Pokémon card collecting has entered a new era, where blockchain technology is redefining what it means to own, trade, and invest in physical collectibles. By leveraging real-world asset (RWA) tokenization, collectors can transform their prized Pokémon cards into digital tokens on the blockchain. This not only ensures authenticity and security but also unlocks global liquidity and fractional ownership. If you’re ready to bridge your collection with crypto markets, here’s how to tokenize your Pokémon cards step by step.

What Does It Mean to Tokenize Pokémon Cards?

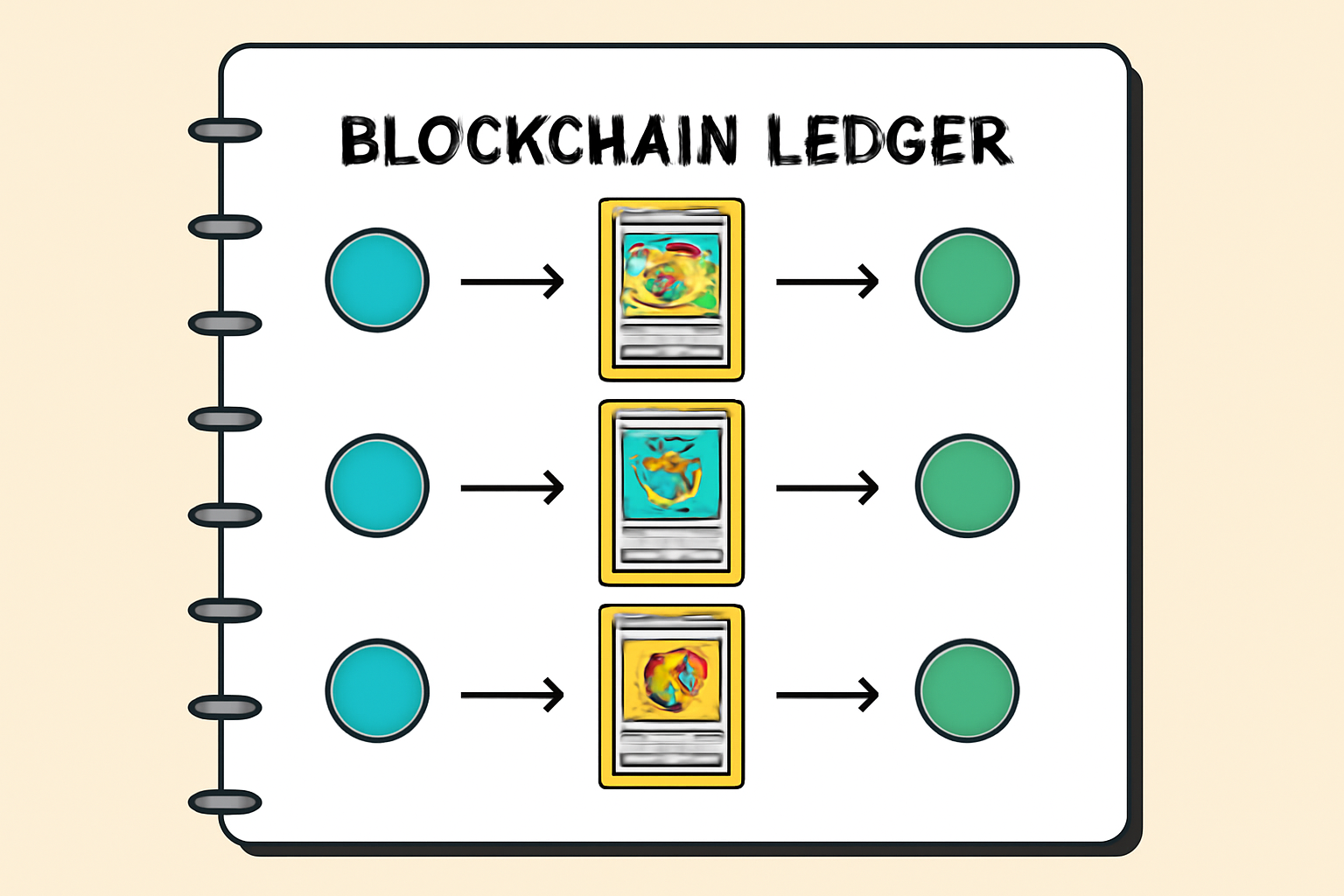

Tokenizing Pokémon cards means creating NFTs (non-fungible tokens) that digitally represent the ownership of specific physical cards. These NFTs are stored on a blockchain and act as verifiable proof of authenticity, condition, and custody. The physical cards themselves are typically held in secure vaults or by trusted custodians until the NFT owner decides to redeem them by burning the token.

This process is rapidly gaining traction among collectors seeking new ways to manage and trade their assets globally. According to CoinGecko, platforms like Courtyard. io and CollectorCrypt are leading the charge, enabling collectors to trade digital versions with on-chain settlement while ensuring physical redemption remains possible.

Step-by-Step Guide: From Physical Card to Blockchain Asset

Let’s break down the essential steps you’ll need to follow:

- Understand Asset Tokenization: Asset tokenization converts rights or ownership of a physical card into a digital NFT on a blockchain. This enables seamless transferability, division (fractionalization), and transparent record-keeping. For more technical background, see Wikipedia’s asset tokenization entry.

- Evaluate Your Card’s Value: Before minting an NFT, assess your card’s value based on rarity, condition, grading (e. g. , PSA/BGS), and current demand trends in both physical and digital markets.

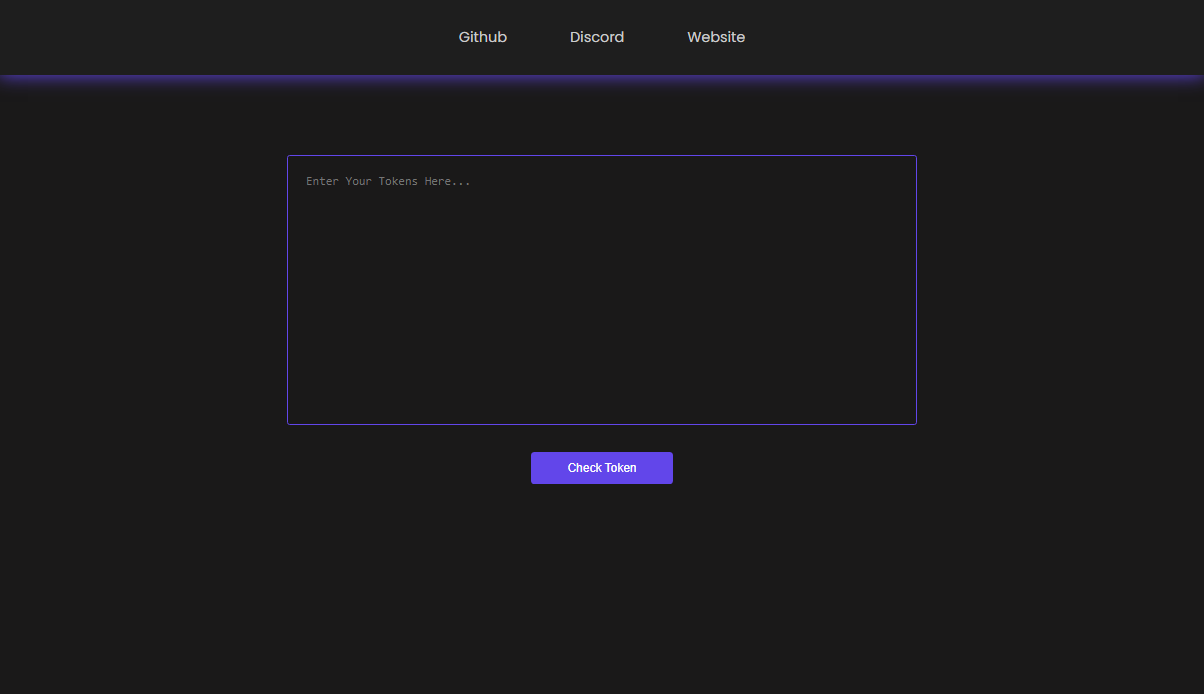

- Select Your Blockchain Platform: Ethereum is the industry standard for NFTs thanks to its ERC-721 protocol, but alternatives like Solana or Polygon may offer lower fees or unique features for trading card NFTs.

- Create Smart Contracts: These define ownership rights and transfer mechanisms for your NFT Pokémon card RWA. You may use existing templates or work with platforms that automate this process.

The Critical Role of Custody and Verification

The credibility of any tokenized asset hinges on robust custody solutions. Once you’ve minted your trading card NFT, the underlying physical card must be securely stored, either with you or via a third-party custodian specializing in collectibles. Platforms such as Courtyard require users to send their cards for professional authentication before minting NFTs (see ChainUp’s guide). This ensures that every digital asset corresponds exactly to a real-world item in verified condition.

Key Benefits of Tokenizing Pokémon Cards as NFTs

-

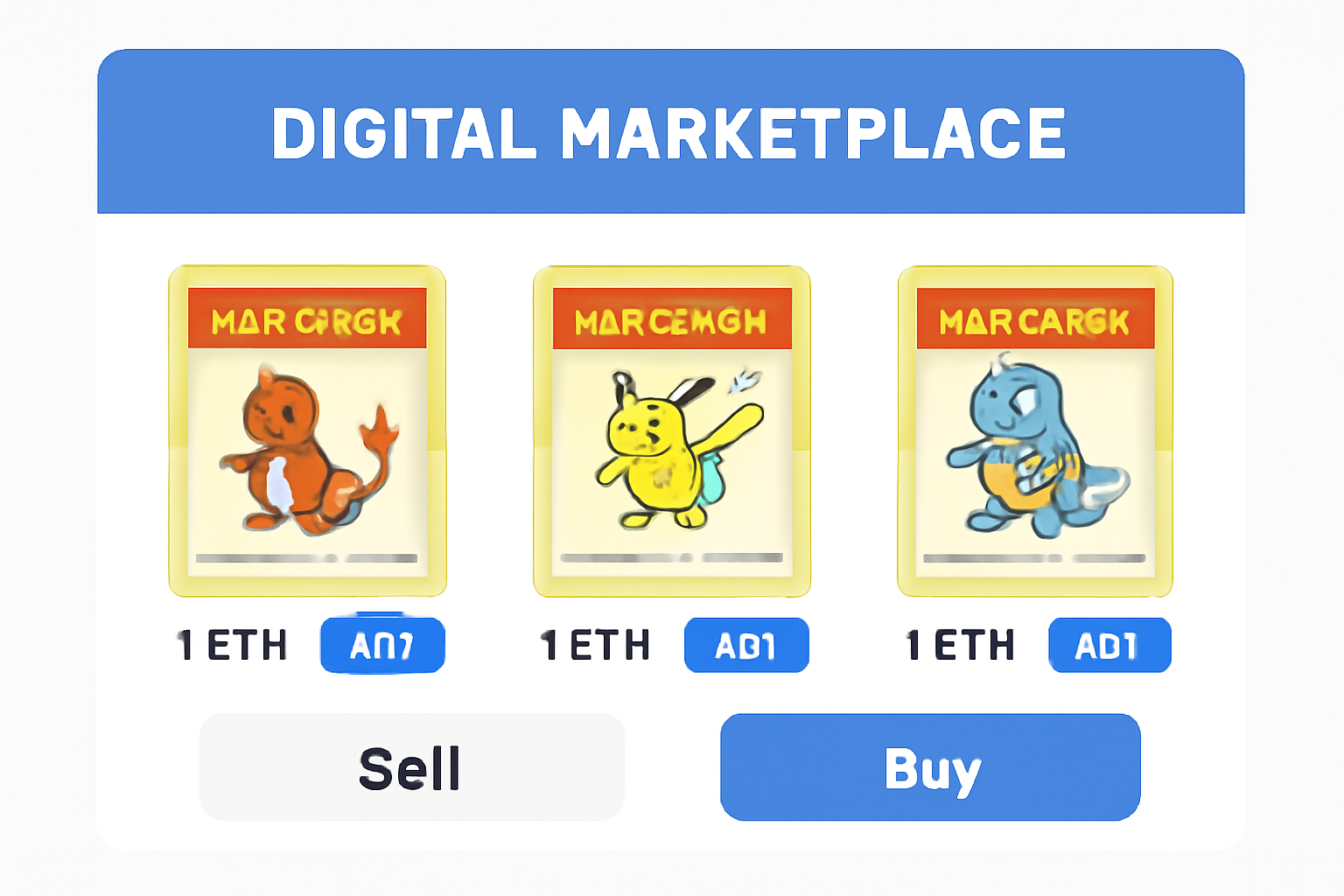

Enhanced Liquidity: Tokenized Pokémon cards can be traded instantly on NFT marketplaces like Courtyard and Collector Crypt, allowing collectors to buy and sell without the delays of physical shipping.

-

Fractional Ownership: Blockchain platforms enable you to split ownership of valuable cards into fractions, letting multiple collectors invest in high-value cards that would otherwise be unaffordable.

-

Transparent Proof of Ownership: Each NFT contains immutable metadata and transaction history, providing verifiable proof of authenticity and ownership on-chain.

-

Immediate Settlement: NFT-based trades settle instantly on platforms such as OpenSea, reducing counterparty risk and eliminating traditional escrow delays.

-

Physical Redemption: Platforms like Collector Crypt allow you to redeem the physical card by burning the NFT, guaranteeing the card leaves vault custody only when ownership is transferred.

-

Global Market Access: Tokenized Pokémon cards can be bought or sold by collectors worldwide, expanding your reach far beyond local markets.

-

Permanent On-Chain Record: All transactions are recorded on the blockchain, providing a transparent and tamper-proof history of each card’s provenance and movement.

Verification processes might include third-party audits or certificates from grading companies, these details should be embedded as metadata within your NFT for maximum transparency.

Navigating Legal Compliance When Tokenizing Collectibles

The legal landscape around RWA tokenization is evolving rapidly. As regulations catch up with innovation, it’s vital for collectors to understand local laws regarding securities, taxation, and consumer protection when creating trading card NFTs from real-world assets. Consulting legal experts can help ensure full compliance at every stage.

After ensuring your Pokémon cards are securely stored and properly verified, the next step is to choose a trading venue that aligns with your goals. Leading NFT marketplaces like OpenSea and Rarible are popular choices, but platforms specifically designed for tokenized RWAs, such as Courtyard. io or CollectorCrypt, offer additional features tailored for collectible trading card NFTs. These include streamlined custody integration, on-chain provenance tracking, and support for physical redemption protocols.

Listing and Marketing Your Tokenized Pokémon Cards

Once your NFT is minted and ready, listing it on a reputable marketplace is crucial. Make sure to include all relevant metadata: card name, edition, grading details, condition report, and any unique attributes. High-resolution images and third-party grading certificates add trust and drive buyer interest. To maximize reach, leverage collector forums, Discord groups, Twitter/X threads, and dedicated crypto-collectible communities.

Marketing isn’t just about exposure, it’s about building credibility. Share the story behind your card’s journey from physical asset to blockchain token. Highlight the security of its custody solution and the transparency of its verification process. The more verifiable data you provide on-chain (including links to grading reports or vault confirmations), the higher your asset will rank in terms of desirability and liquidity.

Top Channels to Promote Tokenized Pokémon Cards

-

X (formerly Twitter): The leading social platform for crypto discussions, NFT drops, and real-time market updates. Engage with hashtags like #TokenizedPokemon and connect with influencers in both the Pokémon and crypto communities.

-

Discord Communities: Join servers such as Collector Crypt and Courtyard.io for targeted promotion, AMA sessions, and direct engagement with NFT collectors.

-

Reddit: Subreddits like r/NFT, r/pkmntcg, and r/CryptoCurrency are active hubs for sharing tokenized asset projects and receiving feedback from both crypto and Pokémon fans.

-

OpenSea: The largest NFT marketplace, where listing your tokenized Pokémon cards increases visibility among global NFT collectors and provides built-in promotional tools.

-

YouTube: Collaborate with crypto and Pokémon content creators for reviews, unboxings, and educational videos to reach a wide audience interested in both collectibles and blockchain technology.

Managing Trades and On-Chain Ownership Transfers

Trading tokenized Pokémon cards as RWAs introduces new mechanics compared to traditional card sales:

- Instant Settlement: Blockchain transactions enable near-instantaneous transfers of ownership with full transparency.

- Physical Redemption: Most platforms require you to ‘burn’ (destroy) the NFT to claim physical delivery from vault custody, a process that guarantees only one valid claim per asset (details here).

- Fractionalization: Some advanced platforms allow you to split high-value cards into fractional shares via multiple NFTs, enabling broader participation without selling the entire card.

Always double-check transaction details before confirming any transfer or sale; blockchain settlements are irreversible by design.

Key Considerations in Today’s RWA Market

The market for trading card NFTs is dynamic and sometimes volatile. Prices can fluctuate rapidly based on collector sentiment, macro crypto trends, or news around regulatory changes. Security remains paramount, use hardware wallets where possible and enable two-factor authentication on all trading accounts.

The regulatory outlook is still evolving worldwide. While some jurisdictions treat NFT collectibles as property or digital assets, others may classify them differently under securities law. Stay updated by following reputable industry sources or consulting with legal professionals familiar with digital asset compliance.

Unlocking New Possibilities for Collectors

The ability to tokenize Pokémon cards as RWAs isn’t just a technical evolution, it’s a cultural shift in how collectors interact with their favorite assets. By bridging physical collectibles with blockchain infrastructure, you gain access to global liquidity pools, transparent provenance records, fractional investment opportunities, and seamless peer-to-peer trades.

This new paradigm empowers collectors at every level, from casual hobbyists looking for secure long-term storage to sophisticated investors seeking exposure in emerging RWA markets. As demand grows and infrastructure matures, expect even greater innovation around interoperability between marketplaces and enhanced custody solutions tailored specifically for trading card NFTs.

The future of collectible ownership lies at the intersection of tradition and technology. By embracing real-world asset tokenization today, you’re not just preserving value, you’re unlocking entirely new dimensions of utility for your collection.