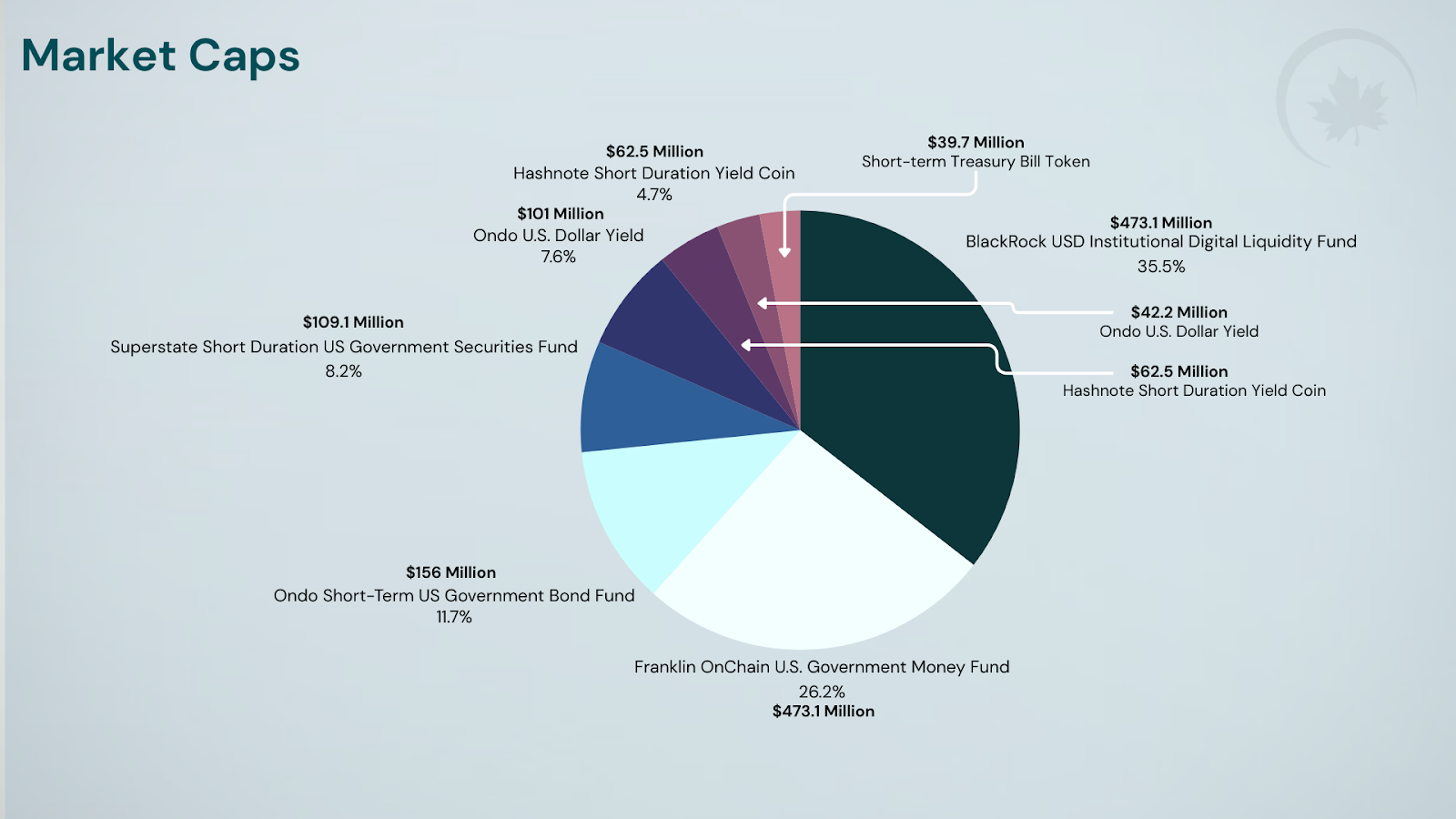

In the evolving world of crypto, few trends capture the intersection of nostalgia and financial innovation like tokenizing PSA 10 Pokémon cards as real-world assets (RWAs). Recent surges tell the story: Collector Crypt’s CARDS token rocketed 10x amid an $87 million RWA market fueled by platforms such as CollectorCrypt and Courtyard. Trading volumes for tokenized Pokémon cards hit $124.5 million, a 5.5x jump, with high-profile examples like the PSA 10 Pikachu Illustrator card tokenized at $5.275 million by Liquid MarketPlace. This isn’t fleeting hype; it’s collectors embracing physical Pokémon cards crypto backed by blockchain security, mirroring the stability of tokenized U. S. Treasuries now at $8.63 billion market cap.

The Explosive Growth of Pokémon RWAs on Blockchain

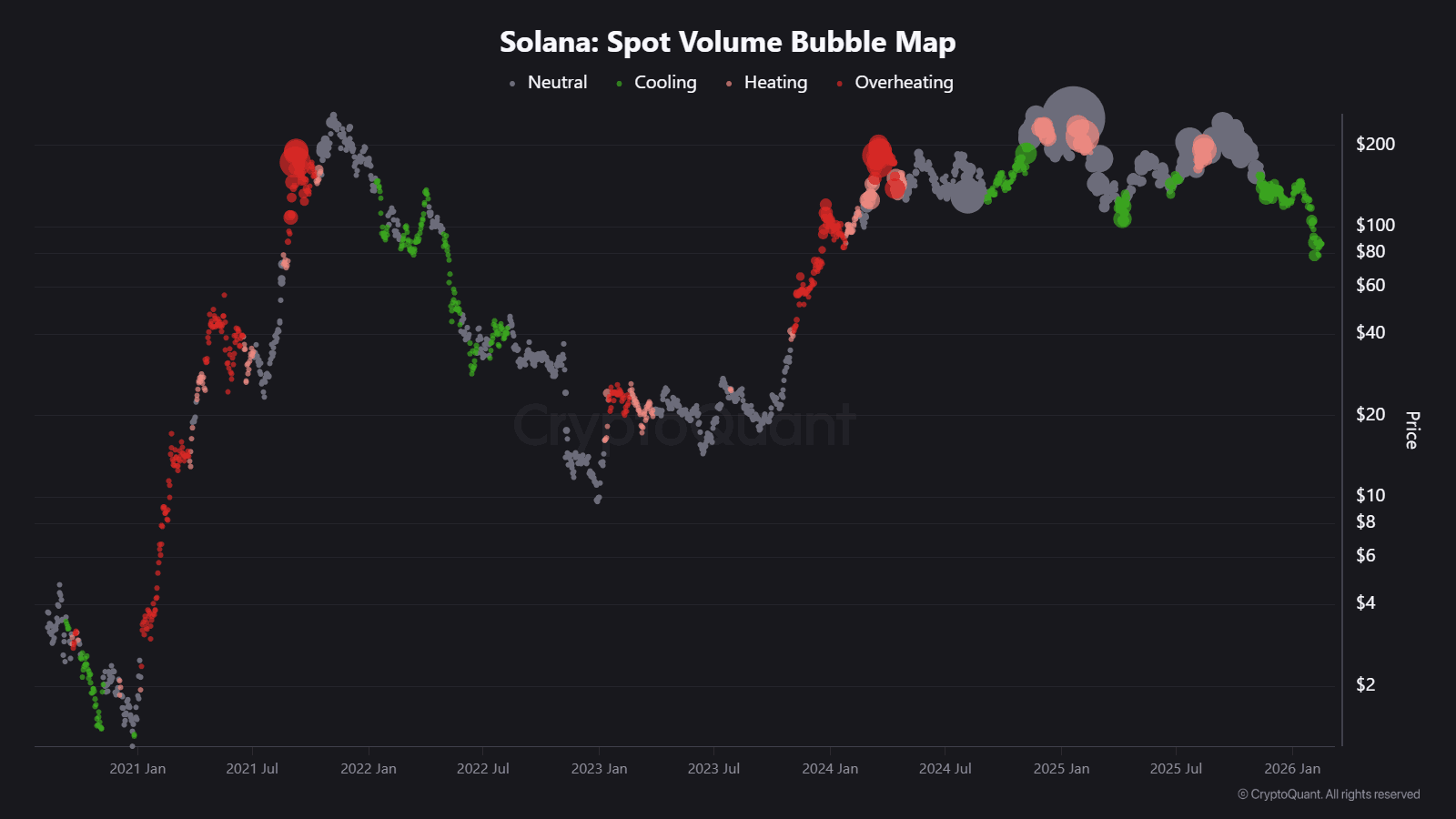

Tokenized Pokémon cards represent a breakthrough in trading card RWA blockchain dynamics. Unlike purely digital NFTs, these are NFTs backed by physical PSA 10-graded gems stored in secure vaults like Brink’s. Platforms drive this momentum: CollectorCrypt transforms cards into tradeable assets on Solana, while Courtyard partners with Polygon Labs for seamless on-chain movement. The Solana Foundation spotlighted a PSA 10 Charizard shifting effortlessly, signaling a structural shift. BeInCrypto notes how this fuels the RWA thesis, with TCG cards positioning Pokémon as digital gold worth millions.

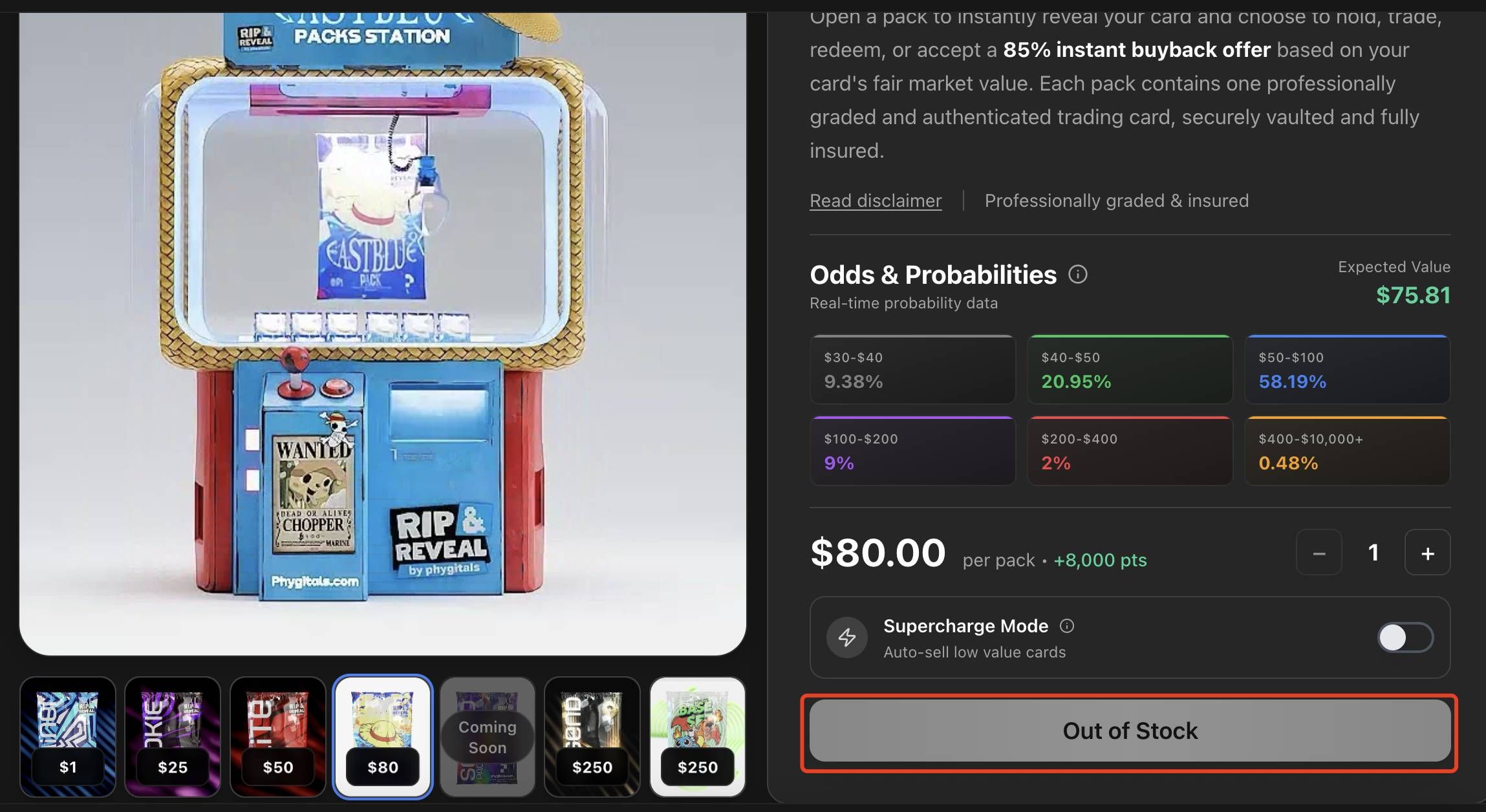

Yahoo Finance reports trades surging to $124 million, enabling instant NFT minting from physical cards. This liquidity unlocks value trapped in collections, much like tokenized Treasuries offer yield without selling bonds. For crypto collectors, it’s a disciplined entry into RWAs, blending collectible passion with 24/7 global access.

Why PSA 10 Graded Cards Excel as Backed RWAs

PSA 10 designation marks perfection: pristine condition, rarity, and proven appreciation. Take the 2003 Skyridge Charizard PSA 10 – one of the rarest, now ripe for tokenize PSA 10 Pokémon cards. Grading ensures authenticity, eliminating counterfeits plaguing traditional markets. Platforms vault these treasures, issuing NFTs for fractional ownership. The PSA 10 Pikachu Illustrator at $5.275 million exemplifies this: tokenized for shares tradable worldwide, democratizing access to assets once reserved for whales.

Key Advantages of PSA 10 Pokémon RWAs

-

Vault-secured physical backing: PSA 10 cards stored in secure vaults like Brink’s by platforms such as Courtyard and Collector Crypt.

-

Fractional ownership for liquidity: Own shares of rare cards like the $5.275 million PSA 10 Pikachu Illustrator via Liquid MarketPlace.

-

24/7 blockchain trading: Trade tokenized cards on Solana, with volumes surging 5.5x to $124 million as per recent reports.

-

Treasury-like stability with appreciation: Combines card value growth with tokenized U.S. Treasuries market at $8.63 billion for stable yields.

-

Seamless crypto wallet integration: Compatible with wallets like Bitget for easy access and management of RWAs.

Aurpay calls TCG tokenization pivotal for RWAs, demonstrating how Pokémon cards achieve digital gold status. CoinGecko highlights top platforms turning vaults into liquid assets. This model parallels backed Treasuries: low volatility, tangible backing, and yield potential via lending, as Decrypt covers with Courtyard’s vaulted PSA 10s.

Tokenization Process: From Vault to Velocity

Tokenizing starts with verification: submit your PSA 10 card for PSA grading confirmation, then vaulting. Platforms like those on tcgonchain. com handle minting NFTs on efficient chains like Solana. Bitget Wallet details CollectorCrypt’s system: structured, secure, and scalable. Owners retain redemption rights, ensuring the physical asset anchors the digital twin.

Cwallet defines tokenization as blockchain conversion of real-world assets into NFTs. For Pokémon cards RWA, this powers liquidity without liquidation. Instagram buzz from crypto communities notes overlapping audiences: crypto holders snapping up Pokémon and sports cards. At tcgonchain. com, we pioneer this for collectors, investors, and enthusiasts, optimizing Pokémon card NFTs treasury-style security with crypto speed.

Disciplined investors recognize parallels between these physical Pokémon cards crypto and tokenized U. S. Treasuries: both deliver backing by verifiable assets with low correlation to volatile crypto markets. At $8.63 billion market cap, tokenized Treasuries prove the model’s maturity, now extending to collectibles. For Pokémon enthusiasts, this means turning idle PSA 10s into productive assets, generating yield through on-chain lending protocols as Decrypt outlines with Courtyard’s Brink’s-vaulted cards.

Traditional Pokémon Card Ownership vs. Tokenized Pokémon RWAs vs. Tokenized Treasuries

| Aspect | Traditional Pokémon Card Ownership | Tokenized Pokémon RWAs | Tokenized Treasuries |

|---|---|---|---|

| Liquidity | Low 🐌 | High ⚡24/7 | High ⚡24/7 |

| Yield Potential | None 📉 | Stablecoin lending yields 💰 | DeFi staking yields 💰 |

| Accessibility | High-value barrier 🔒 | Fractional shares for retail 🆓 | Broad retail access 🆓 |

| Risk Profile | Auction illiquidity, storage risks ⚠️ | Vaulted + on-chain transparency 🛡️ | Sovereign backing + smart contracts 🛡️ |

| Market Cap Example | $124.5M volumes 📊 | $124.5M tokenized Pokémon 🚀 | $8.63B Treasuries 🌍 |

This liquidity revolutionizes trading card RWA blockchain investing. Traditional collectors face illiquid sales via auctions; tokenization offers instant swaps, 24/7 markets, and global reach. As an options strategist, I view these RWAs through a risk lens: they hedge crypto downturns with tangible appreciation, backed by PSA grading’s empirical track record. Courtyard’s Polygon integration exemplifies efficiency, vaulting PSA 10s for seamless lending.

Navigating Risks in Pokémon Card Tokenization

No asset class escapes scrutiny. Custody remains paramount: choose platforms with audited vaults like Brink’s. Market risks include card value fluctuations, though PSA 10s historically outperform broader TCG indices. Regulatory clarity lags, but RWA frameworks evolve, mirroring Treasuries’ compliance path. My quantitative approach favors diversified exposure – allocate 5-10% of a crypto portfolio to tokenize PSA 10 Pokémon cards for uncorrelated alpha.

Essential RWA Risk Checklist

-

1. Verify PSA grading and vault audits: Cross-check the card’s grade on PSA’s database and review audits from vaults like Brink’s used by Courtyard.

-

2. Assess platform tokenomics: Evaluate utility of tokens like Collector Crypt’s CARDS for trading and governance on Solana.

-

3. Monitor redemption terms: Review protocols for claiming physical cards, such as those on CollectorCrypt or Liquid MarketPlace.

-

4. Diversify across cards/platforms: Spread exposure beyond single assets like PSA 10 Pikachu Illustrator ($5.275 million) across Courtyard and CollectorCrypt.

-

5. Track on-chain liquidity metrics: Monitor trading volume and depth for tokens on Solana, noting surges to $124 million in tokenized card trades.

AInvest reports CollectorCrypt’s $124.5 million surge signals RWA maturation. Overlaps with crypto demographics amplify adoption; many Bitcoin holders collect TCGs, per Instagram insights. tcgonchain. com streamlines this, offering end-to-end tokenization for secure, yield-bearing collectibles.

Why tcgonchain. com Leads Pokémon RWAs

At tcgonchain. com, we bridge physical perfection with blockchain precision. Our process – grading verification, vaulting, NFT minting – empowers users to trade PSA 10s as fluidly as crypto. Explore tokenizing rare Pokémon cards as RWAs or dive into step-by-step guides. This isn’t speculation; it’s strategic ownership, where nostalgia meets yield in a $8.63 billion-backed ecosystem.

Crypto collectors, position yourselves at this nexus. Tokenized PSA 10 Pokémon cards offer the stability of Treasuries with collectible upside, vault-secured and fractionally owned. As markets evolve, those mastering these RWAs will capture outsized rewards through disciplined execution.