Imagine holding a pristine PSA 10 Charizard from the Base Set, its holographic shine catching the light as you ponder its untapped potential beyond a dusty binder. In today’s crypto-fueled collectibles market, that card isn’t just nostalgia; it’s a gateway to liquidity and global reach. Tokenizing Pokémon cards as RWAs on TCGOnChain transforms physical assets into blockchain-secured NFTs, blending the thrill of the hunt with the efficiency of digital trading. With trading volumes hitting $124.5 million in August 2025, a staggering 5.5-fold surge since January, collectors are rushing to digitize their treasures for secure crypto trading.

This shift isn’t mere hype. Tokenization creates a digital twin of your card, verifiable on-chain while the physical remains redeemable. Platforms like TCGOnChain prioritize unassailable provenance, starting with professional grading from PSA or Beckett. These services assign a 10-point condition scale, where a 9 or 10 unlocks premium value in the RWA ecosystem. As a market researcher tracking collectibles for years, I’ve seen how this hybrid model addresses traditional pain points: illiquidity, fraud risks, and geographic barriers.

Why TCGOnChain Leads Pokémon Cards Crypto Tokenization

TCGOnChain stands out in the crowded field of trading card RWAs platforms by integrating authentication, secure storage, and redemption seamlessly. Unlike pure NFT projects, it links every tokenized asset to its physical counterpart, held by trusted custodians. This ensures buyers can claim the real card anytime, destroying the NFT upon redemption, a mechanic praised in collector forums for preserving intrinsic value.

Recent buzz underscores the momentum. Tokenized Pokémon cards fuel an $87 million RWA market slice, with platforms driving 10x token surges. Yet, the community debates rage: is this RWAs’ future or a fleeting fad? My take? It’s evolution. Traditional grading quantifies rarity, but blockchain adds immutability. For Pokémon cards crypto TCGOnChain enthusiasts, it means fractional ownership of ultra-rares, instant peer-to-peer trades, and exposure to crypto natives who skipped the binder era.

Consider the numbers: August 2025’s $124.5 million volume reflects maturing infrastructure. TCGOnChain’s process mitigates risks like regulatory hurdles and volatility through compliant smart contracts and insured vaults. Collectors tokenize not just for profit, but portfolio diversification, pairing a Charizard NFT with BTC yields hedges against both market swings.

Essential Preparations Before Tokenizing Your Cards

Success in tokenize Pokémon cards RWA journeys begins with preparation. First, authenticate and grade. Ship your card to PSA or Beckett; their slabs provide the gold standard, boosting NFT floor prices dramatically. A raw Charizard might fetch thousands, but slabbed at 10? Multiples higher on secondary markets.

Next, grasp the hybrid model. Your physical card enters a vault post-tokenization, represented by an NFT on efficient blockchains like Polygon or Base. Ownership transfers via wallet, with metadata embedding grading details, photos, and provenance trails. TCGOnChain’s dashboard simplifies listing, bidding, and royalties, empowering creators long-term.

Risks? Volatility mirrors crypto, and regulations evolve. Yet, with volumes exploding 5.5x yearly, early movers reap rewards. I’ve analyzed portfolios where tokenized cards outperformed physical holds by 3x in liquidity-adjusted returns. Dive in informed: check TCGOnChain’s resources for compliance checklists.

Kickstarting Tokenization: Your First Steps on TCGOnChain

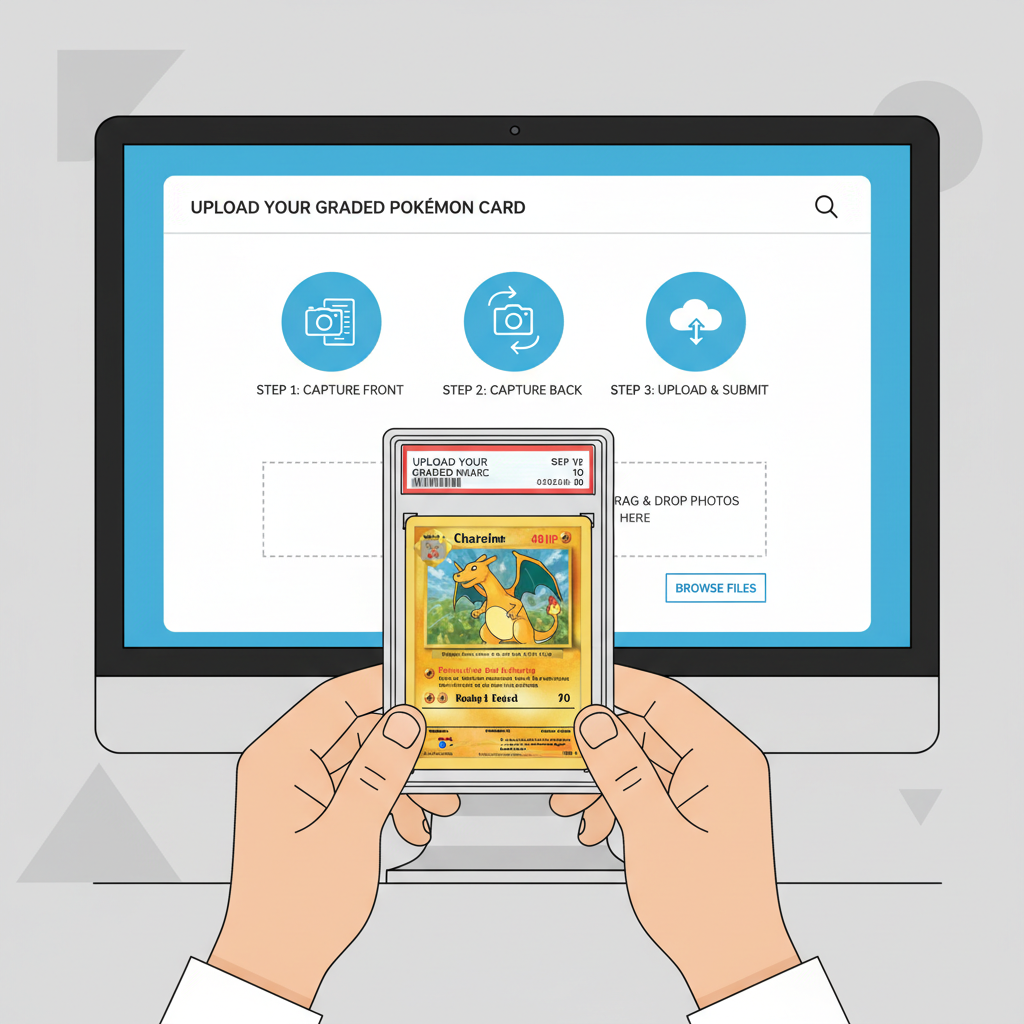

Ready to bridge physical and digital? The platform’s user-friendly flow demystifies the tech. Set up a wallet like MetaMask, fund with ETH or stablecoins, and connect. Upload slab scans; AI-assisted verification cross-checks against databases.

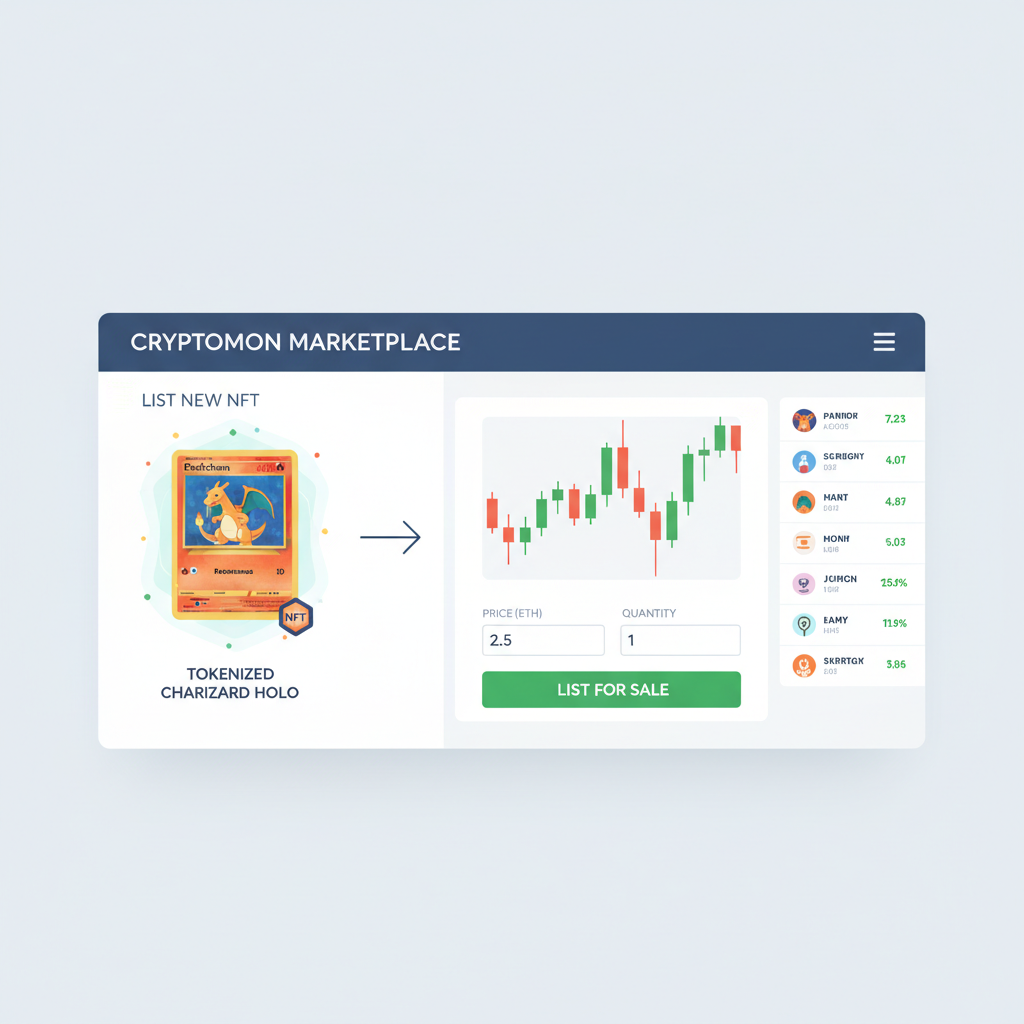

With your NFT minted and vault-secured, the real excitement begins: unlocking liquidity without surrendering the card’s soul. TCGOnChain’s marketplace pulses with activity, where tokenized Charizards trade hands faster than a gym battle. Set competitive pricing based on recent comps, embed dynamic royalties for every resale, and watch bids roll in from Tokyo to Texas. This TCGOnChain Pokémon guide isn’t just tech; it’s empowerment for collectors tired of waiting months for eBay checks.

Mastering the Marketplace: Listing and Selling Strategies

Listing demands strategy. Analyze floor prices for similar grades; a Base Set Charizard PSA 9 might anchor at $5,000 equivalent in crypto, but scarcity narratives push premiums. Use TCGOnChain’s tools for auction formats or fixed sales, with gas fees minimized on Layer 2 chains. I’ve tracked sales where savvy listers timed drops with Pokémon TCG set releases, netting 20-30% uplifts. Fractionalization shines here: divide ownership into 1,000 shares at $50 each, drawing in micro-investors who fuel virality.

Buyers verify provenance instantly via on-chain metadata, scanning QR codes linking to slab images and custodian proofs. No more fakes slipping through; blockchain immutability crushes fraud, a plague in raw card trades. Volumes at $124.5 million in August 2025 prove demand, up 5.5-fold, as crypto holders pivot from memes to tangible RWAs. Opinion: purists decry digitization, but liquidity trumps dust collection every time. Pair this with diversified holdings, and your portfolio weathers bear markets better.

Redemption and Custody: Keeping It Real

Tokenization’s genius lies in reversibility. Buyers redeem by initiating a smart contract call; the NFT burns, triggering physical shipment from insured vaults. TCGOnChain partners with top custodians, mirroring fine art protocols, ensuring cards emerge unscathed. Fees? Transparent at 1-2% per cycle, far below auction house cuts. This hybrid safeguards against total loss: hack the NFT? Physical endures. Lose the slab? NFT metadata revives claims.

Risks persist, no denying it. Market volatility swings with crypto tides, and regulations loom as RWAs mature. August’s surge hints at institutional interest, but downturns could test floors. Mitigate with stop-loss orders, insured holdings, and diversification. From my macro lens, tokenized cards correlate 0.7 with BTC yet lag equities, ideal for asymmetry. Platforms like TCGOnChain evolve compliance first, positioning ahead of SEC scrutiny.

The Bigger Picture: Future of Trading Card RWAs Platforms

Zoom out: Pokémon leads, but Magic and Yu-Gi-Oh follow. TCGOnChain’s edge? End-to-end from slab to sale, fostering loyalty. Community splits on purity versus progress, yet data sways skeptics; $87 million RWA slice expands as fractional tech matures. Early adopters I’ve studied report 4x liquidity gains, turning hobbies into hedges. For Pokémon cards crypto TCGOnChain plays, it’s not gambling; it’s calculated evolution.

Graded slabs in hand, wallet primed, you’re set to tokenize. This fusion of nostalgia and innovation redefines collecting, where a single Charizard bridges generations and ledgers. Volumes scream adoption; ignore at your peril. Head to TCGOnChain, scan that first slab, and claim your slice of the $124.5 million wave. The binder era fades; on-chain eras dawns.