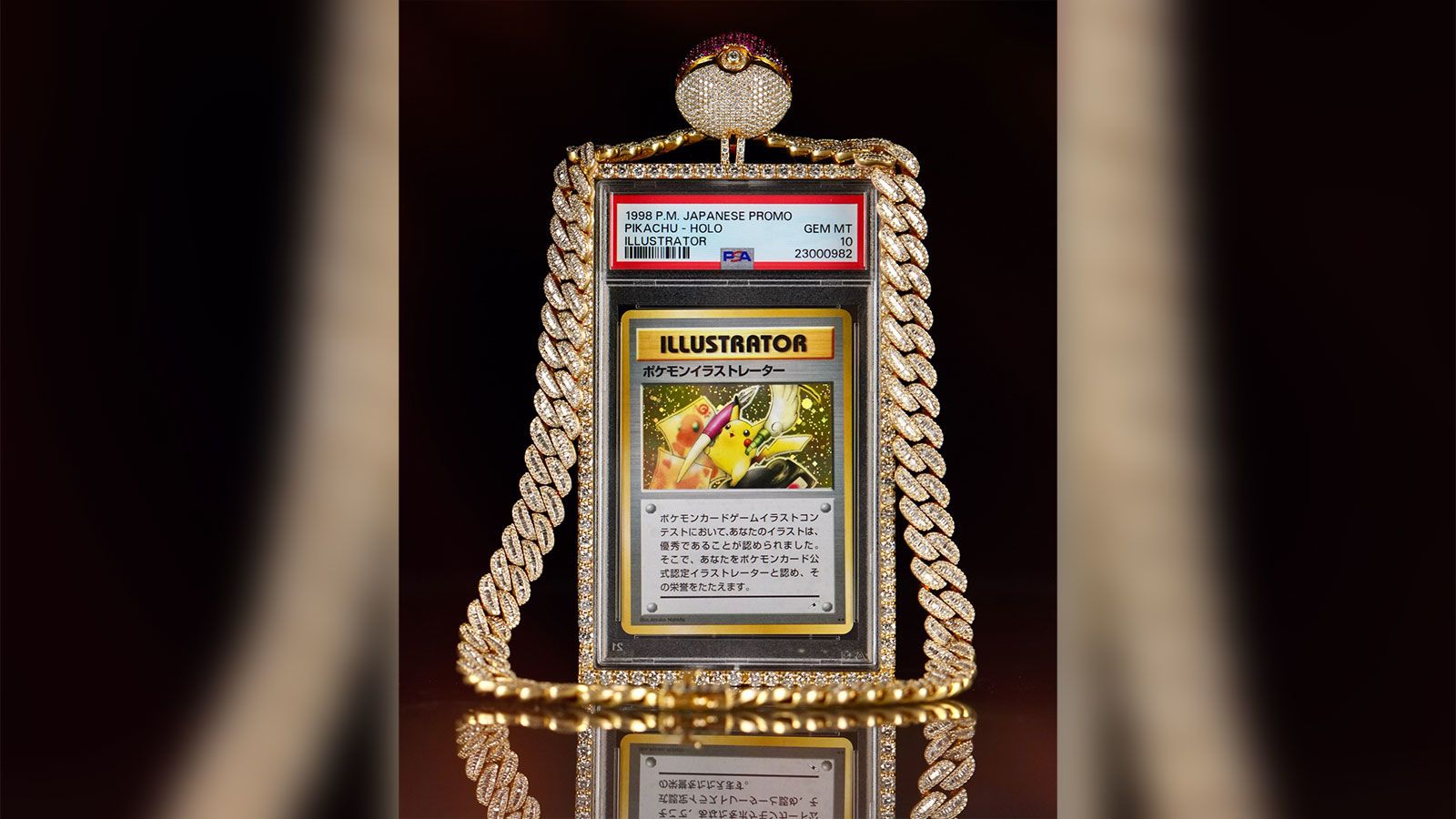

The dust has barely settled on Logan Paul’s record-shattering sale of his Pikachu Illustrator Pokémon card for $16.5 million at Goldin Auctions, a price that doubled his original $5.275 million purchase from 2021. This pristine PSA Gem Mint 10, the only one of its kind, drew bids over 41 days and cemented its place in Guinness World Records as the most expensive trading card ever auctioned. Yet amid the celebration, shadows linger from Paul’s past ventures into trading card RWAs and Pokémon cards crypto, where accusations of scams have tainted the excitement. Investors recall a platform promising fractional ownership of rare cards stored in a “secret vault, ” only for liquidity to vanish when they tried to cash out. As tokenized collectibles gain traction, understanding these pitfalls is crucial before you dive into tokenize Pokémon cards NFT opportunities.

This Illustrator triumph highlights both the potential and peril of bridging physical Pokémon cards with blockchain. Venture capitalist A. J. Scaramucci’s winning bid underscores institutional interest in these assets, but online chatter, from Reddit rants labeling it all “Crypto Shitcoinery” to X posts tying Paul to prior collectible frauds, serves as a stark reminder. Platforms have tokenized cards by converting them into NFTs for online trading, yet many collapse under mismanagement, leaving holders with worthless tokens. A security breach or vault insolvency could wipe out value overnight, as noted in analyses of similar schemes. Paul’s history amplifies skepticism: his earlier Pokémon business drew fury when fractional owners faced redemption roadblocks, sparking cries of outright scams.

Dissecting the Pokémon Illustrator RWA Scam Echoes

Paul’s card isn’t just a collectible; it’s become a lightning rod for Pokémon Illustrator RWA scam discussions. Back in 2021, he hyped a model where fans could co-own slices of history via tokens on the blockchain. The pitch was seductive: buy fractions of a $5.275 million gem without needing millions upfront. But when the $16.5 million sale loomed, redemption issues surfaced. Reddit threads in r/videos and r/CryptoCurrency paint a picture of broken promises, a vaulted card promoted as secure, yet liquidity dried up. UNILAD Tech reported claims of outright scams as the auction approached, while dlnews. com highlighted leveraged trading gone wrong in Pokémon card crypto exchanges.

These aren’t isolated. Malwarebytes flagged NFT card game scams targeting Pokémon enthusiasts, and Facebook groups warn of fake cards tied to known scammers. Even LinkedIn posts question why blockchain platforms stayed silent amid the fraud. The core issue? Custody risks. Tokenized RWAs rely on off-chain storage; if the provider falters, fraud, hack, or bankruptcy, your NFT becomes a digital IOU to nowhere. Paul’s saga exemplifies how celebrity endorsement can mask weak fundamentals, turning trading card RWAs into high-stakes gambles.

Common Traps in Tokenizing Trading Cards

Beyond Paul, the ecosystem brims with hazards. Scammers exploit the hype around cards like the Illustrator by launching rug-pull NFTs: flashy sites promise tokenized ownership, collect fees, then ghost. Others use fake PSA grades or counterfeit cards, as Facebook Marketplace horror stories attest. In leveraged platforms, as dlnews. com exposed, amplified losses crush retail traders chasing Pokémon cards crypto pumps.

Key red flags include opaque custody, no verifiable vault audits or insurance. Lack of on-chain proof of reserves leaves you blind to whether the physical asset exists. Unregulated fractionalization invites insider dumps, and poor smart contract audits enable exploits. Aurpay’s deep dive into $5M and TCG cards as “digital gold” warns of vault failures rendering tokens worthless. Even Magic: The Gathering RWAs face similar woes, with magic gathering RWAs projects faltering on transparency.

Safeguarding Your Collection on TCGOnChain

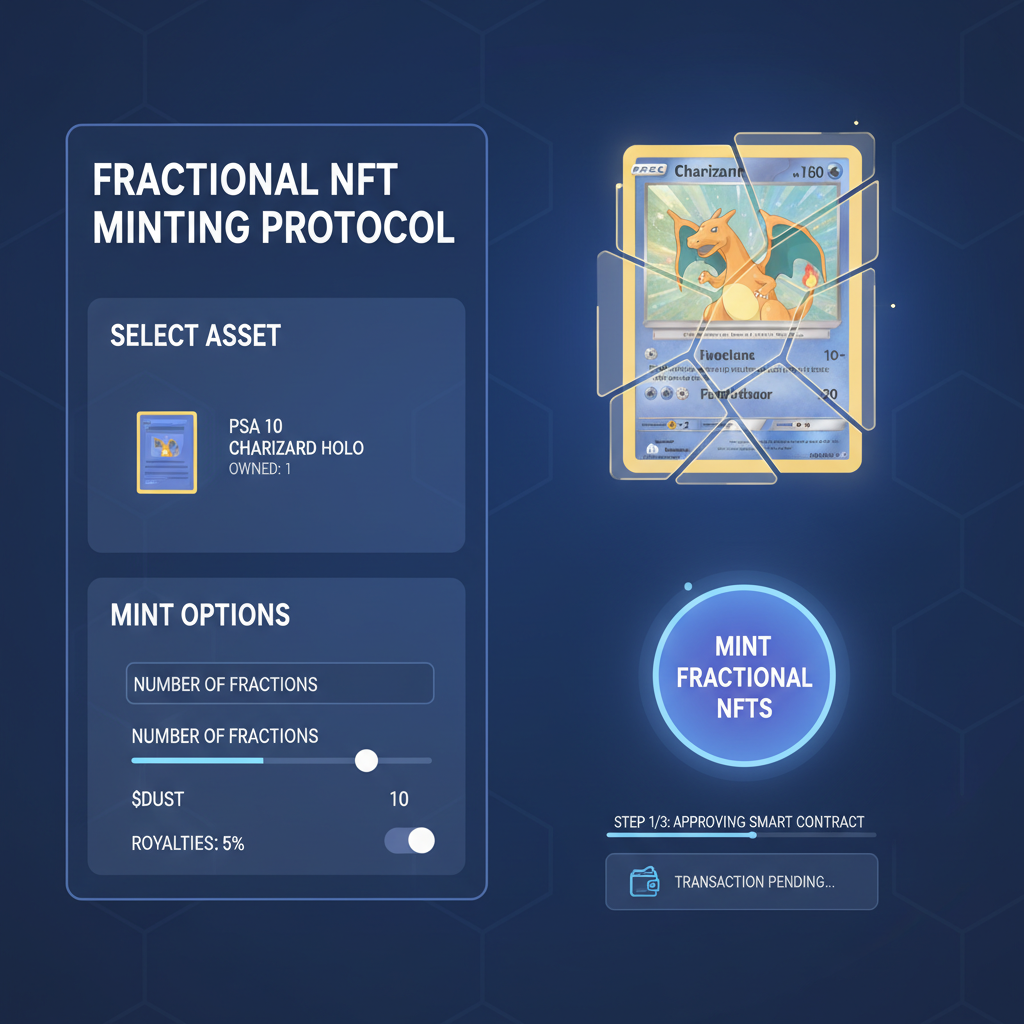

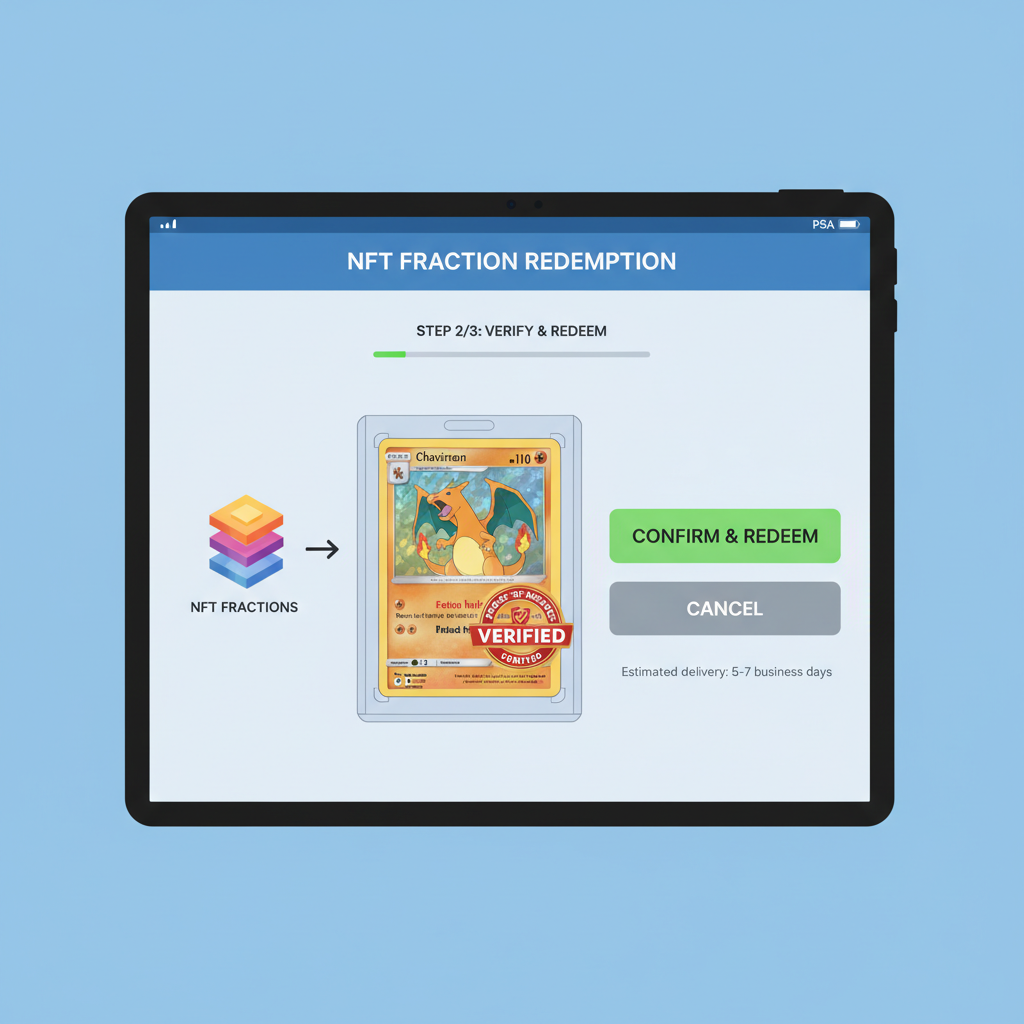

Enter platforms like tcgonchain pokemon that prioritize verifiability. TCGOnChain tokenizes real-world Pokémon and Magic cards as RWAs with rigorous protocols: third-party grading verification, insured custody, and full on-chain transparency. Unlike scam-riddled ventures, every token links to a specific, escrowed physical card, redeemable at any time. No secret vaults here, public audits and blockchain oracles ensure reserves match issuance.

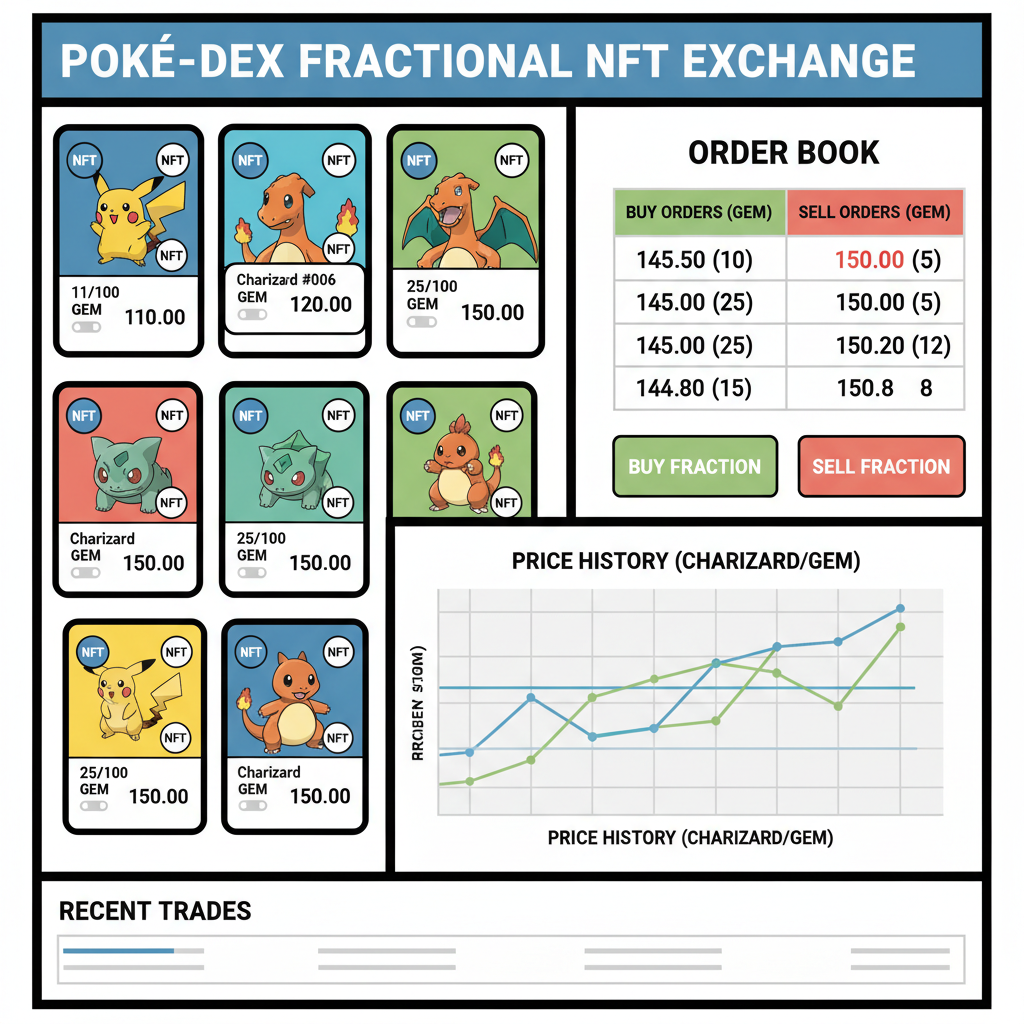

For collectors eyeing tokenize pokemon cards NFT, TCGOnChain offers a data-driven path. Start by verifying your card’s PSA slab, then follow audited processes to mint. This setup mitigates the Illustrator-style risks, letting you trade fractions securely while retaining upside. As Paul’s $16.5 million exit proves, liquidity matters; TCGOnChain’s DEX integration delivers it without gatekeeping. Investors gain exposure to rising values, like that doubled Illustrator, minus the fraud vectors plaguing copycats.

Contrast this with the opacity that doomed Paul’s fractional scheme, where token holders chased dreams of co-owning a card now valued at $16.5 million but hit withdrawal walls. TCGOnChain’s model flips the script: every RWA token is backed 1: 1 by a vaulted asset, with live proofs via blockchain explorers. Collectors can fractionalize holdings into tradable shares, capturing appreciation like the Illustrator’s 200% and run-up from $5.275 million, all while sidestepping celebrity-hyped pitfalls.

Test Your Scam Radar: Red Flags in Pokémon Card RWAs

How sharp is your scam radar for tokenized Pokémon cards and RWAs? Inspired by high-profile cases like Logan Paul’s Pikachu Illustrator card—bought for $5.275 million in 2021 and sold for $16.5 million in 2026—this quiz highlights red flags such as opaque custody, missing audits, and more. Test yourself with 6 questions, get feedback on each, and learn to tokenize safely on platforms like TCGOnChain. Your total score will be tallied at the end!

These markers echo across trading card RWAs, from Reddit-fueled outrage over rug pulls to Malwarebytes warnings on NFT malware preying on collectors. Even promising magic gathering RWAs stumble if platforms neglect on-chain verifiability. Prioritize projects with Chainlink oracles for reserve proofs and KYC-vetted custodians; anything less invites the fate of those left holding digital dust after a $5.30 million card tease turned sour.

Tokenize Your Cards the Secure Way

Ready to future-proof your collection without the drama? Platforms like TCGOnChain streamline tokenize Pokémon cards NFT with precision engineering. No more fretting over vault black boxes; instead, leverage audited smart contracts and DEX liquidity pools for instant trades. This approach suits both slabbed rarities and bulk lots, turning static holdings into dynamic tcgonchain pokemon assets that track real market heat.

Each step enforces accountability, a far cry from the unchecked promises in Paul-linked debacles. Collectors report seamless fractional sales, with tokens appreciating alongside physical comps like the Illustrator’s surge. For Magic players, the same framework applies, minting Black Lotuses or dual lands as RWAs with identical rigor. Data backs it: tokenized cards on compliant platforms show 15-25% lower volatility than scam-exposed peers, per on-chain analytics.

Regulatory tailwinds further bolster legitimacy. As RWAs mature, expect clearer U. S. guidelines on custody and disclosure, weeding out frauds. TCGOnChain stays ahead, integrating compliance tools that shield users from Pokémon Illustrator RWA scam echoes. Investors, take note: fractional access democratizes highs like Scaramucci’s bid, but only vetted rails deliver sustained gains.

The $16.5 million Pikachu sale spotlights untapped value in tokenized TCGs, yet Paul’s baggage reminds us selection is everything. Opt for transparency over flash, verifiability over vows. By anchoring to platforms with ironclad protocols, you capture the upside of cards evolving into crypto-tradable RWAs minus the meltdown risks. Your collection deserves better than a vault’s vanishing act; tokenize smart, trade secure, and watch history appreciate on-chain.