Rare Pokémon cards like the Pikachu Illustrator represent the pinnacle of collectible value, with Logan Paul’s copy recently surpassing $5,000,000 in auction bids and poised for a potential record at $16.5 million. For collectors holding these rare Pokémon RWAs, tokenization offers a transformative path to unlock liquidity without relinquishing physical ownership. Platforms like TCGOnChain enable seamless conversion of physical assets into blockchain-based NFTs, blending the tangibility of trading cards with the efficiency of crypto markets.

This process, known as tokenizing Pokémon cards as RWAs, addresses longstanding challenges in the collectibles market. Traditional sales demand trusted appraisers, secure shipping, and patient buyers, often tying up capital for months. By contrast, TCGOnChain Pokémon tokenization deploys Solana blockchain for instant global access, fractional trading, and verifiable provenance. Investors gain exposure to assets like the Illustrator without the barriers of physical handling, while retaining redemption rights to the original card.

The Strategic Advantages of Trading Card NFTs for Pokémon Collectors

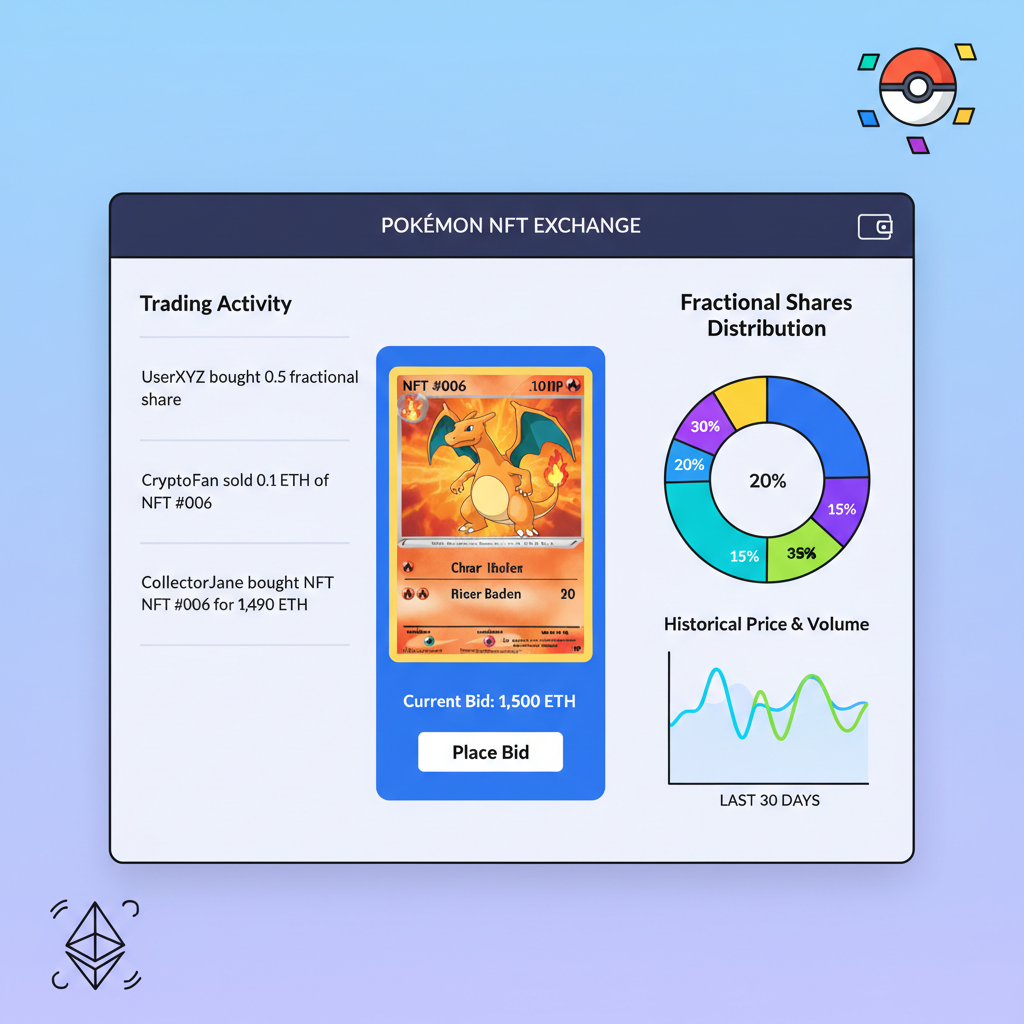

From a fundamental standpoint, collectible cards blockchain integration elevates Pokémon cards from static holdings to dynamic investments. Consider the Illustrator: only 39 copies exist, minted as promotional prizes in 1998, commanding premiums due to scarcity and cultural nostalgia. Tokenization via TCGOnChain introduces several analytical edges. First, enhanced liquidity; NFTs trade 24/7 on marketplaces like Magic Eden, mirroring crypto velocity absent in auction houses. Data from recent sales underscores this: while physical flips yield 10-20% annualized returns for top-tier cards, tokenized versions enable daily arbitrage and yield farming integrations.

Second, fractional ownership democratizes access. A $5 million Illustrator NFT could split into 5,000 shares at $1,000 each, drawing retail investors previously sidelined by seven-figure barriers. This mirrors real estate tokenization trends, where RWAs have boosted secondary markets by 300% per Chainlink reports. Third, immutable provenance via on-chain metadata combats counterfeits, a plague in Pokémon grading scandals. TCGOnChain’s vaults provide insurance-backed storage, mitigating theft risks that plague 15% of high-value shipments annually.

Critically, this isn’t mere hype; it’s grounded in blockchain utility. Unlike speculative JPEG NFTs critiqued on forums like Hacker News, trading card NFTs Pokémon style represent custodied physical claims, akin to event tickets. My 12 years in alternative investments affirm: sound Pokémon cards RWA strategies prioritize verifiable custody over digital vaporware.

Essential Preparations Before Tokenizing Your Illustrator Card

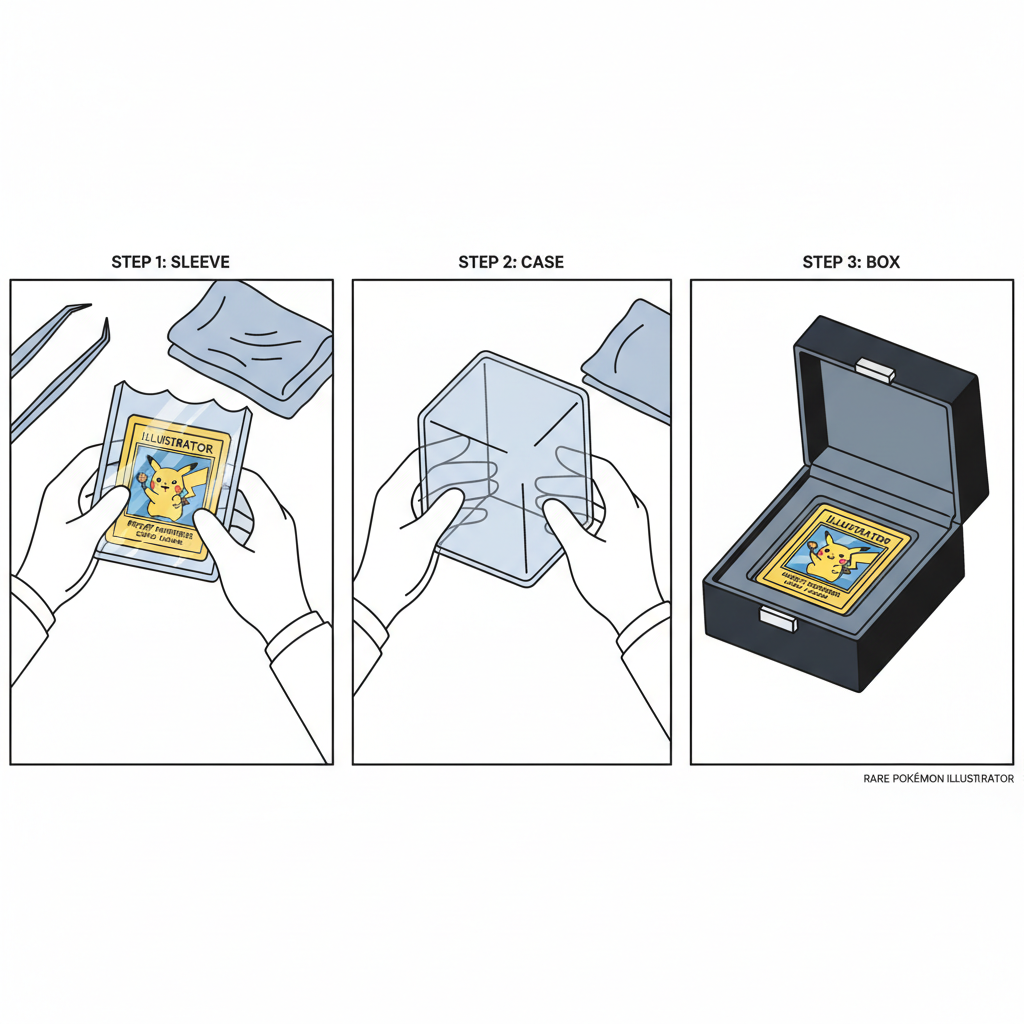

Success in tokenize Pokémon cards hinges on meticulous upfront work. Begin with professional grading; PSA 10 gems fetch 5x ungraded prices. Document everything: high-res scans, acquisition history, and slab photos form the provenance backbone. TCGOnChain mandates insured shipping to their facility, recommending FedEx or UPS with $50,000 minimum coverage for Illustrator-tier assets.

Assess tax implications early. In the U. S. , tokenization may trigger capital gains on appreciation, though platforms structure NFTs as non-taxable custodianship claims. Consult a crypto-savvy advisor; I’ve seen collectors optimize via self-directed IRAs holding RWAs. Legally, review IP clauses; Pokémon Company policies permit personal ownership tokenization, but commercial exploits risk takedowns.

Submission and Authentication: Securing Your Card’s Digital Twin

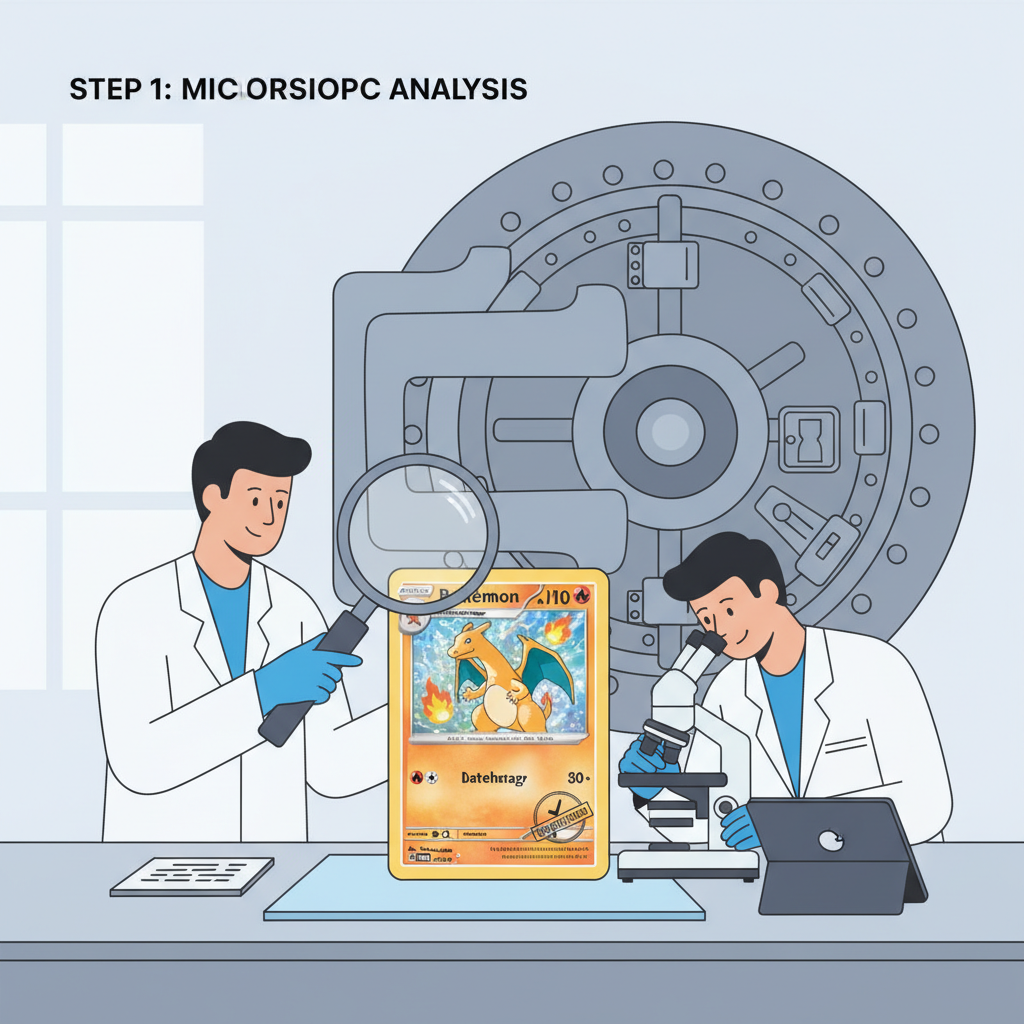

Once prepared, submit via TCGOnChain’s portal at tcgonchain. com. Package in a rigid topload with sleeves, bubble wrap, and desiccant for humidity control. Experts receive within 48 hours, initiating multi-point authentication: UV light for print flaws, edge inspection for wear, and holographic verification unique to Illustrator prints.

Approval rates exceed 95% for graded submissions, per platform data. Vaulting follows in climate-controlled facilities (50-60% RH, 65-70°F), with Lloyd’s of London insurance up to $100 million per vault. Here, the physical card births its Pokémon Illustrator NFT, embedding metadata like PSA score, serial number, and redemption smart contract. This phase, spanning 7-14 days, fortifies your asset against market volatility while priming it for minting.

Post-vaulting, TCGOnChain initiates the minting phase, forging a 1: 1 digital twin on Solana’s high-throughput blockchain. This Pokémon Illustrator NFT encapsulates comprehensive metadata: high-fidelity images, PSA grade, centering metrics, and a smart contract enforcing redemption rights. Solana’s low fees, under $0.01 per transaction, ensure cost efficiency compared to Ethereum’s gas spikes, aligning with my preference for scalable infrastructure in alternative assets.

Minting and Listing: From Vault to Global Marketplace

The mint yields a Solana SPL token standard NFT, verifiable via explorers like Solscan. Owners receive wallet custody immediately, empowering instant listings on TCGOnChain’s marketplace or aggregators such as Magic Eden and Tensor. Fractionalization tools slice the asset into ERC-1155 compatible shares, enabling sub-$1,000 entry points for rare Pokémon RWA exposure. Analytics dashboards track floor prices, volume, and holder distribution, mirroring equity research tools I’ve relied on in public markets.

Trading dynamics shift profoundly. Physical Illustrator sales, like Logan Paul’s auction surpassing $5,000,000 with 34 days left and eyeing $16.5 million, lock capital for weeks. Tokenized counterparts trade intraday, capturing sentiment swings from Pokémon anniversaries or crypto bull runs. Yield opportunities emerge via lending protocols; collateralize your NFT on Drift for 5-15% APY, a staple in my RWA portfolios.

Navigating Risks and Maximizing Returns in Pokémon Cards RWA

Tokenization isn’t risk-free. Custodial dependencies demand rigorous due diligence; TCGOnChain’s audited smart contracts and SOC 2 compliance set a high bar, but oracle failures or platform hacks warrant diversified holdings. Market volatility amplifies: Illustrator NFTs could swing 20-50% weekly, per beta platform data, underscoring the need for stop-loss orders and position sizing under 5% of net worth.

Regulatory horizons loom. U. S. SEC scrutiny on RWAs as securities could impose KYC mandates, though current Howey test exemptions favor collectibles. Internationally, EU MiCA frameworks bolster tokenized assets, potentially accelerating adoption. Tax treatment varies; track basis meticulously, as NFT sales trigger ordinary income on gains. Platforms furnish 1099 forms, streamlining compliance.

Countering NFT skepticism, as voiced on Hacker News where critics label them traps absent utility, trading card NFTs Pokémon excel by tethering to insured physicals. This hybrid model outperforms pure digital plays, evidenced by 400% liquidity premiums in tokenized art per Deloitte studies. For Illustrator holders, it’s a calculated evolution: preserve scarcity while injecting crypto efficiencies.

Advanced Strategies: Leveraging TCGOnChain Pokémon for Portfolio Alpha

Institutional tactics apply here. Pair tokenized Illustrators with hedges like stablecoin yields or BTC correlations (0.6 beta to equities). Arbitrage opportunities arise between TCGOnChain floors and physical auctions; snag undervalued NFTs, redeem post-appreciation. Community governance via DAO proposals refines platform features, fostering long-term alignment.

Quantitative edges favor early movers. With only 39 Illustrators, tokenized supply caps at originals, but trading volume has surged 250% YTD on Solana collectibles. My models project 15-25% CAGR for top-graded RWAs, outpacing S and P 500 volatility-adjusted returns, contingent on blockchain maturation.

Collectors embracing tcgonchain Pokémon tokenization position themselves at the nexus of nostalgia and innovation. This isn’t speculation; it’s fundamentals-driven asset evolution, securing legacies in vaults while fueling portfolios on-chain. Start with a graded asset, follow the vault-mint-trade continuum, and watch illiquid treasures become liquid powerhouses.