Collectors and investors are witnessing a profound shift in how trading cards like Pokémon and Magic: The Gathering are owned, traded, and valued. Tokenizing trading cards as Real-World Assets (RWAs) is not just the latest crypto buzz – it’s a structural innovation bringing real-world utility far beyond mere speculation or hype cycles. Let’s explore why this matters for the future of card collecting and investment.

Unlocking Liquidity: Trading Cards as Fluid Digital Assets

Historically, high-value trading cards have been illiquid. Selling a rare card could mean weeks of negotiation, authentication, shipping, and paperwork. Tokenization changes this paradigm. By converting physical cards into blockchain-based tokens, collectors can trade instantly on global digital marketplaces. This dramatically reduces friction – no more slow-moving auctions or regional limitations.

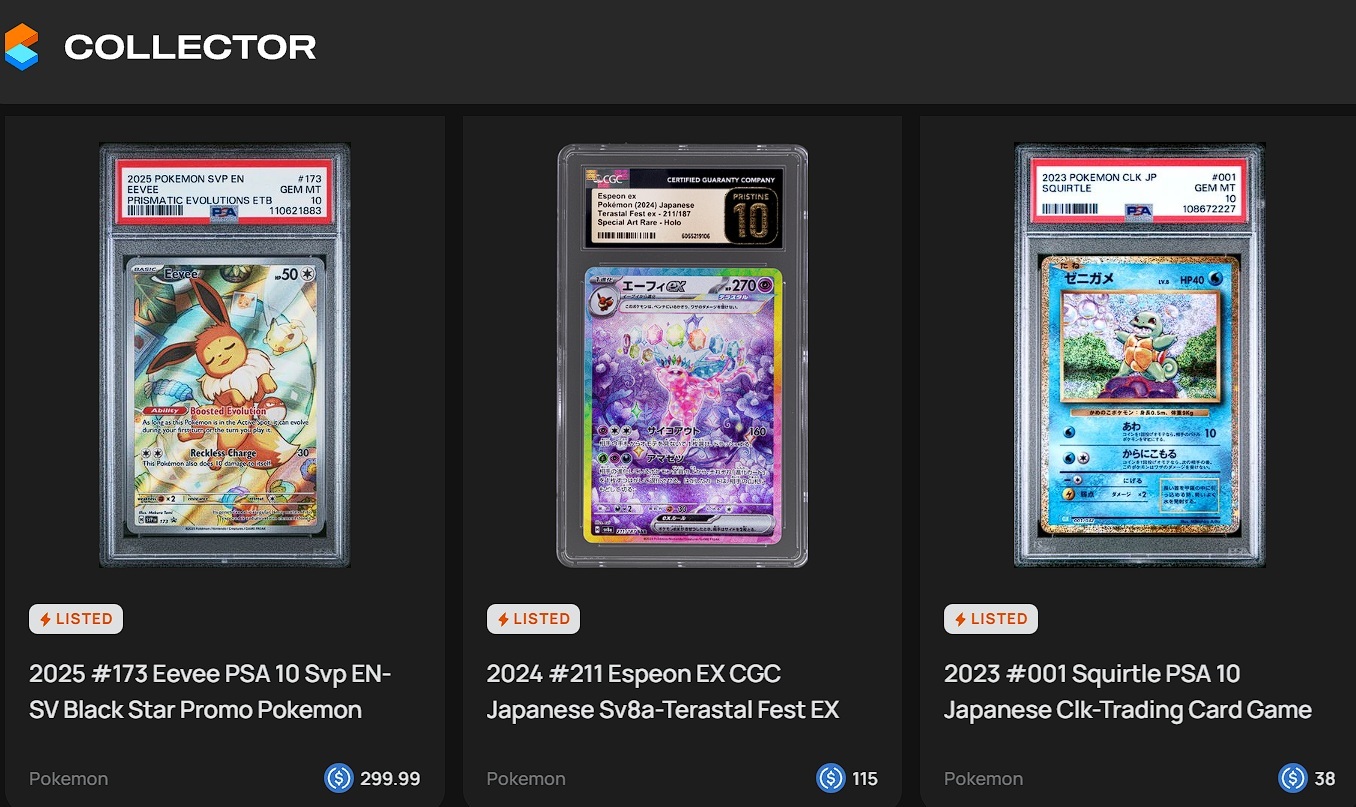

The benefits go even further: tokenized cards can be bought or sold 24/7, with clear ownership records secured by blockchain transparency. Platforms like Collector Crypt and Courtyard are already demonstrating how tokenized Pokémon cards can drive RWA adoption by addressing liquidity challenges head-on (source).

Fractional Ownership: Lowering Barriers for New Investors

The days when only the ultra-wealthy could own a piece of cardboard worth thousands are fading fast. Fractionalization is one of the most powerful utilities unlocked by RWA tokenization. Now, a $50,000 Charizard card can be divided into hundreds or thousands of digital shares – allowing fans and investors to purchase small fractions according to their budget.

Leading Platforms Offering Fractionalized Trading Card Investments

-

Courtyard specializes in tokenizing physical trading cards, particularly Pokémon and other collectible cards. Investors can purchase blockchain-based fractions of high-value cards, with each token representing a verifiable share of the physical asset secured in vaults.

-

Collector Crypt enables users to invest in fractionalized ownership of rare trading cards, including Pokémon and sports cards. The platform leverages blockchain technology to ensure transparent ownership and secure storage of the underlying physical assets.

-

RWA Marketplace by Courtyard offers a dedicated marketplace for trading fractionalized real-world assets, with a strong focus on trading cards. Users can buy, sell, and trade tokenized shares, increasing liquidity and accessibility for collectors and investors.

-

Rares is a platform primarily focused on fractionalizing sports memorabilia, including trading cards. Users can invest in shares of iconic cards, such as vintage basketball or baseball cards, with all assets authenticated and stored securely.

-

RWA.io provides tokenization services for various real-world assets, including trading cards. The platform allows for the creation and trading of fractionalized ownership tokens, streamlining access and liquidity for collectors.

This democratizes access to iconic collectibles and enables more diverse portfolios. It also means that price appreciation (or depreciation) is shared among many holders rather than just one lucky owner. As noted by OKX, this model increases accessibility while maintaining robust security through blockchain verification.

Transparency and Authenticity: Trust in Every Transaction

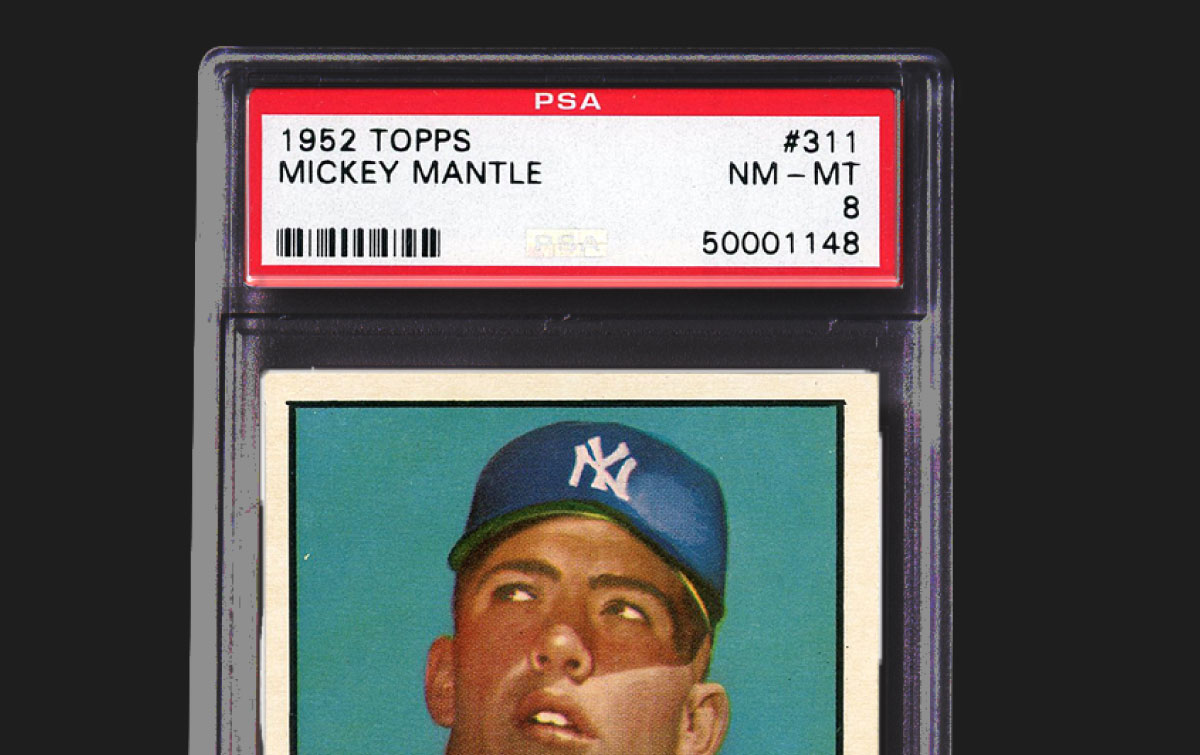

Authenticity has always been a pain point in trading card markets. Counterfeits, disputes over grading, and opaque transaction histories have made some collectors wary of big-ticket deals. Blockchain solves these issues by providing an immutable record for each tokenized asset – including provenance, grading information, prior owners, and transaction dates.

This transparency doesn’t just reduce fraud; it builds trust among buyers and sellers worldwide. When you buy an NFT representing a real Pokémon card on platforms like tcgonchain. com, you know exactly what you’re getting – no guesswork required.

The Expanding Utility Beyond Collecting

The true breakthrough comes when utility extends past simple buying and selling. Tokenized trading cards can serve as collateral for loans in decentralized finance (DeFi) systems or even participate in yield-generating protocols (learn more here). This bridges traditional collectibles with modern financial tools – an unprecedented leap for both worlds.

Imagine using your prized graded Pokémon card not just as a collector’s trophy, but as an active asset in your portfolio. With RWA tokenization, cards can be staked for rewards, pledged as collateral for instant liquidity, or even integrated into gamified DeFi platforms. This is where the utility of RWA trading cards truly shines: they become dynamic financial instruments, not just static collectibles.

For investors who value diversification and risk management, this unlocks possibilities that were previously out of reach. Instead of waiting for the right buyer or hoping for price spikes, owners can generate yield or access capital without liquidating their position. It’s a tangible benefit that goes well beyond speculative trading and hype cycles.

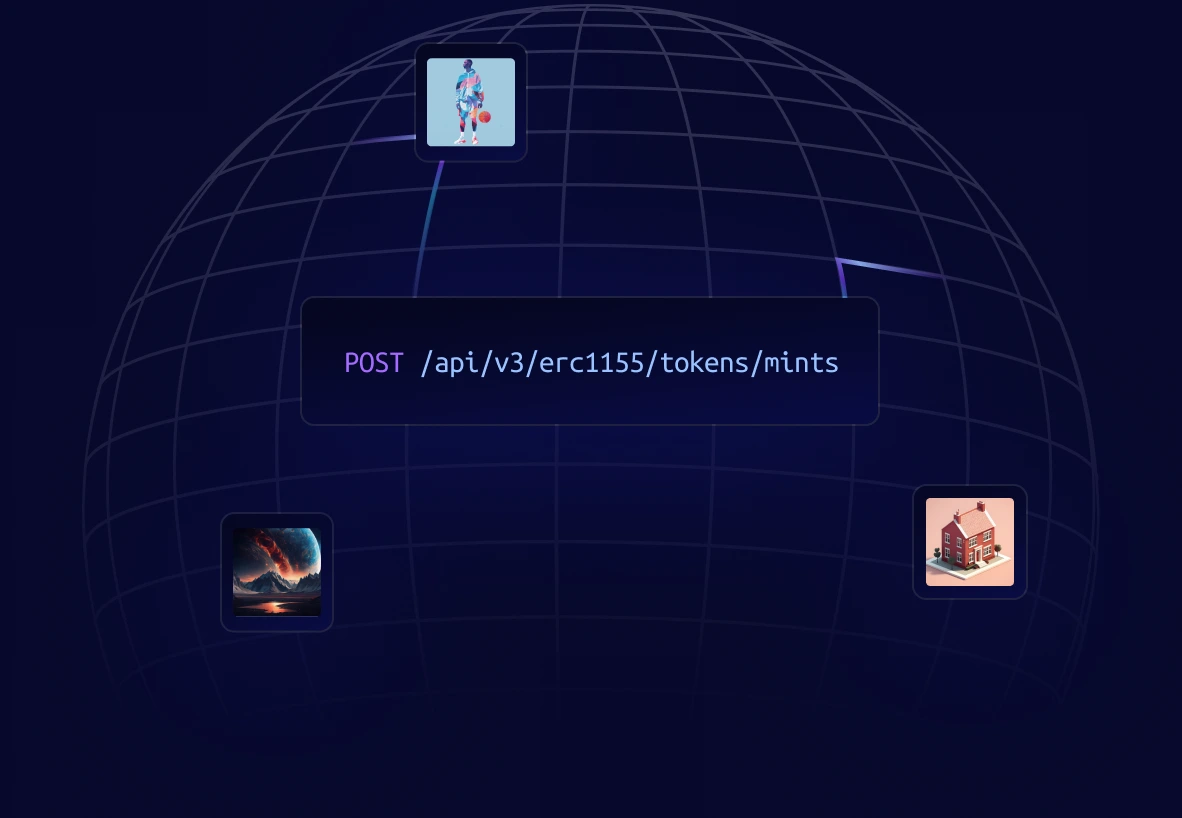

Streamlining Administration: Automated and Secure Ownership

Manual record-keeping and paperwork have long plagued high-value asset transactions. Tokenization automates these processes, ownership transfers are executed on-chain with smart contracts, providing instant settlement and reducing human error. This isn’t just about convenience; it’s about security and efficiency at scale. Administrative headaches become relics of the past.

How Blockchain Automates Trading Card Provenance and Transfers

-

Immutable Provenance Tracking: Platforms like Courtyard use blockchain to record every ownership transfer and transaction of tokenized trading cards, ensuring a permanent, tamper-proof history that collectors and buyers can independently verify.

-

Automated Ownership Transfers: Services such as Collector Crypt enable instant, automated transfer of trading card ownership via smart contracts, eliminating manual paperwork and reducing the risk of human error.

-

Real-Time Auditing and Transparency: Blockchain explorers like Etherscan allow anyone to audit tokenized trading card transactions in real time, providing open access to authenticity and transaction records for greater trust.

-

Streamlined Compliance and Authentication: Platforms including Venly automate compliance checks and card authentication, leveraging smart contracts to enforce rules and verify asset legitimacy without manual intervention.

-

Seamless Integration with DeFi Platforms: Tokenized cards on networks like Polygon can be used as collateral or traded in decentralized finance applications, enabling automated lending, borrowing, and liquidity provision for physical collectibles.

The result? A more robust market where authenticity is provable, disputes are minimized, and every transaction leaves a transparent trail. As noted by industry experts in recent research, streamlined administration is one of the most overlooked yet transformative aspects of RWA tokenization.

A New Era for Collectors: Global Access Meets Local Passion

The days when geography limited your ability to buy or sell high-end cards are over. Blockchain-based ownership means global marketplaces operate around the clock, no matter where you live or what currency you use. This increased accessibility fuels greater demand and price discovery while empowering passionate collectors from all corners of the world.

As we look ahead to 2025 and beyond, it’s clear that NFT trading cards benefits reach far deeper than speculation alone. The convergence of authenticity blockchain cards technology with decentralized finance is rewriting what it means to collect, and invest, in physical assets.

Diversify with purpose: Tokenized trading cards as RWAs offer real financial utility, liquidity, transparency, fractional ownership, that was once unimaginable in traditional collecting.