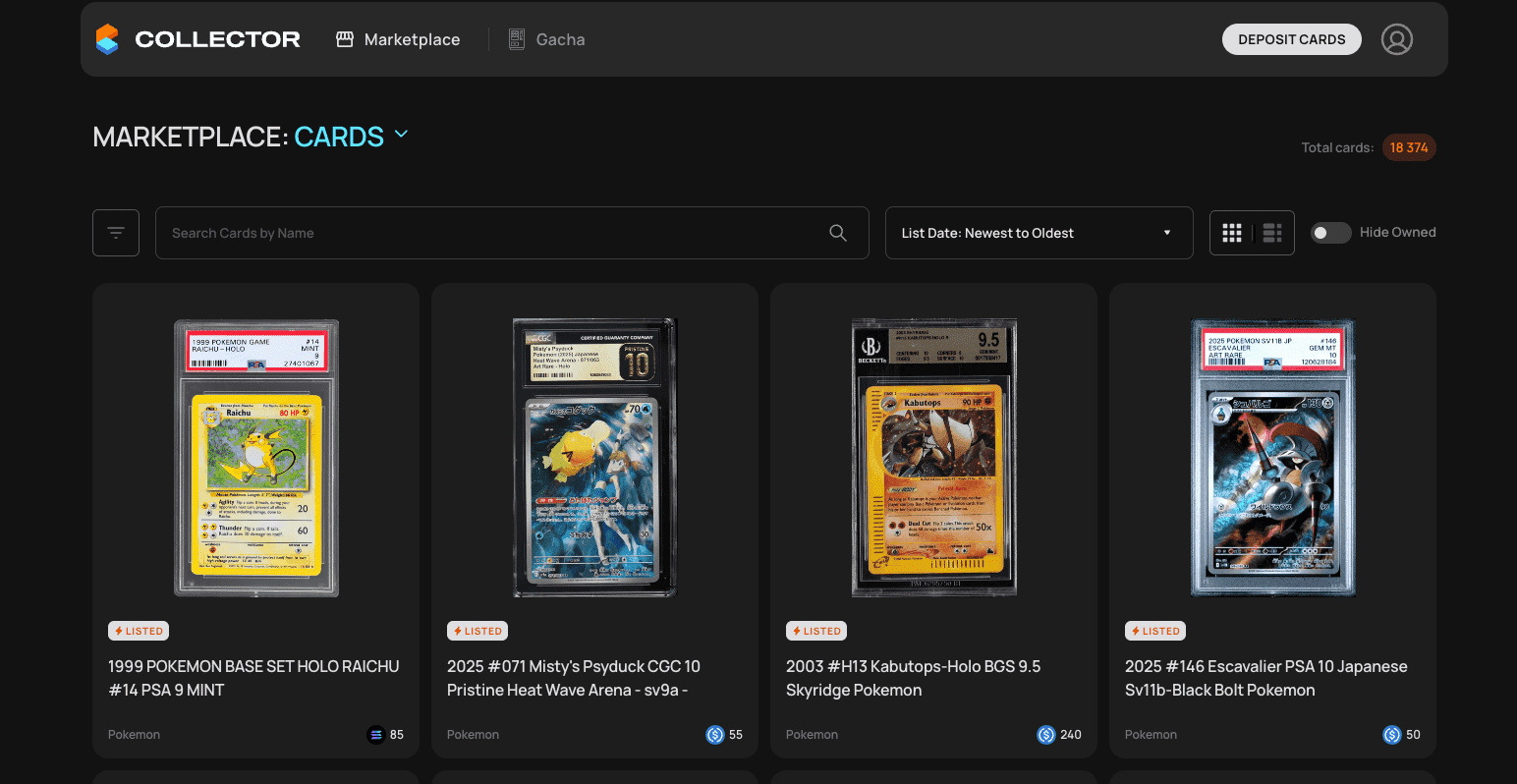

In 2024, Pokémon cards ignited a seismic shift in the world of on-chain collectibles, transforming from nostalgic cardboard treasures to one of the most sought-after real-world assets (RWAs) on the blockchain. The catalyst? Tokenization – a process that redefines ownership, liquidity, and global access for collectors and investors alike. Platforms like Collector Crypt and Courtyard have spearheaded this movement, leveraging blockchain to inject unprecedented transparency, speed, and efficiency into trading card markets.

Pokémon Cards: From Nostalgia to Digital Gold

Pokémon cards have always been more than just a game. Over the years, they evolved into high-value collectibles – with certain first-edition cards routinely commanding five- or six-figure sums in traditional markets. But 2024 marked a paradigm shift. By embracing blockchain tokenization, these iconic cards became digital gold, unlocking new dimensions of value and utility.

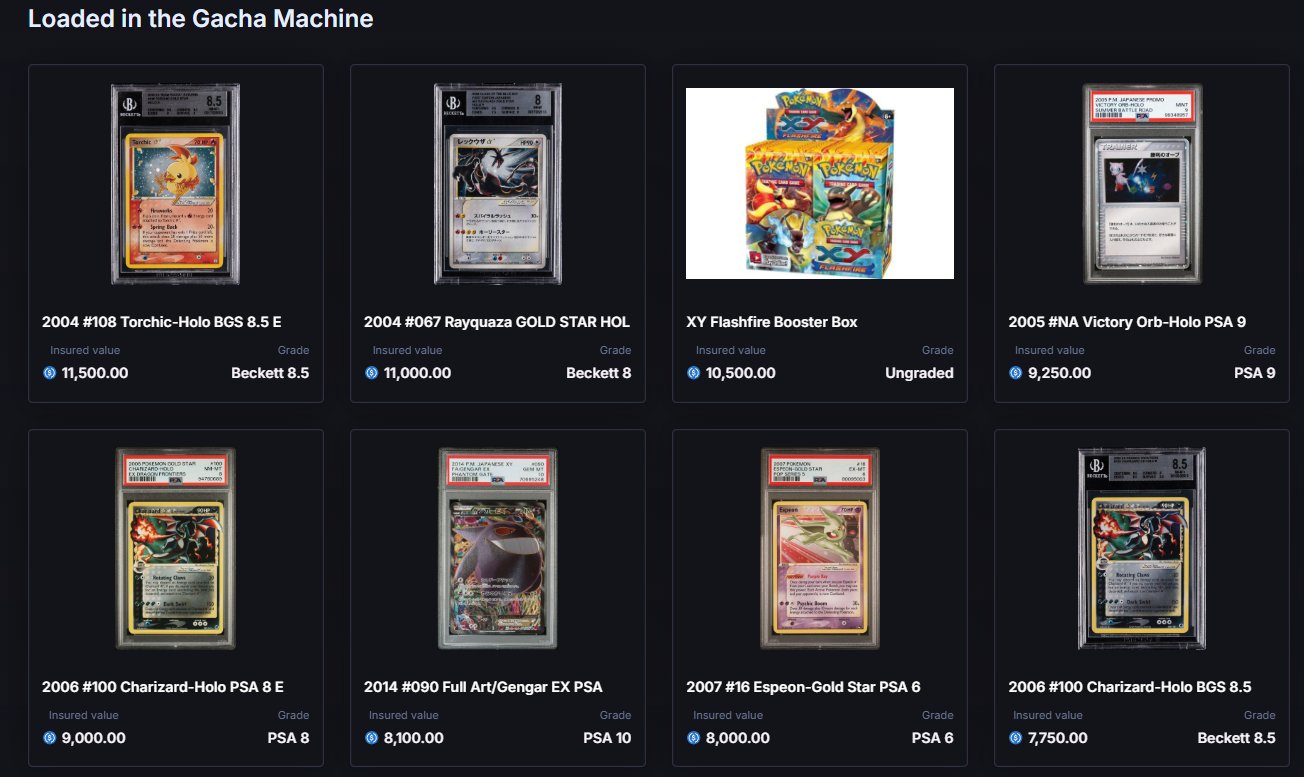

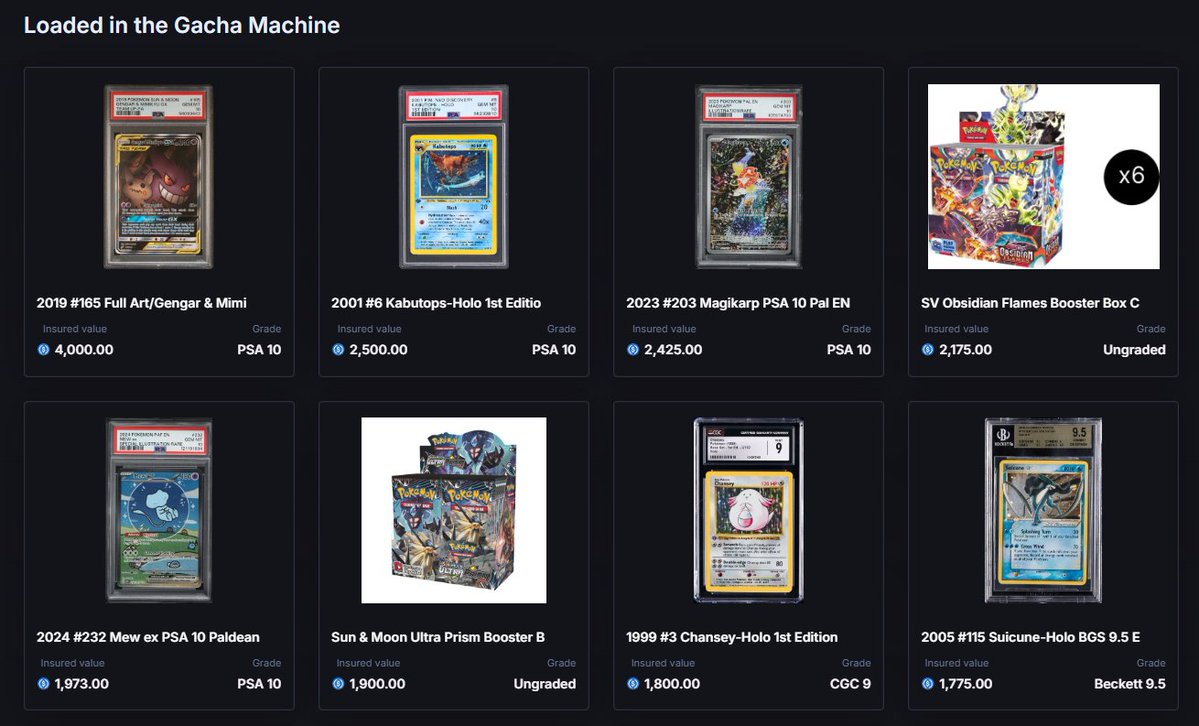

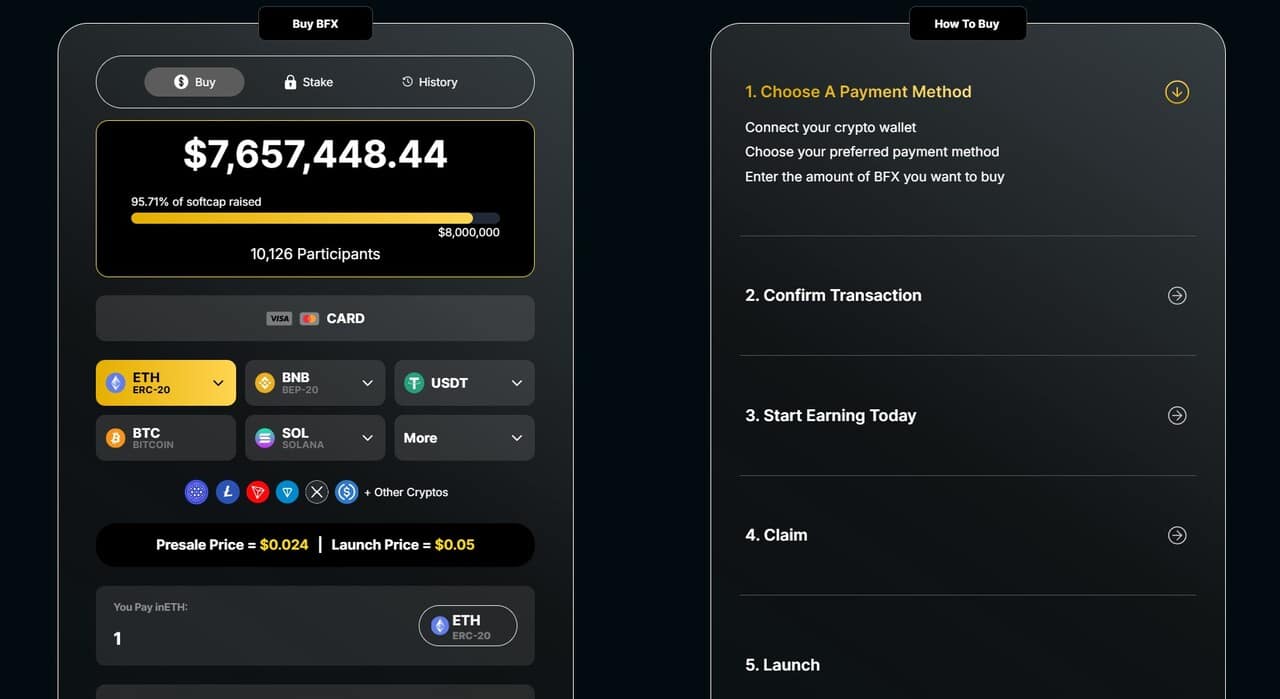

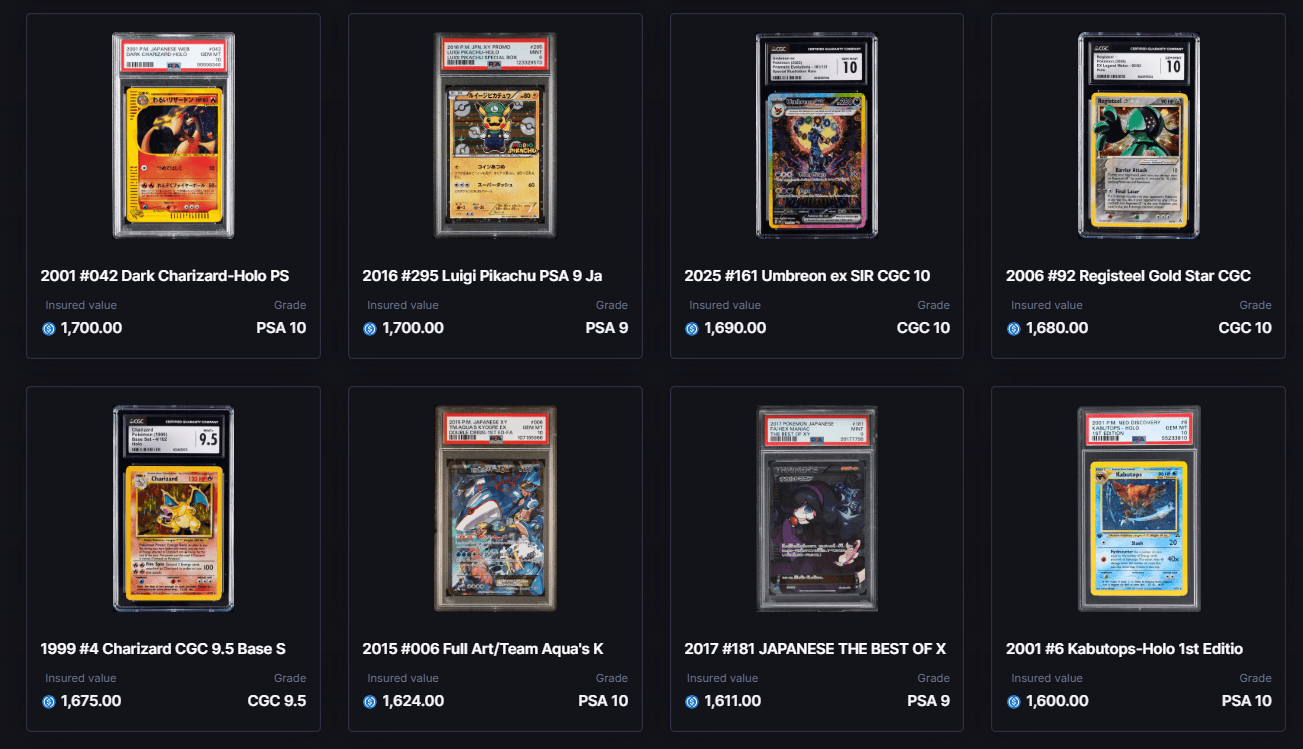

Collector Crypt’s launch of its native CARDS token in August 2025 was a turning point. Within weeks, CARDS surged over 600%, reflecting explosive demand for tokenized Pokémon assets. The platform’s innovative Gacha-style repacks and instant buyback features further fueled adoption by providing instant liquidity for previously illiquid physical assets. Courtyard followed suit with its own tokenization initiatives, driving a 100% increase in NFT sales through seamless integration of physical collectible cards into the blockchain ecosystem (source).

The Mechanics Behind Tokenized Pokémon Cards

So how does this all work? Tokenizing Pokémon cards means each physical card is securely authenticated and vaulted by trusted custodians. Then, that unique asset is represented as an NFT on-chain – typically on fast networks like Solana or Ethereum Layer 2s. This NFT acts as both proof of ownership and a tradable asset within digital marketplaces.

The benefits are clear: 24/7 global liquidity, instant settlement without the friction of shipping or third-party escrow, and verifiable authenticity via blockchain records. For investors used to slow-moving eBay auctions or private dealer networks, this is a tactical upgrade – turning collectibles into true financial instruments.

Key Benefits Fueling Pokémon Card RWA Adoption

-

Instant Global Liquidity: Platforms like Collector Crypt and Courtyard tokenize Pokémon cards, enabling collectors to buy, sell, and trade assets 24/7 on-chain, bypassing traditional market constraints.

-

Enhanced Transparency & Security: Blockchain-backed ownership records ensure every Pokémon card’s provenance and authenticity are verifiable, reducing fraud and boosting collector confidence.

-

Fractional Ownership: Tokenization allows users to own fractions of high-value Pokémon cards, making blue-chip collectibles accessible to a broader pool of investors.

-

Instant Buybacks & Gacha-Style Repacks: Collector Crypt’s instant buyback and innovative Gacha repacks offer dynamic liquidity and gamified experiences, driving user engagement and rapid asset turnover.

-

Surging Market Demand: The CARDS token surged over 600% after its August 2025 launch, reflecting robust demand for Pokémon card RWAs and signaling strong market momentum. (Source)

-

Seamless Integration with DeFi: Pokémon card NFTs can be deposited as collateral or traded in on-chain liquidity pools, bridging collectibles with decentralized finance ecosystems.

A New Era for Collectors: Liquidity Meets Security

The broader RWA market hit $25B in August 2024 according to AInvest research, with tokenized trading cards alone reaching $87.2M in capitalization (source). This surge is not just speculative hype – it’s driven by tangible improvements in market mechanics:

- Instant Trading: Platforms like Collector Crypt allow users to buy or sell fractional shares or full ownership instantly via their CARDS token.

- NFT-backed Deposits: Collectors can deposit their physical cards as NFTs for use as collateral across DeFi protocols.

- Global Accessibility: Anyone with an internet connection can participate in high-value Pokémon card markets without geographic or regulatory friction.

This blend of security (through off-chain custody) and accessibility (via on-chain settlement) is setting new standards for what it means to own and trade collectibles in the crypto era.

We’re witnessing the convergence of two previously siloed worlds: the tactile thrill of collecting and the frictionless efficiency of crypto markets. The result? Pokémon cards are now more than just memorabilia, they’re programmable assets, tradable 24/7, and usable as collateral in decentralized finance (DeFi) protocols. This is why savvy investors and collectors are flocking to tokenized Pokémon card platforms. The security of off-chain vaulting, paired with instant on-chain settlement, has fundamentally altered risk profiles and market dynamics.

But it’s not just about speed and access. Transparency is a game-changer here. Every transaction is logged on-chain for public verification, eliminating the trust gap that plagued legacy collectibles markets. No more relying on word-of-mouth provenance or opaque dealer networks. Blockchain’s audit trail means buyers know exactly what they’re getting, while sellers can prove authenticity without dispute.

The RWA Playbook: Strategies for Collectors and Investors

If you’re eyeing Pokémon cards as a crypto-native asset, here’s how to approach it tactically:

Tactical Strategies for Investing in Tokenized Pokémon Cards

-

Leverage Established Platforms Like Collector Crypt and CourtyardFocus your investments on reputable tokenization platforms such as Collector Crypt and Courtyard. These platforms offer secure on-chain trading, robust custody solutions, and have demonstrated strong growth—Collector Crypt’s CARDS token surged over 600% after its August 2025 launch.

-

Monitor Native Tokens for Market SentimentTrack the performance of native platform tokens like CARDS. The CARDS token’s recent 600% surge signals high demand and liquidity. Use these price movements as a proxy for overall market sentiment and timing your entry or exit.

-

Utilize Instant Buyback and Gacha-Style FeaturesTake advantage of innovative platform features such as Collector Crypt’s instant buyback and Gacha-style repacks. These tools can provide liquidity and unique entry points, letting you capitalize on market volatility or secure rare cards at competitive prices.

-

Participate in NFT-Backed Deposits for YieldPlatforms like Collector Crypt allow NFT-backed deposits, enabling you to earn yield or access liquidity without selling your Pokémon cards outright. This strategy can maximize capital efficiency while maintaining exposure to rare assets.

-

Track RWA Market Analytics on RWA.xyzUse data platforms such as RWA.xyz to monitor tokenized Pokémon card volumes, liquidity, and investor activity. Staying data-driven helps you identify trends and avoid illiquid or overhyped assets.

First, understand your risk appetite, rare cards will always command premium prices, but liquidity can vary by platform and series. Next, choose platforms with rigorous custody standards and transparent vaulting processes; not all tokenization models are created equal. Finally, leverage DeFi integrations where possible to maximize capital efficiency, staking your NFT-backed Pokémon card for yield or using it as loan collateral can unlock new revenue streams previously unavailable to traditional collectors.

Where Does This Go Next?

The numbers don’t lie: with tokenized trading card capitalization hitting $87.2M in 2024 alone (source), the market is only getting started. As regulatory clarity improves, especially with frameworks like the U. S. GENIUS Stablecoin Act, the infrastructure for on-chain RWAs will mature further. Expect to see new financial products emerge around collectible RWAs: index funds tracking top-performing cards, lending protocols tailored for high-value NFTs, even insurance wrappers for vaulted assets.

This isn’t speculation, it’s a structural evolution in both collectibles and crypto finance. Platforms like Collector Crypt and Courtyard have proven that when you combine nostalgia with blockchain utility, you get an asset class that’s both emotionally resonant and institutionally investable.

Final Thoughts: Why Pokémon Cards Lead On-Chain Collectibles in 2024

The rise of pokemon cards crypto, tokenized pokemon cards, and on-chain collectibles is more than a fad, it’s a tactical response to inefficiencies in legacy trading card markets. By embracing blockchain liquidity and transparency, these assets have become more accessible, secure, and valuable than ever before.

If you’re ready to bridge your collection into the digital era or explore new investment frontiers in RWAs, now is the time to act strategically, because the playbook for trading card NFTs is being written right now.