Pokémon card tokenization is rapidly transforming the landscape for collectors and investors, merging the trusted world of physical trading cards with the efficiency and innovation of blockchain technology. In August 2025, trading volumes for tokenized Pokémon cards soared to $124.5 million, marking a 5.5-fold increase since January 2024. This surge is not just a speculative bubble; it’s the result of tangible advancements in how collectible RWAs (real-world assets) are bought, sold, and leveraged in the crypto economy.

Pokémon Cards Crypto Boom: Platforms and Market Data

At the heart of this new era is Collector Crypt, a Solana-based marketplace that allows users to tokenize professionally graded Pokémon cards into NFT-backed assets. The platform’s innovative “Gacha machine” feature generated $16.6 million in a single week, driving instant liquidity and global participation. The native CARDS token experienced an explosive tenfold increase within its first week, reaching a fully diluted valuation of $450 million and stabilizing near $74 million in market cap after an initial peak.

Meanwhile, Courtyard on Polygon has quietly amassed over 3 million tokenized Pokémon cards since 2021, providing robust vault storage and physical redemption options that ensure authenticity and security for investors worldwide.

How Tokenized Pokémon Cards Create New Investment Opportunities

The core value proposition of pokemon card tokenization lies in three main factors: liquidity, accessibility, and financial utility. By converting physical assets into trading card NFTs, platforms like Collector Crypt and Courtyard have unlocked:

Top Benefits of Pokémon Card Tokenization

-

Enhanced Liquidity and 24/7 Trading: Tokenized Pokémon cards can be instantly traded on blockchain marketplaces like Collector Crypt and Courtyard, eliminating traditional barriers such as shipping delays and manual verification. This enables collectors and investors to access global liquidity at any time, with August 2025 trading volumes reaching $124.5 million.

-

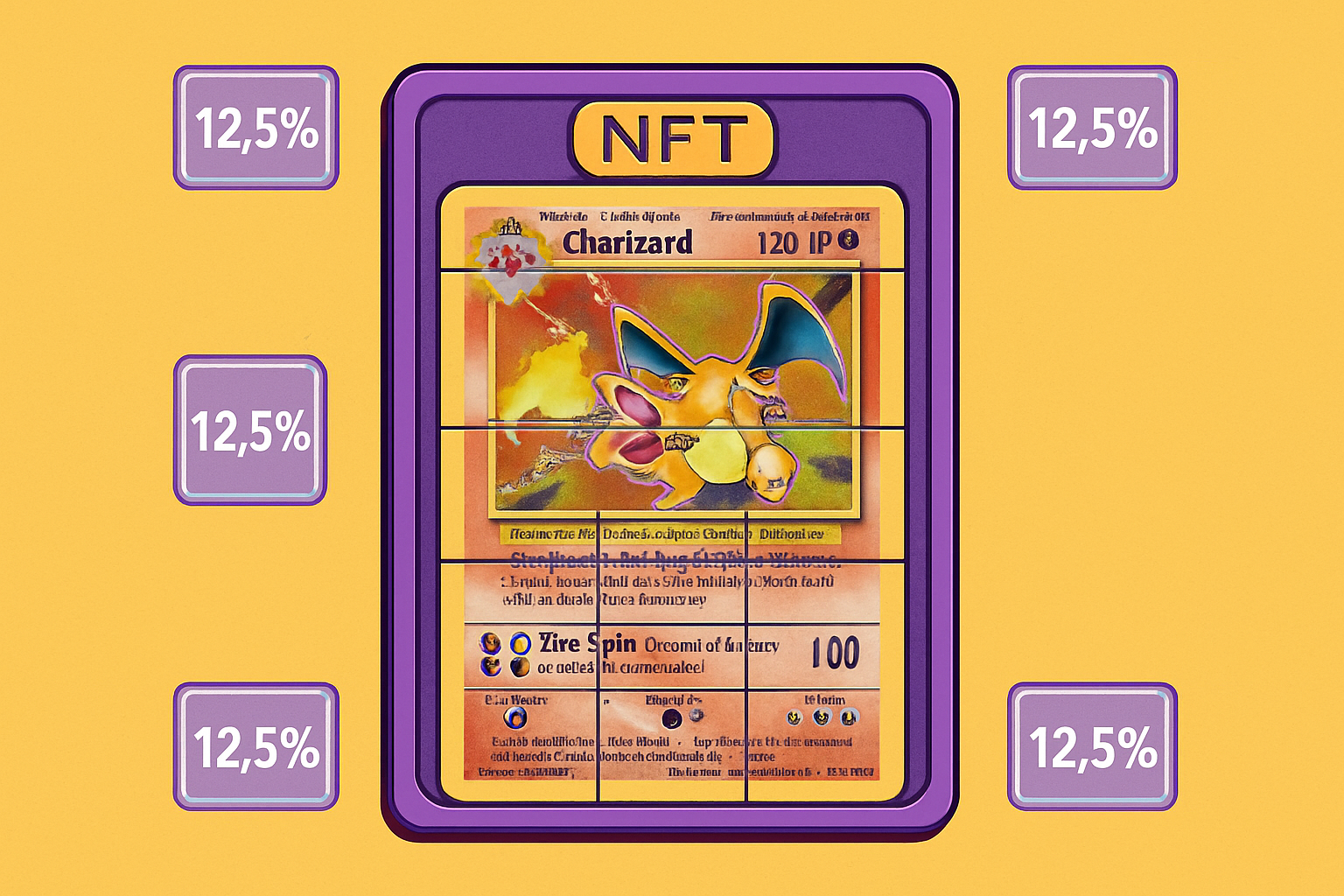

Fractional Ownership of High-Value Cards: Platforms such as Courtyard allow investors to purchase fractions of rare, professionally graded Pokémon cards. This lowers the entry barrier for high-value collectibles and enables portfolio diversification without needing to own entire cards.

-

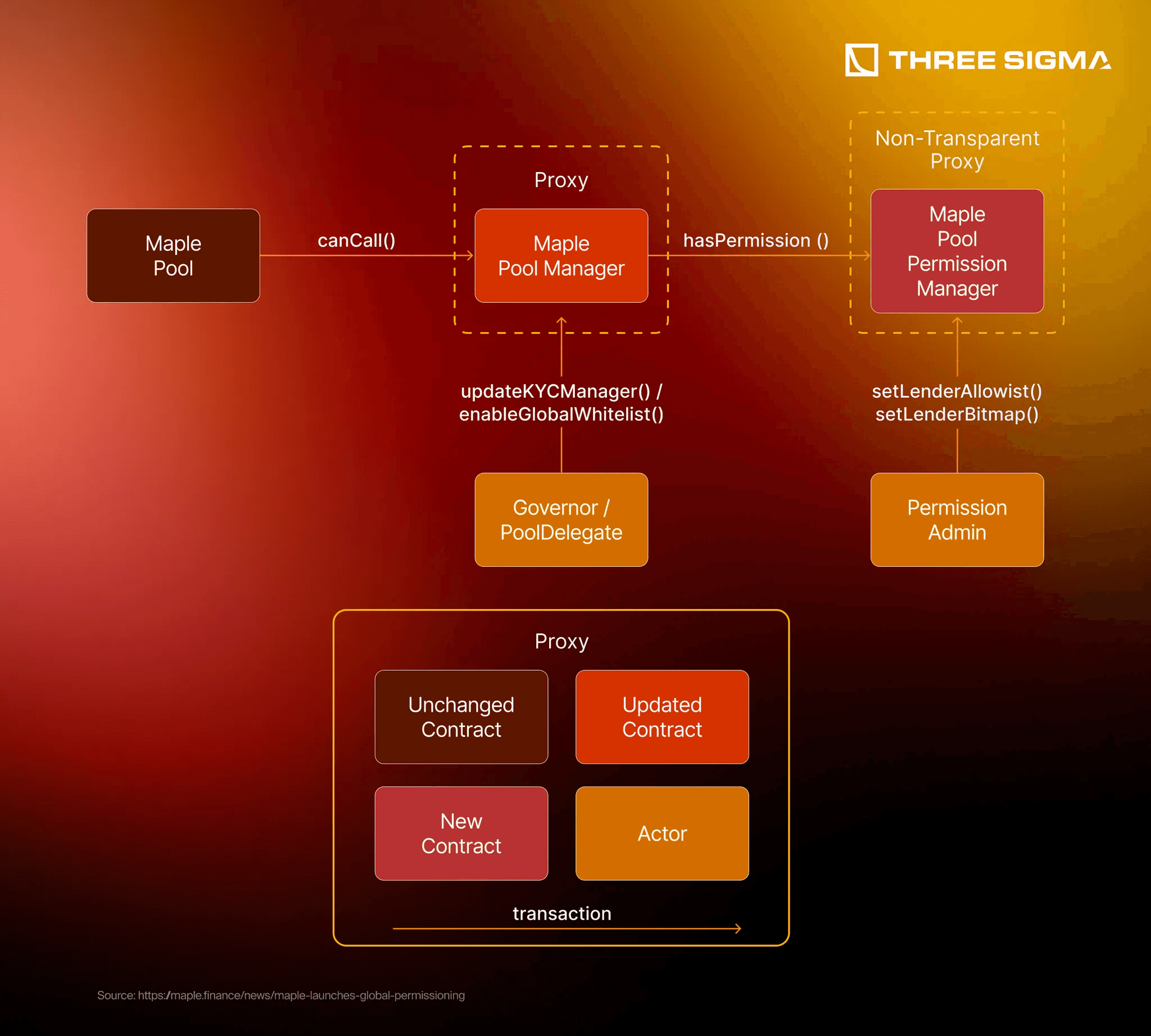

DeFi Integration and Collateralization: Tokenized Pokémon cards can be used as collateral for decentralized finance (DeFi) applications, unlocking lending and borrowing opportunities that were previously unavailable in the traditional collectibles market.

-

Guaranteed Authenticity and Secure Storage: Both Collector Crypt and Courtyard store physical Pokémon cards in secure vaults and issue NFTs only for professionally graded cards, ensuring authenticity and minimizing the risk of counterfeits.

-

Transparent Ownership and Provenance: Blockchain technology provides immutable records of ownership and transaction history for each tokenized card, giving collectors and investors full transparency and reducing disputes over provenance.

Enhanced Liquidity: Traditional collectibles markets are plagued by slow transaction times, shipping logistics, and authentication hurdles. Tokenized Pokémon cards can be traded instantly on blockchain marketplaces, eliminating these bottlenecks and enabling 24/7 global liquidity. This shift is especially attractive to short-term traders and arbitrageurs seeking to capitalize on real-time price movements.

Fractional Ownership: High-value cards that were once reserved for elite collectors are now accessible to a broader audience through fractionalization. Investors can own shares of rare cards such as a PSA 10 Charizard, diversifying their portfolios without committing to full ownership or illiquidity.

DeFi Integration: Tokenized cards are increasingly being used as collateral in decentralized finance applications. While there are practical limits to how much value can be safely lent against these NFTs due to volatility and authentication risks, the emergence of lending protocols signals a new paradigm where collectibles serve as productive financial assets.

Risks in the Pokémon NFT Marketplace: What Investors Need to Know

No new asset class comes without risk. The evolving regulatory landscape around collectible RWAs means that legal frameworks are still catching up to technological innovation. Market volatility is another key concern; prices for both the underlying cards and their associated NFTs can swing sharply based on sentiment in both the crypto and collectibles sectors.

The reliability of each pokemon nft marketplace is also crucial. Investors should scrutinize platform security, custody arrangements, and transparency before committing significant capital. For a comprehensive breakdown of how these platforms operate and what to watch out for, see our guide: How Tokenized Pokémon Cards Work: Benefits, Risks, and How to Get Started.

Authentication remains a persistent challenge, even as tokenized Pokémon cards offer blockchain-backed provenance. The physical cards must be securely vaulted and professionally graded to ensure the NFT’s value truly reflects the real-world asset. Counterfeit risks, while reduced compared to peer-to-peer trading, have not been eliminated entirely. Investors should prioritize platforms with transparent grading partnerships and robust audit trails.

Another emerging use case is pokemon card lending, where holders can stake their tokenized assets as collateral for loans in stablecoins or other cryptocurrencies. This unlocks liquidity without forcing a sale, but comes with notable caveats: lending platforms may apply conservative loan-to-value ratios due to the inherent volatility and authentication risk of trading card NFTs. As seen in recent market data, loan eligibility and interest rates are tightly linked to the perceived security of the underlying vault and grading process.

Navigating the Future: Trends and Strategies for Collectors

The intersection of pokemon cards crypto and decentralized finance is still in its infancy, but several trends are worth watching. First, expect further integration of tokenized cards into DeFi protocols, including more sophisticated lending markets and fractionalized portfolios. Second, regulatory clarity will likely drive mainstream adoption, as clearer guidelines attract institutional capital and reduce compliance risk.

Key Strategies for Safely Investing in Tokenized Pokémon Cards

-

Choose Reputable Tokenization Platforms: Prioritize established marketplaces like Collector Crypt (on Solana) and Courtyard (on Polygon), which offer secure vault storage, professional card grading, and transparent NFT redemption processes.

-

Verify Physical Backing and Redemption Policies: Ensure each NFT is fully backed by a professionally graded physical Pokémon card stored in a secure vault, and that the platform offers clear, reliable redemption options for the underlying asset.

-

Assess Platform Security and Transparency: Review the platform’s track record for asset security, insurance coverage, and public audits. Platforms like Collector Crypt and Courtyard provide details on vault providers and grading partners.

-

Understand Market Liquidity and Pricing: Leverage platforms with high trading volumes and instant liquidity, such as Collector Crypt, which saw $124.5 million in trading volume in August 2025 and uses a gacha machine for randomized card pulls.

-

Monitor Regulatory Developments: Stay informed about evolving regulations for tokenized real-world assets, as legal frameworks may impact investment stability and asset redemption.

-

Diversify Investments and Manage Volatility: Utilize fractional ownership features to diversify across multiple high-value cards and platforms, mitigating risk from price swings in both crypto and collectibles markets.

-

Evaluate DeFi Integration Carefully: When using tokenized cards as collateral for DeFi lending or borrowing, understand the platform’s liquidation policies and collateralization ratios, as NFT-backed loans may have practical limits.

For collectors and traders eager to participate, due diligence is paramount. Assess the smart contract security, insurance provisions, and redemption mechanisms of each platform. Watch for new features such as on-chain price discovery tools, dynamic NFT metadata reflecting real-time grading updates, and cross-chain interoperability with other collectible RWAs. Those seeking step-by-step instructions on how to get started can reference our dedicated guide: How to Tokenize Your Pokémon Cards as NFTs: Step-by-Step Guide for Collectors.

Ultimately, pokemon card tokenization is not just a speculative trend but a structural shift in how value is created, traded, and secured in the collectibles market. With trading volumes hitting $124.5 million in August 2025 and platforms like Collector Crypt and Courtyard setting new benchmarks for liquidity and trust, the opportunity set for both traditional collectors and crypto-native investors has never been broader. As the market matures, expect innovation to accelerate, and for Pokémon cards to remain at the forefront of the collectible RWAs revolution.