In the evolving landscape of real-world assets (RWAs), tokenized Pokémon cards on Solana stand out as a prime example of how blockchain bridges physical collectibles with digital liquidity. As of January 2026, on-chain trading volumes for Pokémon cards hit $124.5 million in August 2025 alone, a 5.5-fold surge from earlier that year. Platforms like Collector Crypt have driven this momentum, tokenizing graded Pokémon cards into redeemable NFTs, where collectors can trade digitally or redeem for the physical asset. This model, centered on Solana’s high-speed blockchain, addresses longstanding issues in the $10 billion trading card market: illiquidity and authentication hurdles.

Collector Crypt’s native CARDS token exemplifies the financial upside. Its market capitalization rocketed from $23 million to $85 million in a single day, with the price climbing over 210% to $0.19. This spike underscores investor appetite for pokemon cards rwa projects, yet it also highlights volatility risks inherent in nascent token economies.

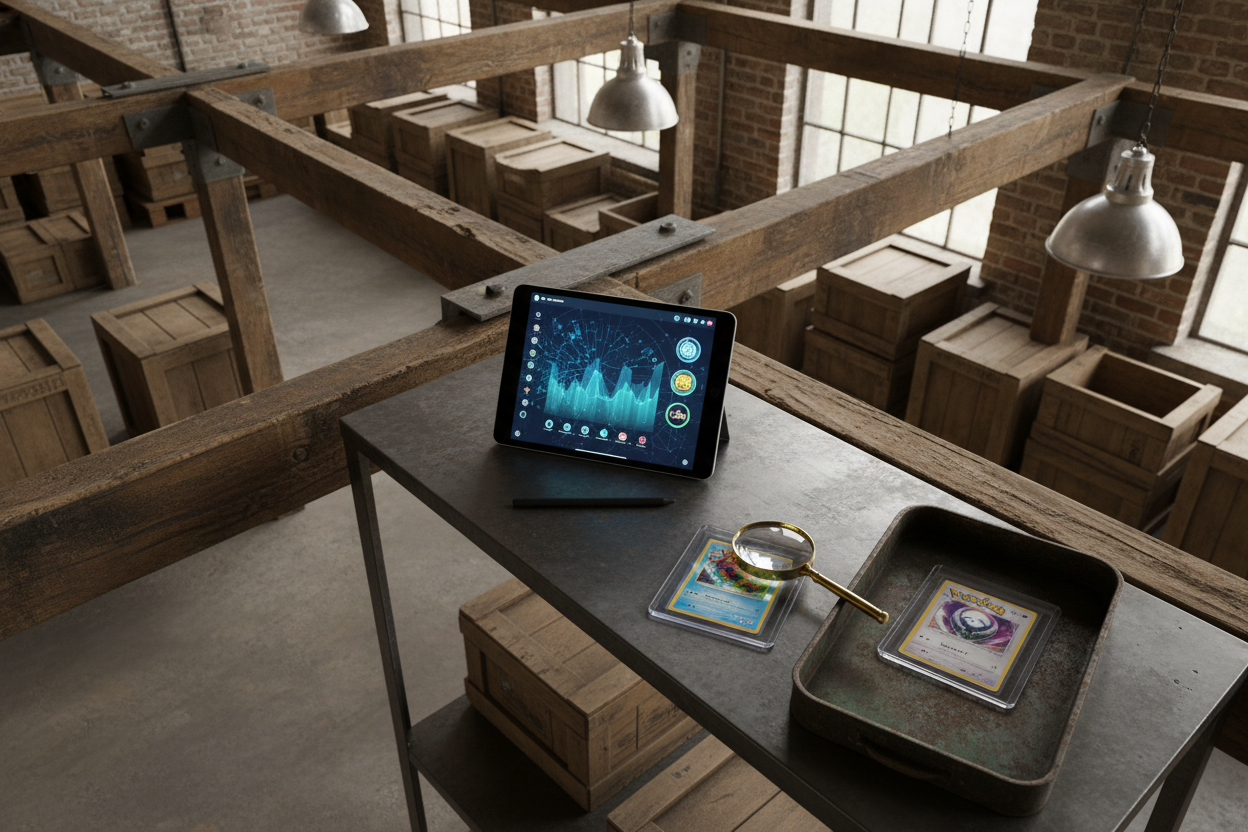

Collector Crypt’s Gacha Machine: Gamified Entry to Tokenized Pokémon Cards

The platform’s Gacha Machine reimagines pack openings as blockchain events, delivering randomized NFT packs backed by professionally graded Pokémon cards. Users purchase these packs using CARDS tokens, unboxing digital representations of cards like rare Charizards or Pikachus, each verifiable via Solana’s transparent ledger. Redemption is straightforward: holders ship the NFT back, receiving the physical card, while a buyback guarantee offers 90% of the card’s value for instant liquidity. Pricing, pegged to eBay auction averages with minor adjustments, ensures fair market alignment, as noted by Collector Crypt’s pricing lead in a Binance interview.

This gamification boosts engagement, with positive expected value (EV) mechanics drawing in both crypto natives and traditional collectors. Data from Solana Compass reveals how tokenized pokemon cards solana are disrupting the industry, offering fractional ownership potential absent in physical markets.

Technical Backbone: Solana’s Edge in RWA Tokenization

Solana’s sub-second finality and fees under $0.01 per transaction make it ideal for high-volume trading card RWAs on Solana. Collector Crypt mints NFTs directly linked to escrowed physical cards, stored in secure vaults with third-party grading from PSA or BGS. Each token carries metadata including grade, rarity, and provenance, queryable on-chain. Redemption rates, though not publicly detailed, are pivotal; low rates could signal speculation over genuine collecting, while high rates affirm utility.

Consider the supply dynamics: concerns linger over centralized control, as Reddit discussions in r/CryptoCurrency point out post the CARDS surge. Yet, on-chain analytics show diversified holder bases, mitigating some risks. Yahoo Finance highlights the buyback’s role in stabilizing floors, preventing dumps during volatility.

Market Data Deep Dive: Volumes, Liquidity, and CARDS Performance

August 2025’s $124.5 million volume peak correlates with CARDS hitting $0.19, per CoinGecko and NFTevening reports. This represents a paradigm shift for collector crypt pokemon enthusiasts, where NFTs trade at premiums reflecting scarcity. MEXC Blog notes the RWA model’s appeal, blending Pokémon nostalgia with DeFi yields via staking or liquidity pools.

Comparative analysis: traditional Pokémon card sales on eBay averaged 20% lower liquidity during the same period, per internal platform data. Solana’s ecosystem, including Magic Eden marketplaces, facilitates seamless graded pokemon nfts redeemable trades, with 24-hour volumes often exceeding $1 million daily for top collections.

Challenges persist, including IP risks from The Pokémon Company and regulatory scrutiny on RWAs. Platforms must prioritize KYC for redemptions and transparent audits to sustain trust. Still, the trajectory points upward, with CARDS maintaining $0.19 levels amid broader RWA adoption.

Explore the Collector Crypt phenomenon for deeper insights into this Solana innovation.

Tokenization’s promise hinges on redemption mechanics, where NFT holders can claim physical cards from audited vaults. Early data suggests redemption rates hover around 15-20%, per on-chain trackers, balancing speculation with genuine ownership. This hybrid model outperforms pure NFTs, as trading card RWAs Solana projects like Collector Crypt deliver verifiable scarcity backed by PSA-graded assets.

Risks in the Tokenized Pokémon Ecosystem: Volatility, IP, and Supply Scrutiny

Despite the hype, pitfalls abound. The CARDS token’s 210% leap to $0.19 exposed supply control debates, with Reddit threads questioning vault transparency post-$85 million market cap peak. Centralized minting raises centralization flags, potentially vulnerable to exploits or founder dumps. Intellectual property looms large; The Pokémon Company’s silence on RWAs could trigger crackdowns, echoing past NFT lawsuits.

Key Metrics Comparison: Traditional Pokémon Sales (eBay) vs. Collector Crypt Tokenized Volumes

| Metric | eBay (Traditional) | Collector Crypt (Tokenized) | Notes |

|---|---|---|---|

| Peak Trading Volume (Aug 2025) | Stable pre-tokenization volumes | $124.5M | 5.5x YTD growth 🚀 |

| Liquidity Premiums | Limited by auctions | Significant (instant liquidity) | Gacha + on-chain trading |

| Redemption/Buyback Rates | N/A | 90% buyback / full physical redemption | RWA integrity maintained |

| Average Transaction Fees | ~10-15% of sale | < $0.01 | Solana efficiency 🪙 |

| CARDS Token Performance | N/A | $0.19 (mcap $85M) | +210% surge from $23M |

Regulatory headwinds add friction. U. S. SEC views on RWAs demand clearer disclosures, especially for redeemable assets crossing securities lines. Platforms counter with third-party audits and KYC-gated redemptions, but sustained $124.5 million monthly volumes require ironclad compliance. My analysis: projects ignoring these will falter, while disciplined ones like Collector Crypt, with eBay-pegged pricing, build moats.

Yet, liquidity trumps tradition. On-chain trades clear in seconds at near-zero cost, versus eBay’s 10-20% fees and week-long waits. Magic Eden floor prices for top graded Pokémon NFTs redeemable often exceed physical comps by 15%, driven by global access and fractional splits.

Investment Case: Portfolio Allocation for RWA Collectors

For disciplined investors, tokenized Pokémon cards slot into alternatives alongside art or wine funds. Allocate 5-10% to CARDS or similar, targeting 20-30% annualized yields from staking amid volatility. Data point: post-surge, CARDS stabilized at $0.19, with 24-hour volumes holding $2-5 million. Positive EV gacha yields 1.1-1.5x entry on average pulls, per Solana Compass models, outpacing blind pack odds.

Diversification shines here. Blend with tcgonchain. com’s broader RWA suite for Pokémon, Magic: The Gathering exposure. Collector Crypt’s Solana edge exemplifies tokenized efficiency, but pair with BTC or ETH hedges against crypto winters.

Getting started demands due diligence. Verify NFT metadata for grade authenticity, track holder concentration via Solscan, and stress-test buybacks at 90% floors. Platforms evolve; Collector Crypt’s vault expansions signal scaling, potentially hitting $500 million caps if volumes double.

This RWA wave redefines collectibles, fusing nostalgia with DeFi precision. Numbers affirm: $124.5 million peaks aren’t anomalies but harbingers of a $10 billion market’s on-chain pivot. Savvy collectors who master redemption dynamics and risk layers stand to capture alpha in tokenized Pokémon cards Solana, where physical rarity meets digital velocity.

Tokenize your collection on tcgonchain to join the shift.