In 2025, the collectibles world witnessed a dramatic shift as Pokémon cards surged to become the most liquid on-chain Real-World Asset (RWA). What began as a nostalgic hobby for millions has evolved into a sophisticated crypto-native market, where physical cards are tokenized and traded globally in real time. This transformation is not just about digital ownership – it’s about unlocking new levels of liquidity, transparency, and accessibility for collectors and investors alike.

Pokémon Cards: The Blueprint for On-Chain Collectible Liquidity

Why have Pokémon cards outpaced other collectibles in the RWA space? The answer lies in their unique combination of cultural cachet, standardized grading, and global demand. Unlike art or luxury watches, trading cards are inherently easier to authenticate and fractionalize. Platforms like Collector Crypt have capitalized on this by offering seamless tokenization services – transforming physical Pokémon cards into NFTs backed by verifiable real-world assets.

The numbers speak volumes: In August 2025 alone, Collector Crypt’s $CARDS token launch on Solana was backed by a pool of authenticated Pokémon cards, fueling a monthly trading volume of $44 million. That’s a staggering 124% increase from the previous month. Meanwhile, the overall market cap for tokenized trading card RWAs soared to $87.2 million, up 32% in just 24 hours. These figures underscore how Pokémon cards have become the benchmark for liquidity in the on-chain collectible sector.

The Mechanics Behind Pokémon Card Tokenization

The process is more nuanced than simply minting an image as an NFT. At its core, tokenizing a Pokémon card means creating a blockchain-based digital twin that is fully backed by the physical asset. Platforms like Collector Crypt employ rigorous authentication – often using third-party grading services – before vaulting each card in secure storage facilities. Once verified, each card is assigned an NFT that can be instantly traded or fractionally owned via smart contracts.

This system offers several key advantages:

Key Benefits of Pokémon Card Tokenization

-

Unprecedented Liquidity: Tokenized Pokémon cards can be traded instantly on-chain, eliminating the delays and friction of traditional marketplaces. Platforms like Collector Crypt have enabled monthly trading volumes as high as $44 million, making these collectibles among the most liquid real-world assets.

-

Global, 24/7 Market Access: Blockchain-based trading allows collectors and investors to buy, sell, or fractionalize Pokémon cards from anywhere in the world at any time, bypassing geographic and time zone barriers.

-

Authenticity & Transparency: Each tokenized card is backed by an authenticated physical asset, with ownership and provenance recorded immutably on the blockchain. This significantly reduces the risk of counterfeits and disputes.

-

Fractional Ownership: Tokenization enables collectors to own a fraction of high-value cards, lowering barriers to entry and allowing more people to participate in the Pokémon card market.

-

Innovative Features & Buyback Options: Platforms like Collector Crypt offer unique features such as digital “Gacha machines” for randomized NFT packs and a buyback option where users can exchange NFTs for 90% of the card’s resale value as calculated via eBay, providing both excitement and liquidity.

-

Rapid Market Growth: The tokenized trading card sector has seen explosive growth, with the market cap for trading card RWAs reaching $87.2 million—a 32% increase in just 24 hours, highlighting strong demand and investor interest.

One standout innovation is Collector Crypt’s digital “Gacha machine, ” which mimics Japan’s beloved capsule-toy dispensers but with randomized NFT-based card packs. This feature alone generated $16.6 million in sales during a single week – proof that gamified mechanics can supercharge market activity while attracting both crypto natives and traditional collectors.

Pushing Boundaries: Instant Liquidity and New Market Dynamics

The true breakthrough lies in how these platforms enable instant buyback options and secondary trading markets. For example, Collector Crypt allows users to exchange their NFTs for 90% of the current resale value (as calculated via major platforms like eBay). This creates robust price discovery and gives holders confidence that their digital assets remain tethered to real-world value.

The result? Pokémon cards have completed their journey from “offline collectibles” to “consumer-grade on-chain assets, ” now driving unprecedented volumes across blockchain ecosystems such as Solana. As reported by CryptoRank, weekly trading volumes can exceed $16 million, with active markets fueled largely by new entrants eager to participate in this next-generation collectibles economy.

If you want to explore more about how these trends are shaping the future of collectible RWA trading, see our deep dive at How Tokenized Pokémon Cards Are Changing the RWA Landscape: A Deep Dive Into On-Chain Collectibles.

This rapid evolution has not only made Pokémon cards onchain a reality, but has also turned them into a core pillar of the emerging collectible RWA trading sector. The fusion of blockchain technology with trusted authentication and real-world demand has created a market where liquidity rivals that of major cryptocurrencies. For many, this is the first time they can buy, sell, or even fractionally own high-value Pokémon cards without worrying about counterfeits or complex logistics.

The Role of Community and Technology in Sustaining Liquidity

The sustainability of this new market isn’t just about tech. It’s about community and trust. Platforms like Collector Crypt have invested heavily in user experience, from transparent grading reports to social trading features that let collectors showcase their portfolios and share insights. Gamified elements such as digital Gacha machines keep engagement high, while smart contracts automate everything from royalties to instant buybacks.

What’s more, the interoperability between NFT marketplaces and DeFi protocols means holders can now use tokenized Pokémon cards as collateral or participate in yield-generating activities. This DeFi integration is drawing a new wave of investors who see Pokémon cards as “digital gold” – an asset class with both nostalgic value and tangible financial upside.

Top Uses for Tokenized Pokémon Cards On-Chain

-

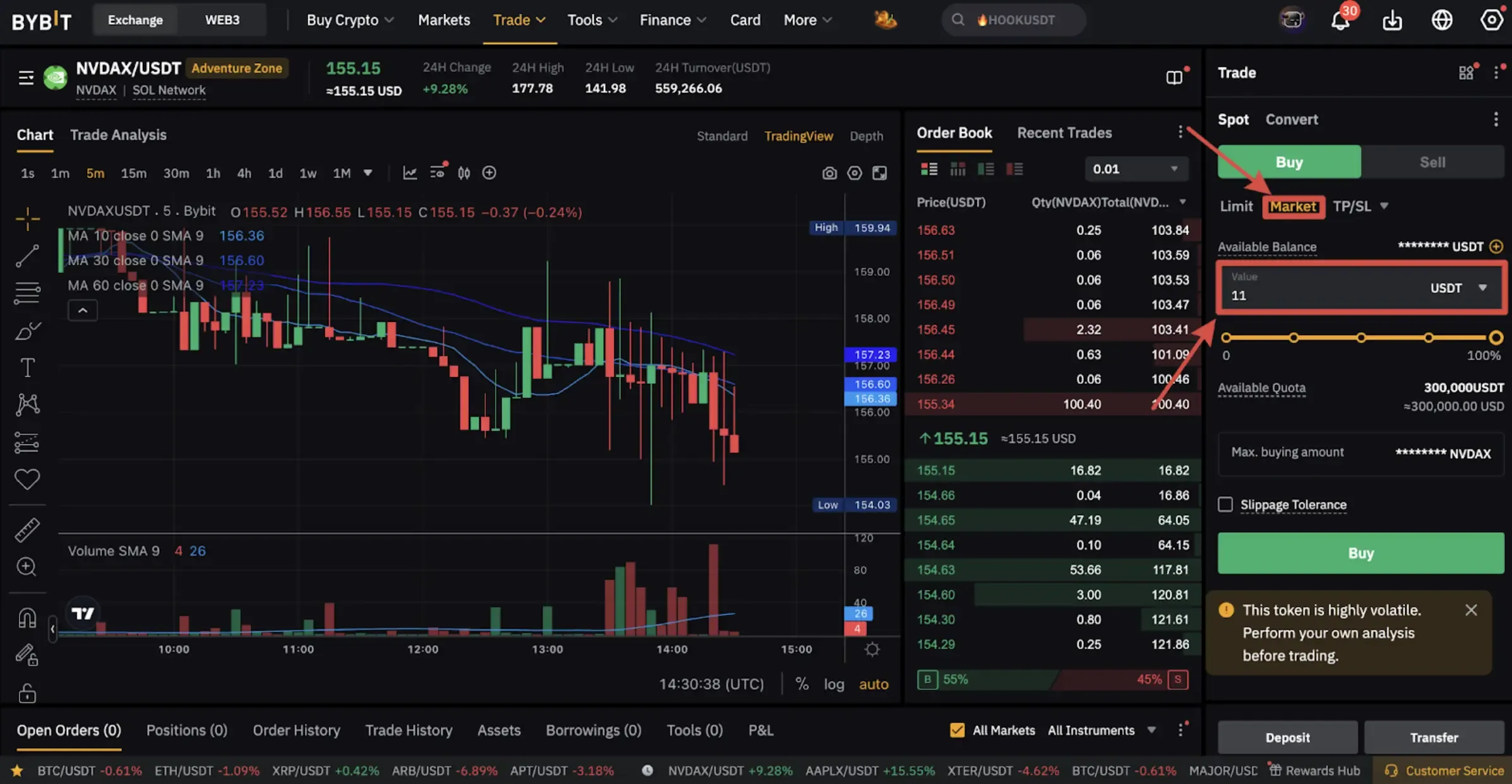

Earn Yield via Collector Crypt’s $CARDS Token: By holding $CARDS on Solana, investors gain exposure to a pool of authenticated Pokémon cards. The token’s underlying assets generate yield through trading fees and platform incentives, with monthly trading volumes reaching $44 million in September 2025.

-

Use Tokenized Cards as Collateral for DeFi Loans: Platforms like Collector Crypt enable users to pledge tokenized Pokémon cards as collateral for on-chain loans, unlocking liquidity without selling prized assets. Loan-to-value ratios are based on real-time card valuations from sources like eBay.

-

Diversify Portfolios with Fractionalized Card Ownership: Tokenization allows for fractional ownership of high-value cards, letting investors diversify across multiple rare Pokémon cards rather than concentrating risk in a single asset. This approach is accessible via platforms such as Collector Crypt and other RWA marketplaces.

-

Instant Global Trading on Solana: Thanks to blockchain integration, users can trade tokenized Pokémon cards 24/7 on platforms like Collector Crypt, benefiting from unprecedented liquidity and a monthly trading volume surge of 124% in September 2025.

-

Participate in Digital Gacha Machines for Randomized Packs: Collector Crypt’s digital Gacha machine lets users purchase randomized NFT-based Pokémon card packs, mirroring the thrill of traditional pack opening. This feature generated $16.6 million in sales in a single week, reflecting strong user engagement.

The market’s transparency is further enhanced by real-time on-chain data. Anyone can verify volumes, ownership history, or even cross-check card grades before making a purchase. This level of openness is unprecedented in traditional collectibles markets and has helped reduce friction for global participants.

What’s Next: Expansion Beyond Pokémon?

The success story of tokenized Pokémon cards is already inspiring other IP holders to consider similar models. Magic: The Gathering cards are following suit, and even luxury goods like sneakers are being explored as potential RWAs for blockchain trading. As more assets go digital-first, platforms will need to double down on security, regulatory compliance, and continuous innovation to maintain trust at scale.

If you’re curious about how these innovations could impact your own collecting or investing strategies – whether you’re a seasoned TCG veteran or just crypto-curious – check out our practical guide at How to Tokenize Your Pokémon Cards as NFTs: A Step-by-Step Guide for Collectors.

Final Thoughts: The New Standard for Collectible Liquidity

Pokémon card liquidity on-chain is now setting the pace for all physical-digital asset bridges. With monthly volumes hitting $44 million, instant secondary markets, and seamless integration with DeFi tools, these assets are no longer just nostalgic relics but powerful financial instruments accessible worldwide.

The next chapter will likely see further convergence – between gaming IPs, mainstream finance, and passionate collector communities – forging an ecosystem where anyone can participate in the upside of rare collectibles with unprecedented ease. For those watching closely, it’s clear: the age of true collectible liquidity has arrived.