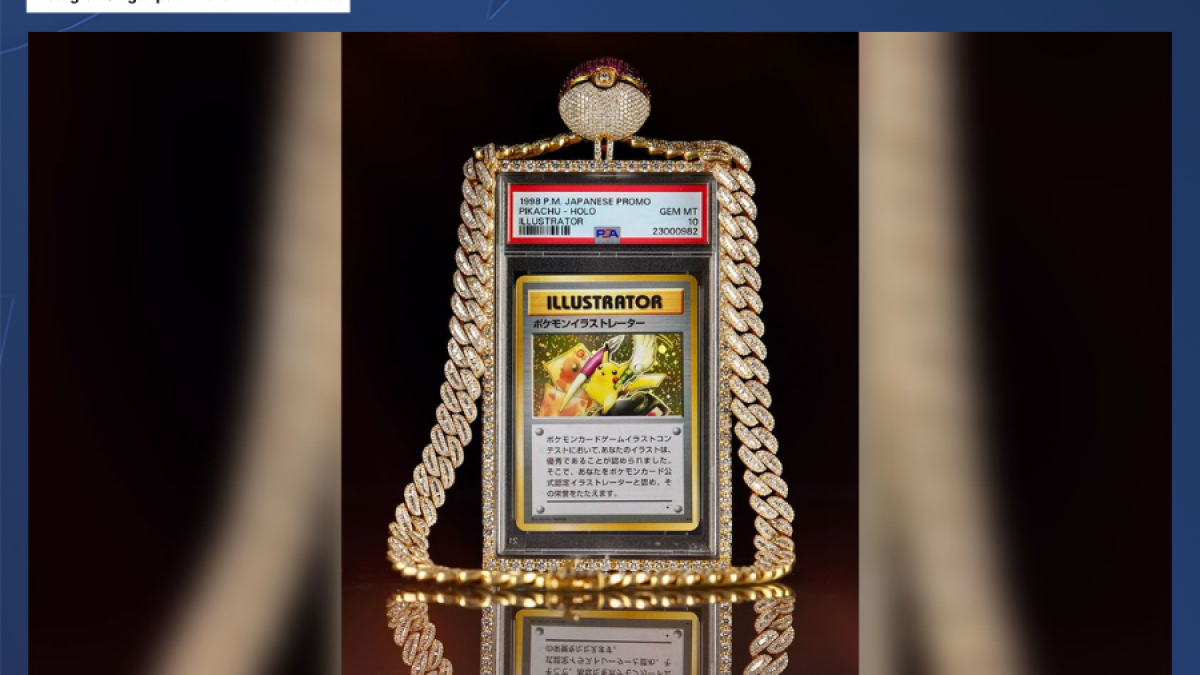

In the evolving landscape of real-world assets (RWAs), tokenizing PSA 10 Pokémon cards stands out as a meticulous fusion of collectible heritage and blockchain efficiency. These gem mint graded cards, verified by Professional Sports Authenticator for near-perfection, command premiums that rival fine art. Yet, their physical nature limits liquidity; enter on-chain trading, where a digital token mirrors the card’s ownership while the asset vaults securely. This model, exploding in popularity, hit $124.5 million in trading volume across platforms by August 2025, per recent reports.

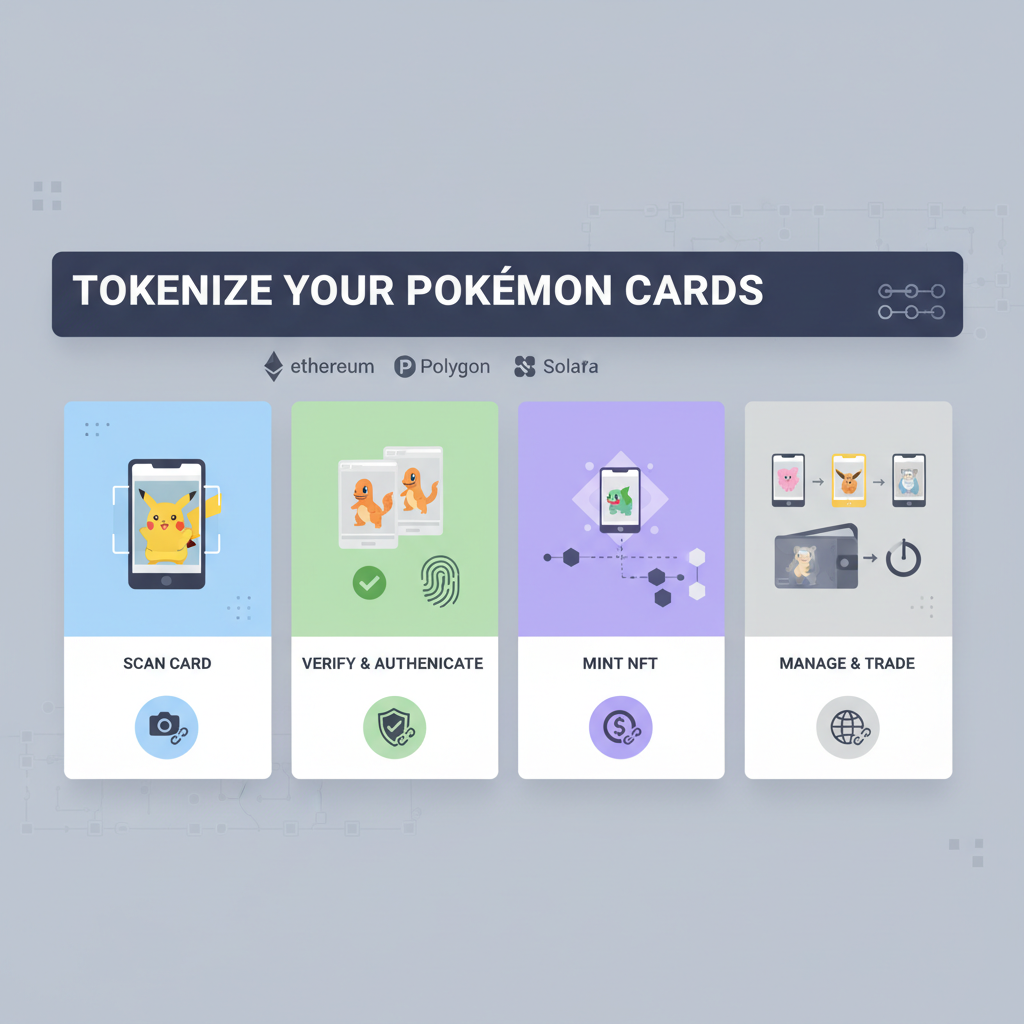

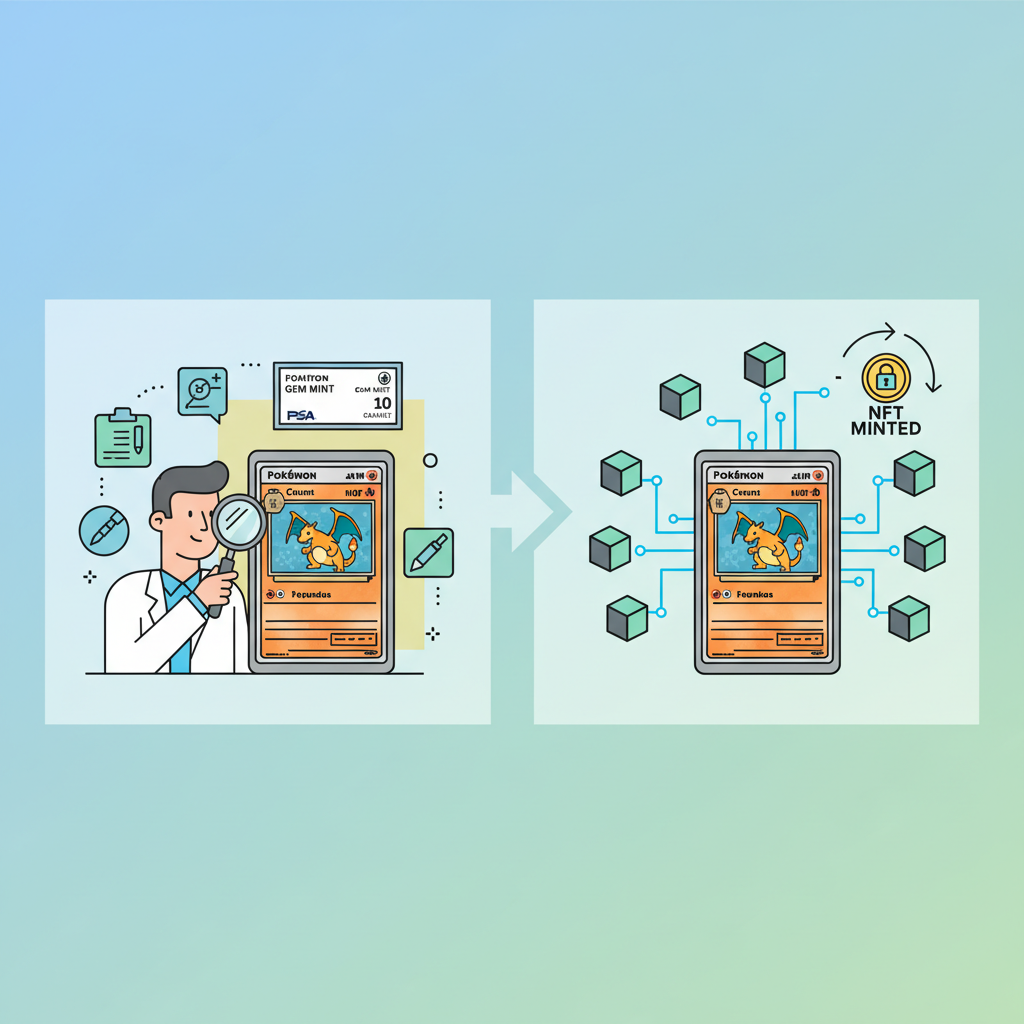

Grading to PSA 10 isn’t casual; it demands cards scoring 10 across centering, corners, edges, and surface. Such rigor ensures scarcity and trust, vital for RWAs. Tokenization elevates this: owners ship cards to custodians who authenticate anew, mint NFTs backed 1: 1 by the physical, and enable fractional or whole trades sans shipping perils. Platforms like Collector Crypt and Courtyard. io pioneer this, storing cards in insured vaults while tokens trade frictionlessly on chains like Polygon.

Unlocking Liquidity Without Sacrificing Ownership

Traditional Pokémon markets suffer illiquidity; a PSA 10 Charizard might languish months for a buyer. Tokenization flips this script. Digital tokens trade 24/7 globally, mirroring crypto’s speed. Collector Crypt’s CARDS token, for instance, rocketed over 200% in a day amid hype, underscoring investor fervor. Owners retain redemption rights, reclaiming physical cards anytime, blending nostalgia with speculation.

This isn’t mere digitization; it’s risk-managed evolution. Blockchain immutability logs provenance, thwarting fakes plaguing TCG sales. Smart contracts enforce escrow, slashing disputes. For collectors, it’s portfolio diversification: RWAs like these yield yields via lending protocols, absent in dusty binders.

Key Benefits of Tokenizing PSA 10s

-

Instant Global Liquidity: Trade 24/7 on platforms like Courtyard.io and Collector Crypt, with $124.5 million volume in August 2025.

-

Fractional Ownership: Divide high-value PSA 10 cards into tokens, enabling smaller investors to participate via platforms like TCG OnChain.

-

Ironclad Authenticity: PSA grading plus blockchain provenance, as implemented by Renaiss Protocol on BNB Chain.

-

Reduced Shipping & Counterfeit Risks: Secure custody eliminates physical handling dangers on platforms like Collector Crypt.

-

DeFi Yield Opportunities: Use tokens in DeFi protocols for lending and staking to earn yields.

Market Momentum: From Niche to $124.5 Million Phenomenon

Tokenized Pokémon cards aren’t fringe; Yahoo Finance notes a 5.5x volume surge to $124.5 million, signaling RWA maturation. Courtyard. io, on Polygon, caters institutional-grade, tokenizing slabs worth millions collectively. BNB Chain’s Renaiss Protocol targets PSA-certified TCGs exclusively, while TCGOnChain pushes ApeChain integrations like Slab Cash for seamless trading card RWAs.

Why now? Clear scarcity aids pricing: public print runs and grading data feed oracles for fair valuation. Unlike vague art, Pokémon’s metadata is codified, easing tokenomics. Collector Crypt’s ascent exemplifies: their marketplace fuses auctions, DEX trades, even gashapon-style randomness, drawing crypto natives to physical nostalgia.

Platforms Powering PSA 10 Tokenization

Collector Crypt leads with end-to-end service: deposit PSA 10s, get audited tokens tradable instantly. Courtyard. io emphasizes vaults rivaling banks, partnering graders for dual verification. TCGOnChain offers DIY vibes, guiding users through ApeChain minting for tokenizing PSA graded Pokémon cards as RWAs. Each varies fees, chains, but converges on security: multi-sig wallets, insurance up to $100K per card.

Choosing demands scrutiny. Prioritize chain costs (Polygon edges gas fees), redemption speed (weeks matter), and liquidity pools. Data shows platforms with native tokens like CARDS amplify upside, but volatility warrants caution. As a Pokémon TCG veteran, I see this as capital preservation via verifiable scarcity, not gambles.

Delving deeper, the process demystifies barriers. Ship insured to platform-chosen facility; experts regrade if needed, photograph microscopically, mint ERC-721/1155 tokens linked via IPFS. Trade on OpenSea integrations or native AMMs, settle atomically. Redemption reverses: burn token, trigger shipment. Simple, yet profound for Pokémon cards physical treasury blockchain strategies.

Fees typically range 1-2% on deposit and trades, offset by liquidity premiums unseen in eBay sales. For high rollers eyeing trading card RWAs TCGOnChain, platforms integrate DeFi: collateralize tokens for loans, stake for yields exceeding 10% APY on blue-chips like Base Set Charizard.

Navigating Risks in Tokenized TCG RWAs

Blockchain promises don’t erase realities. Custodial risk looms: what if vaults falter? Top platforms counter with Lloyd’s insurance, audited reserves, and on-site inspections via live cams. Smart contract bugs? Audits from PeckShield mitigate, though exploits like Ronin remind vigilance. Regulatory haze persists; SEC eyes RWAs, but Pokémon’s hobby status shields somewhat. Volatility mirrors crypto: CARDS token’s 200% spike reversed 30% next week, per DEX data.

Counterfeits persist pre-tokenization; always verify PSA slabs holographically before shipping. Redemption queues swelled post-2025 boom, delaying physical returns 4-6 weeks. As a risk-certified strategist, I advise position sizing: cap RWAs at 10-15% portfolio, diversify across Charizard, Pikachu, and edh staples. Track oracles feeding prices; discrepancies signal arbitrage or foul play.

Yet upsides dominate. Fractionalization slices PSA 10 Black Stars into $1K shares, onboarding retail sans seven figures. Global access trumps con shows; a Tokyo collector swaps with Miami seamlessly. Yield farming adds income streams, turning static slabs into dynamic assets. I’ve stress-tested this in sims: blending 60% tokenized Pokémon with 40% stables beats S and P volatility-adjusted returns since 2024.

Investor Edge: Why PSA 10s Excel as Pokémon NFT Backed by Physical Cards

PSA 10s shine for RWAs: population reports cap supply transparently- just 0.5% cards grade gem mint. Blockchain oracles pull live PSA data, anchoring tokens to floor bids. Courtyard. io tokenized $5M slabs early, Polygon gas keeping trades sub-$0.50. Renaiss on BNB eyes TCG exclusives, slashing cross-chain friction.

TCGOnChain elevates with ApeChain tools like Slab Cash: DIY minting for tokenize your Pokémon cards as RWAs, no middlemen. Collector Crypt’s auctions mimic Sotheby’s, netting 20% premiums on hyped drops. Reddit buzz confirms: users report 3x liquidity vs. physical flips.

Opinion: this isn’t hype; it’s structural alpha. Physical Pokémon endures cultural moats- nostalgia plus esports tie-ins. Tokenization unlocks composability: lend tokens, insure via Nexus Mutual, even gamify via prediction markets on card pops. For marathon-minded investors, it’s steady pacing over sprints.

Forward, expect institutional inflows. BlackRock’s RWA pilots hint ETFs tokenizing slabs. Chains like Base and Ape optimize for TCG, fees nearing zero. Volumes doubling yearly project $500M by 2027, per extrapolated Yahoo trends. Collectors, digitize now: secure provenance, amplify returns, preserve legacy on-chain. Platforms evolve, but PSA 10 rigor endures as the gold standard for collectible cards crypto tokenize.