In 2025, the world of Pokémon card collecting has entered a new era, blending nostalgia with cutting-edge blockchain technology. Tokenized Pokémon cards are now at the center of this transformation, turning beloved physical collectibles into highly liquid digital assets. The result? A market that processed a staggering $124.5 million in trading volume in August 2025 alone, surging 5.5x since the start of the year and drawing global attention from collectors, crypto traders, and investors alike.

What Are Tokenized Pokémon Cards?

Tokenized Pokémon cards are physical trading cards that have been professionally graded, securely vaulted, and then minted as unique NFTs (non-fungible tokens) on a blockchain. Each NFT represents 1: 1 ownership of a specific card locked away in storage, effectively bridging real-world assets (RWAs) with the speed and transparency of digital markets.

This process solves long-standing pain points for collectors: authentication, shipping risk, and illiquidity. Instead of worrying about counterfeits or international shipping delays, owners can buy, sell, or transfer their tokenized cards instantly on-chain. When desired, they can redeem their NFT to claim the physical card from storage.

Top Platforms for Trading Tokenized Pokémon Cards

-

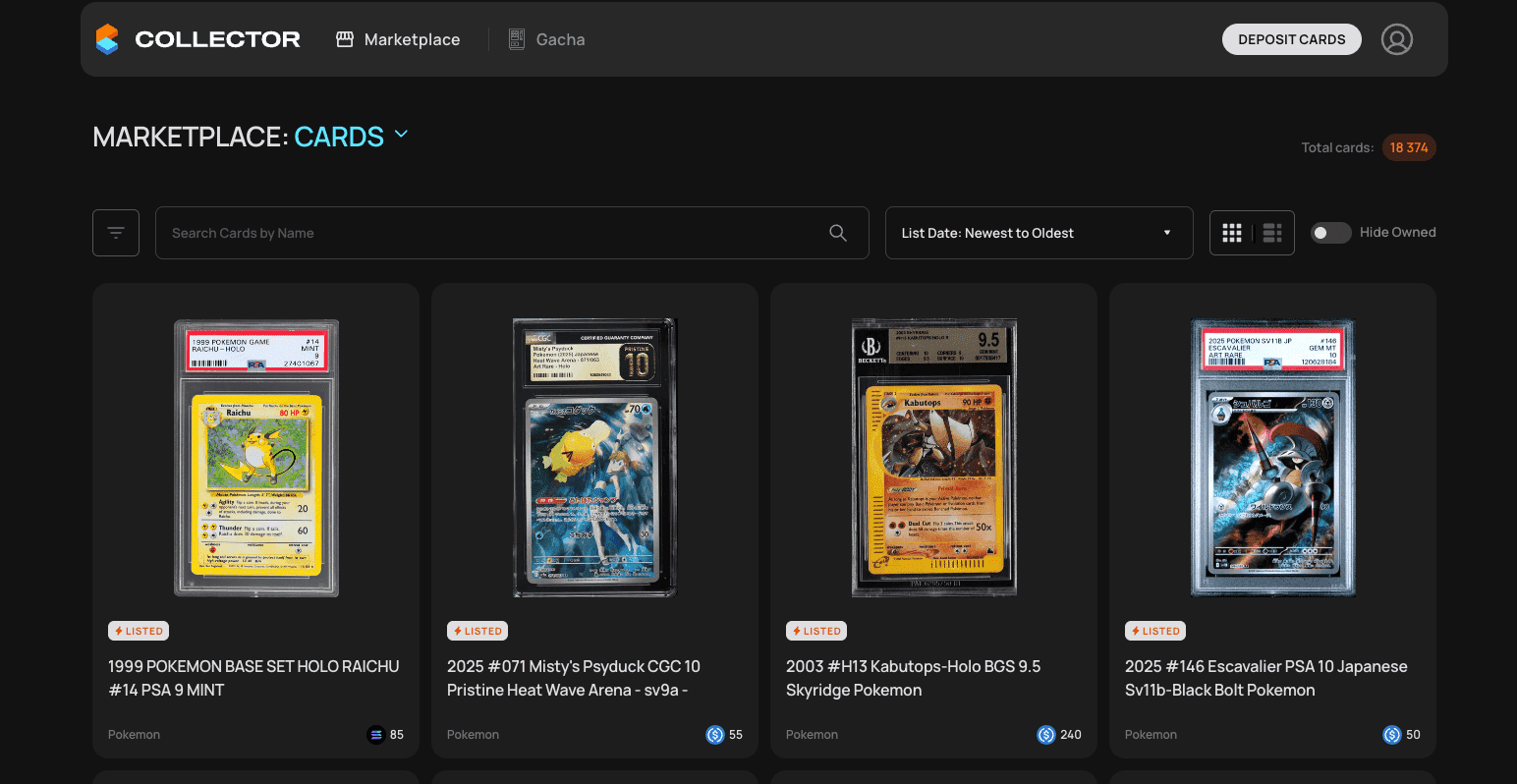

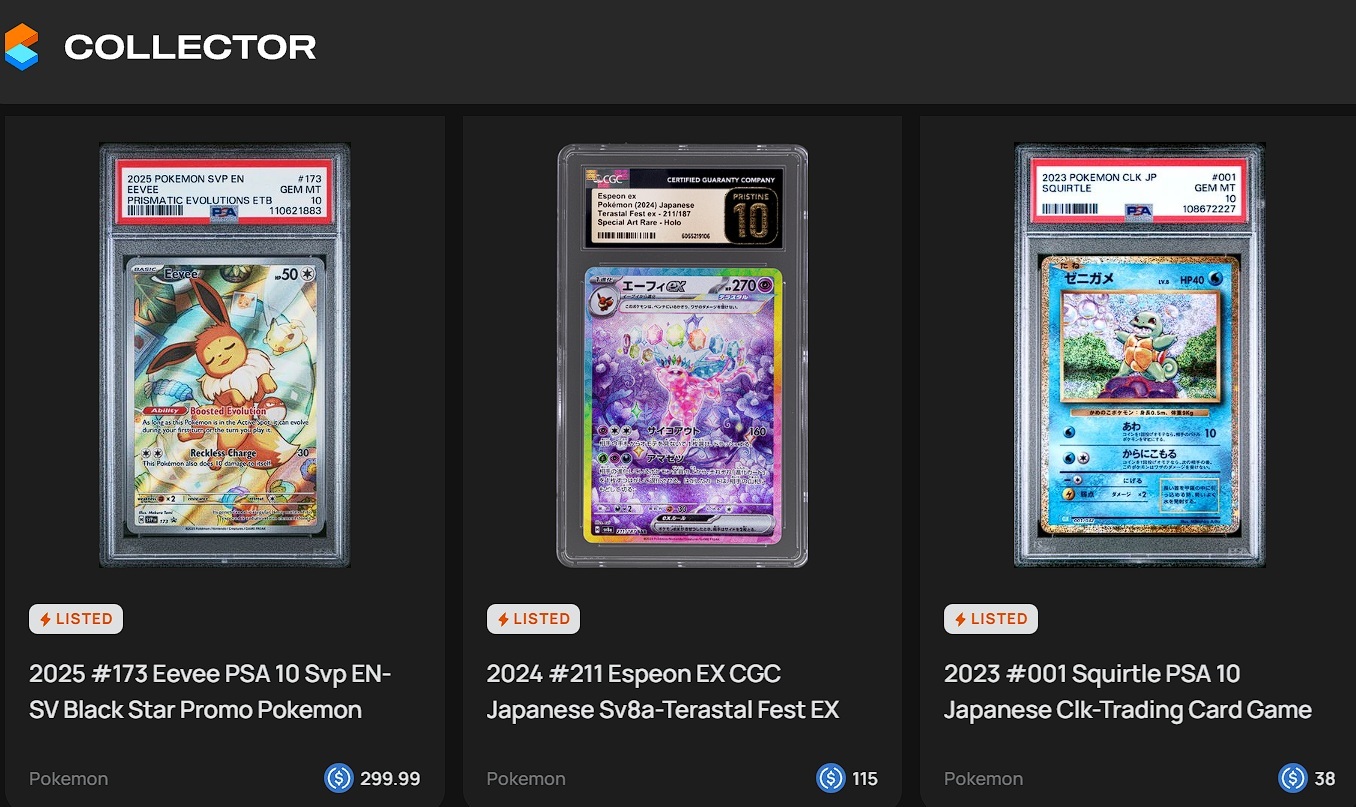

Collector Crypt (Solana): A leading Solana-based platform, Collector Crypt enables users to trade tokenized Pokémon cards with features like random pack openings, an instant buyback mechanism, and its native CARDS token. In August 2025, the CARDS token surged tenfold, reaching a fully diluted valuation of $450 million.

-

Courtyard (Polygon): Built on the Polygon network, Courtyard offers graded card storage, 1:1 NFT minting, and physical redemption for Pokémon cards. The platform is recognized for its secure vaulting and transparent ownership verification, making it a trusted choice for serious collectors.

-

Liquid MarketPlace: This platform specializes in tokenizing high-value collectibles, including Pokémon cards, allowing users to fractionally own and trade authenticated cards on-chain. Liquid MarketPlace provides robust security and an accessible interface for both new and experienced collectors.

-

OpenSea: As the world’s largest NFT marketplace, OpenSea supports secondary trading of tokenized Pokémon cards minted on Ethereum and Polygon. Collectors benefit from global liquidity and a wide selection of verified Pokémon card NFTs.

Platforms Leading the Charge: Collector Crypt and Courtyard

The explosive growth in trading card NFTs 2025 is powered by innovative platforms like Collector Crypt (on Solana) and Courtyard (on Polygon). Collector Crypt has captivated users with its native CARDS token, whose value soared more than 1000% within days, and features like random pack openings via its onchain gacha machine. The platform’s fully diluted valuation hit $450 million as traders swarmed to participate.

Learn how to tokenize your own Pokémon cards as NFTs here.

Meanwhile, Courtyard emphasizes security and transparency by offering graded card storage and verifiable redemption services. Their system ensures each NFT is directly tied to an authenticated physical asset held in a secure vault, reassuring both seasoned collectors and new entrants to the space.

The Impact on Collectors and Market Dynamics

The integration of blockchain technology into Pokémon card collecting is fundamentally reshaping how value is discovered and exchanged. Tokenization delivers:

- 24/7 global liquidity: Buy or sell anytime without waiting for auctions or mail delivery.

- Enhanced security: NFTs prove authenticity while vaults protect against theft or damage.

- Fractional ownership: Some platforms allow splitting high-value cards into shares for broader access.

- Simplified lending: Tokenized RWAs can be used as collateral for crypto loans, though practical limits remain.

This new model is attracting not just hobbyists but also sophisticated investors seeking exposure to alternative assets with proven cultural staying power.

The Numbers Behind the Hype: $124.5 Million Monthly Volume

The scale of adoption is impossible to ignore. In August 2025 alone, tokenized Pokémon cards generated $124.5 million in on-chain trading volume, a figure validated across multiple industry sources. This surge is set against a broader TCG market projected to reach $11.8 billion by 2030. As blockchain trading cards become mainstream, expect both prices and participation to climb further.

Yet, this rapid ascent is not without its growing pains. The influx of speculative capital, exemplified by the CARDS token’s meteoric rise and volatile swings, has led to increased scrutiny from both regulators and long-term collectors. Questions around intellectual property, supply management, and the risk of market manipulation are top of mind. Platforms must now balance innovation with compliance and sustainability to ensure that the ecosystem matures responsibly.

Challenges and Considerations for 2025

While RWA Pokémon NFTs offer unprecedented convenience and liquidity, they also introduce new complexities. Regulatory uncertainty lingers, especially as global authorities debate how to classify and oversee NFT-based collectibles. Intellectual property rights present another hurdle: although platforms facilitate the trading of physical cards as NFTs, the underlying artwork and branding remain tightly controlled by Pokémon’s parent companies. Additionally, liquidity can be a double-edged sword, while it enables fast trading, it may amplify volatility during market corrections.

For those interested in using tokenized Pokémon cards as collateral for lending or DeFi applications, practical limits remain. Most platforms require high-value cards and robust verification processes before accepting them for loans. This ensures security but may restrict participation for casual collectors.

Key Risks and Rewards of Tokenized Pokémon Card Investing

-

Enhanced Global Liquidity: Tokenized Pokémon cards can be traded 24/7 on platforms like Collector Crypt and Courtyard, allowing collectors to buy and sell instantly without waiting for physical delivery. This has contributed to a record $124.5 million in trading volume in August 2025 alone.

-

Improved Security and Authenticity: Each tokenized card is professionally graded and stored in secure vaults, with digital ownership represented by NFTs. This process, used by Courtyard and Collector Crypt, helps eliminate counterfeits and reduces shipping risks.

-

Market Volatility and Speculation: The rapid rise of tokens like CARDS—which saw a 10x price increase and a fully diluted valuation of $450 million in a week—highlights the speculative nature of the market. Prices can swing dramatically, posing risks for short-term investors.

-

Regulatory and Intellectual Property Risks: Tokenized Pokémon cards operate in a gray area regarding copyright and regulatory compliance. Legal uncertainties could impact trading or ownership rights if regulations tighten or enforcement increases.

-

Access to Fractional Ownership and Lending: Platforms like Courtyard offer fractional ownership and on-chain lending, letting investors access high-value cards with smaller capital outlays. However, practical limits exist for using these NFTs as collateral, and liquidity may not always be guaranteed.

Looking Ahead: The Future of Tokenized Collectibles

The trajectory of crypto Pokémon cards in 2025 points toward further integration between physical collectibles and digital finance. As more collectors embrace blockchain trading cards, expect to see:

- Expanded platform interoperability: Seamless movement of NFTs between different blockchains and marketplaces.

- Advanced authentication: Integration of AI-driven grading and on-chain provenance tracking.

- Community governance: Token holders influencing platform policies or card release schedules.

- Broader RWA adoption: The playbook used for Pokémon will likely expand to Magic: The Gathering, sports cards, and beyond.

For now, the $124.5 million in monthly trading volume stands as a testament to surging demand and the market’s appetite for innovation. Whether you’re a seasoned collector or a crypto-native investor, understanding both the technology and the risks is essential to navigating this new landscape.

As tokenization continues to evolve, the line between physical nostalgia and digital opportunity is blurring fast. If you’re ready to participate in this new era of collecting, or want to learn how to tokenize your own cards for the first time, explore our step-by-step guide for collectors.