The intersection of blockchain and collectibles is no longer theoretical, it’s a market reality, and nowhere is this more evident than in the explosive growth of tokenized Pokémon cards. As the Real-World Asset (RWA) sector matures, Pokémon card NFTs are not only capturing headlines but also driving unprecedented trading volumes, fundamentally reshaping how collectors, investors, and platforms interact with physical assets.

Pokémon Card Tokenization Surges: $124.5 Million in August 2025

In August 2025, the market for tokenized Pokémon cards hit a record-breaking $124.5 million in trading volume, a staggering 5.5x increase since January. This surge is not an isolated event but part of a broader shift as collectors seek liquidity, authenticity, and global accessibility for their prized assets. The two dominant platforms leading this charge are Courtyard, which processed $78.4 million in trades, and Solana-based Collector Crypt, which accounted for $44 million during the same period (source: coinalertnews. com).

Unlike traditional RWA markets dominated by private credit or U. S. Treasury debt, tokenized trading cards represent “exotic RWAs”: unique collectibles that unlock new forms of value and participation for both retail investors and seasoned collectors.

The Mechanics: How Tokenized Pokémon Cards Work

The core innovation lies in bridging physical authenticity with digital liquidity. Platforms like Courtyard mint NFTs on the Polygon blockchain that correspond to actual graded Pokémon cards stored securely in partner vaults. Each NFT acts as a digital certificate of ownership, tradeable instantly on-chain or redeemable for the physical card itself. This model not only ensures provenance but also enables fractional ownership, letting users invest in high-value cards without needing to purchase the entire asset outright.

Meanwhile, Collector Crypt has set itself apart by gamifying the experience through its digital “Gacha machine”: a randomized NFT card pack mechanism that generated $16.6 million in sales within one week. Their native token, CARDS, experienced a tenfold price increase over seven days, reaching a fully diluted valuation of $450 million, a testament to surging user engagement and speculative interest.

Why Tokenized Trading Cards Are Disrupting Collectible RWAs

The implications extend far beyond novelty or speculation:

- Liquidity: Instant peer-to-peer trading on global NFT marketplaces reduces friction compared to traditional auction houses or peer deals.

- Transparency: Blockchain provenance eliminates counterfeiting risk, a persistent problem in high-value collectibles.

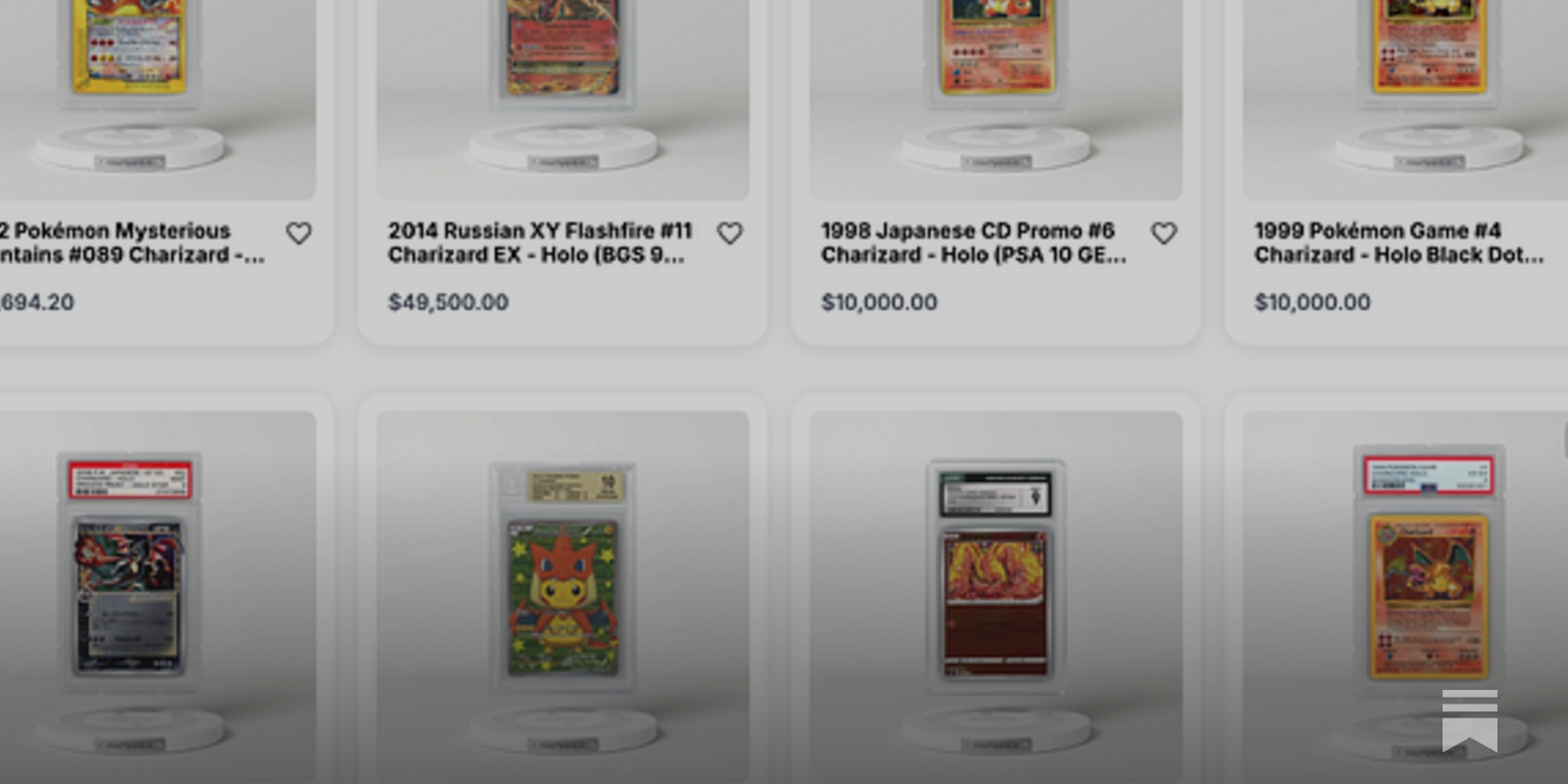

- Diversification: Fractionalization allows broader participation from retail investors who previously could not access blue-chip collectibles like PSA-graded Charizards.

- User Engagement: Gamified features such as randomized packs drive repeat activity and community growth.

This new paradigm is attracting both crypto-native users and legacy collectors seeking modern solutions to age-old problems like illiquidity and authentication fraud. The sector’s momentum is further amplified by specialized RWA marketplaces such as Courtyard. io and CollectorsDAO, and by vault partners who ensure secure storage of physical assets while enabling seamless redemption processes.

The Road Ahead: A New Era for Trading Card Crypto?

The data-driven trajectory suggests that tokenized Pokémon cards are more than just a passing trend, they are setting standards for how all collectible RWAs may be structured going forward. With robust infrastructure now underpinning both authentication and liquidity mechanisms, these platforms are positioned to expand their reach across other trading card games and rare collectibles.

Regulatory clarity and further institutional adoption will play pivotal roles in determining the pace and scale of this evolution. As the infrastructure for trading card crypto matures, expect to see increased interoperability between platforms, improved insurance solutions for vault-stored assets, and a broader array of fractionalized products. The surge to $124.5 million in August 2025 is not just a headline – it’s a signal that the market is entering a phase of mainstream acceptance and capital inflow.

For those considering entry into the space, understanding the technical mechanics and risk factors is essential. Smart contract audits, insurance coverage for physical vaults, and transparent redemption policies should be non-negotiables when selecting a platform. Additionally, monitoring secondary market liquidity and NFT floor prices can help inform timing and strategy for both collectors and speculators.

How to Participate in Pokémon Card NFT Marketplaces

The process of onboarding into tokenized trading cards has become increasingly streamlined. Platforms like tcgonchain. com provide step-by-step guides for tokenizing your own cards or acquiring fractional stakes in rare assets. The ability to trade instantly with global participants removes traditional barriers such as geography or auction schedules.

How to Tokenize Your Pokémon Cards as RWAs

-

1. Select a Reputable Tokenization PlatformChoose a leading RWA marketplace specializing in tokenized Pokémon cards, such as Courtyard (Polygon-based) or Collector Crypt (Solana-based). These platforms have facilitated millions in trades—Courtyard reached $78.4 million in August 2025, while Collector Crypt accounted for $44 million in trading volume.

-

2. Authenticate and Submit Your Physical CardsSend your Pokémon cards to the platform’s partnered vault service for professional authentication and secure storage. This process ensures the card’s legitimacy and physical safety before tokenization.

-

3. Mint NFTs Representing Your Physical CardsOnce authenticated, the platform will mint an NFT on the blockchain (Polygon for Courtyard, Solana for Collector Crypt) that represents your specific card. This NFT serves as a digital proof of ownership and can be traded or held.

-

4. Trade or Fractionalize Your Tokenized CardList your NFT on the platform’s marketplace for instant trading, or choose to fractionalize ownership, allowing multiple investors to hold shares in a high-value card. Collector Crypt’s digital Gacha machine and Courtyard’s trading features are popular options.

-

5. Redeem the NFT for the Physical Card (Optional)If you wish to reclaim your physical Pokémon card, redeem the NFT through the platform. The vault will verify your request and ship the authenticated card back to you, ensuring a secure and transparent process.

If you’re interested in learning more about the technical details or want to start your journey, check out our comprehensive guide: How to Tokenize Your Pokémon Cards as NFTs: A Step-by-Step Guide for Collectors.

Broader Implications: The Future of Collectible RWAs

The tokenization model pioneered by Pokémon cards offers a blueprint for other segments within the RWA collectibles landscape – from Magic: The Gathering to sports memorabilia and beyond. By leveraging blockchain’s core properties (immutability, transparency, programmability), these platforms are unlocking new forms of value creation that extend well beyond speculative trading.

Collectors now have tools to prove authenticity instantly, trade globally 24/7, and participate in communities where rarity is algorithmically verifiable rather than subjectively appraised. As more high-value assets are brought on-chain, expect continued innovation around governance (e. g. , DAO-managed vaults), dynamic pricing models, and cross-chain liquidity pools.

Numbers never lie, but context is everything. The current momentum behind tokenized Pokémon cards is data-driven proof that collectible RWAs are evolving from static trophies into dynamic financial instruments.

The convergence of crypto infrastructure with physical collectibles marks a structural shift in how value is stored and transferred across generations. Whether you’re a seasoned collector or an investor seeking diversification outside conventional asset classes, this new era offers both opportunity and challenge – but above all else, it demands attention.