Tokenizing your Pokémon and Magic: The Gathering cards as NFTs is transforming the landscape for collectors, investors, and crypto enthusiasts. In 2025, the market for tokenized trading cards has reached unprecedented levels, with platforms like Collector Crypt and Courtyard facilitating secure storage and instant digital trading of physical collectibles. This guide will walk you through the essential steps to bring your prized cards onto the blockchain, ensuring authenticity, provenance, and global liquidity.

Why Tokenize Your Pokémon and Magic Cards?

The surge in tokenized Pokémon cards: with the market recently reaching $124.5 million in value, highlights a shift from traditional collecting to digital-first ownership models. Tokenization allows you to:

- Verify authenticity: Each NFT is tied to a physical card stored in a secure vault, eliminating counterfeits.

- Trade globally: Instantly buy or sell your collectibles with crypto on open marketplaces.

- Monetize easily: List cards for sale or auction without shipping logistics or middlemen.

- Redeem physical assets: Burn your NFT to claim the real-world card if desired.

This new model blends nostalgia with cutting-edge technology, making it possible for anyone to participate in the collectible economy, no matter where they are located.

The Rise of Trading Card RWAs: Market Context and Top Platforms

The popularity of trading card RWAs (real-world assets) has exploded thanks to platforms dedicated to bridging physical cards and NFTs. According to CoinGecko and Bitget reports:

- Collector Crypt: Known for its gacha vending machine feature, instant buyback mechanism, and surging $CARDS token. Users send their card in, receive an NFT backed by vault storage, then trade or redeem as desired.

- Courtyard: Specializes in bridging digital and physical collecting by allowing tokenization, trading, and redemption of real Pokémon cards stored securely.

- Holos: Offers seamless transformation of physical trading cards into NFTs with direct digital ownership options.

This ecosystem is rapidly evolving as more collectors seek secure ways to digitize their portfolios while maintaining access to the underlying asset. For those new to this space or looking for authoritative step-by-step instructions, read on, or explore our full guide at How to Tokenize Your Pokémon Cards as NFTs: Step-by-Step Guide for Collectors.

Your Step-by-Step Guide: From Physical Card to Blockchain Asset

The process begins with digitizing your collectible, either through high-resolution scanning or professional photography, to create an appealing visual asset. Next comes image enhancement using design tools (like Photoshop or Canva) where details such as name, stats, rarity grade, and lore are added for richer metadata when minting as an NFT.

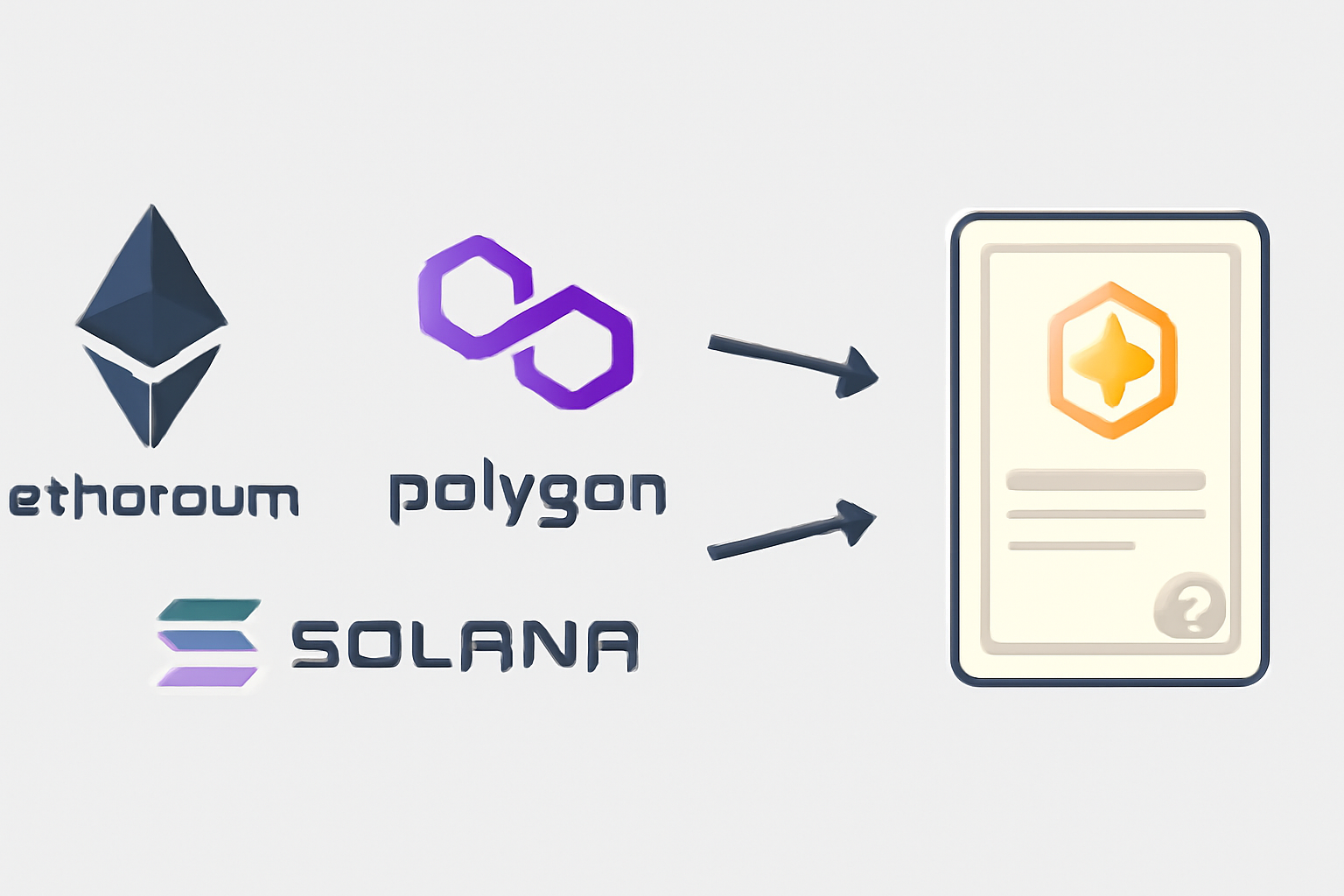

Selecting the right blockchain platform is crucial: Ethereum remains dominant but incurs higher fees; Polygon offers lower costs; Solana stands out for speed and scalability. Setting up a compatible wallet (MetaMask for Ethereum/Polygon or Phantom for Solana) is essential before you can mint your NFT on major marketplaces like OpenSea or Magic Eden.

This step-by-step approach ensures that both seasoned collectors and crypto newcomers can navigate the process confidently. Stay tuned as we dive deeper into minting strategies, pricing models, security best practices, and how specialized RWA platforms elevate your experience beyond generic NFT marketplaces.

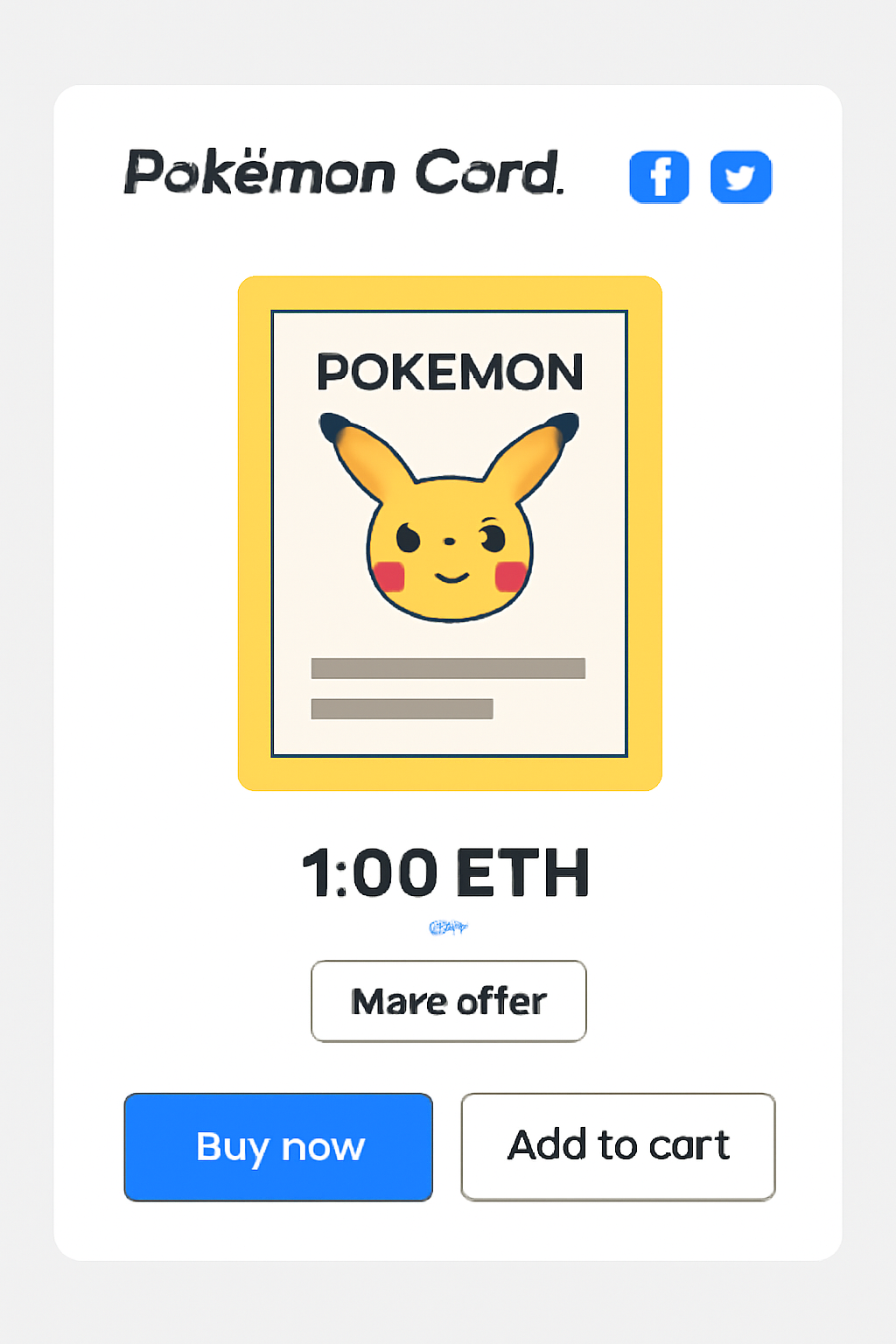

Once your digital assets are minted, the next challenge is maximizing visibility and liquidity. Listing your tokenized Pokémon or Magic cards on reputable NFT marketplaces gives you access to a global pool of collectors and investors. Platforms such as OpenSea, Magic Eden, and niche RWA-focused portals like Collector Crypt or Courtyard offer various listing options: fixed price, reserve auctions, or even fractional ownership for ultra-rare cards.

Optimizing Your Listings and Engaging with the Community

Successful sellers don’t just upload and wait, they leverage smart promotion strategies. Share your listings on social platforms frequented by collectors (Discord, Twitter/X, Reddit) and participate in community events or AMAs hosted by tokenization platforms. Adding detailed metadata, like provenance details, grading info, and card history, can boost buyer confidence and drive higher bids.

Don’t overlook security: enable two-factor authentication on your wallet, use hardware wallets for large holdings, and avoid sharing private keys. As the market matures, scams targeting collectible NFTs have become more sophisticated; staying vigilant is non-negotiable.

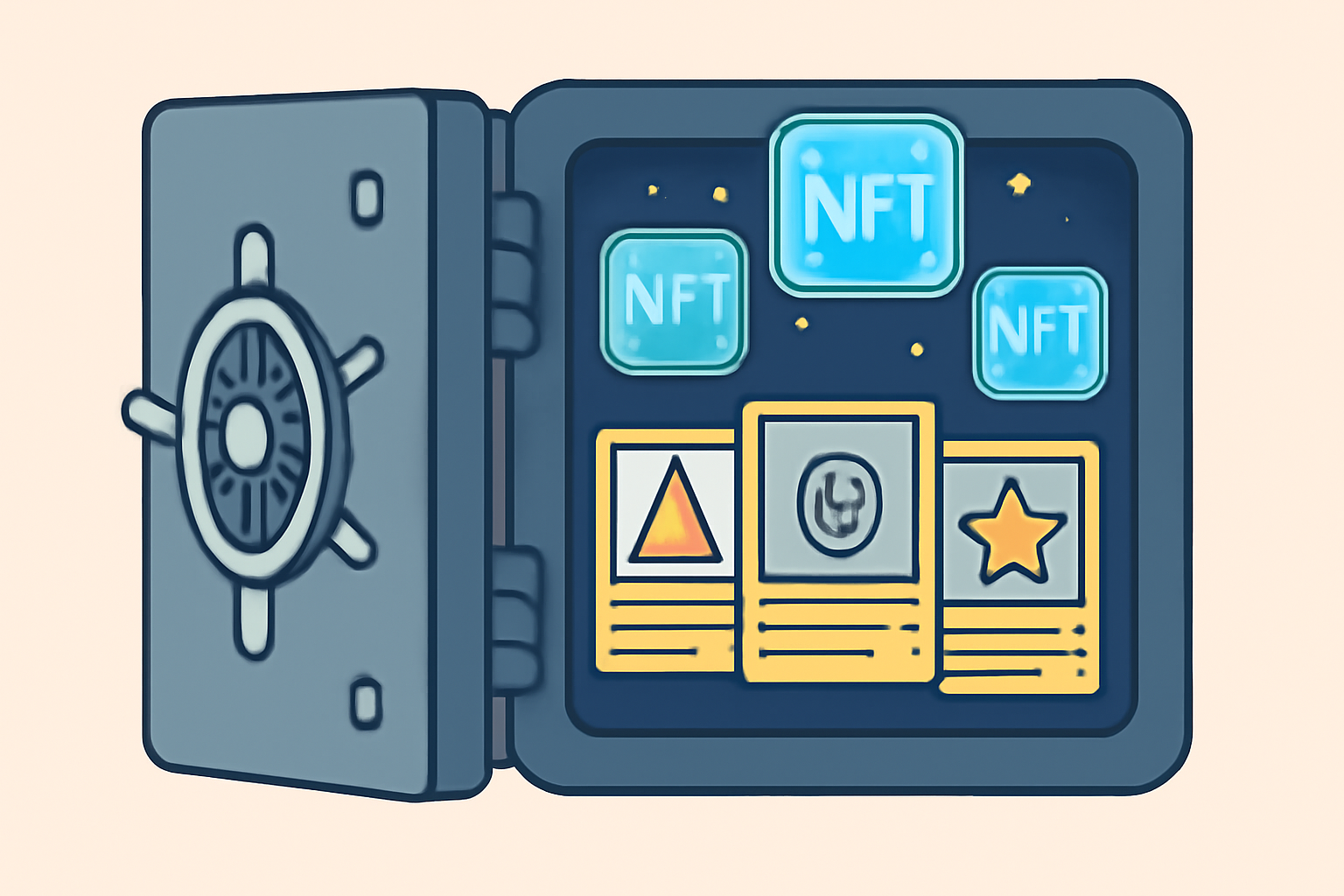

Navigating Redemption: How to Claim Your Physical Card

The ability to redeem a physical card by burning its NFT is a key feature of leading trading card RWA platforms. Collector Crypt’s vault-backed model ensures that when you burn your NFT, the corresponding card is shipped directly to you, no intermediaries required. This process is blockchain-verified from start to finish, preserving trust in both digital and physical realms.

Some platforms even allow for partial redemption or fractional sales of high-value cards, letting multiple owners share exposure to rare assets without breaking the bank. Always check each platform’s redemption policy before minting or buying RWAs.

Market Trends: The Future of Tokenized Collectibles

The momentum behind collectible card NFTs shows no signs of slowing down. With $124.5 million in tokenized Pokémon cards circulating as of October 2025 (source: Medium), institutional investors are taking note. New features like instant buybacks (as seen with Collector Crypt’s $CARDS token), gacha-style vending machines for randomized pulls, and integrated analytics tools are making it easier than ever to manage diversified portfolios spanning both digital and physical assets.

The combination of nostalgia-driven demand and next-gen blockchain infrastructure means that anyone, from casual fans to serious investors, can participate in this rapidly evolving ecosystem.

Key Takeaways for Card Collectors Entering Crypto

- Tokenization bridges physical collecting with global digital markets, unlocking new liquidity while preserving authenticity.

- Select specialized platforms like Collector Crypt or Courtyard for seamless vaulting and redemption features tailored specifically for trading cards.

- Stay informed about security best practices; always use trusted wallets and double-check platform policies before transacting.

- The collectible RWA space is growing fast, with innovative monetization models arriving every quarter, keep an eye out for updates!

If you’re ready to bridge your collection into the world of crypto or want more technical specifics on how each step works in practice, our comprehensive guide at How to Tokenize Your Pokémon Cards as NFTs: Step-by-Step Guide for Collectors covers everything from digitization tips to advanced portfolio strategies.