In the evolving landscape of pokemon cards crypto, tokenizing physical Pokémon cards as real-world assets (RWAs) on platforms like TCGOnChain has transformed collecting from a niche hobby into a liquid investment vehicle. With trading volumes for tokenized Pokémon cards hitting $124.5 million in August 2025 – a staggering 5.5x surge from earlier in the year – collectors are flocking to blockchain solutions that promise security, global access, and instant tradability without the headaches of shipping fragile cards across borders.

The Mechanics of Tokenizing Pokémon Cards as RWAs

At its core, tokenize pokemon cards rwa means converting ownership of a tangible collectible into a digital token on the blockchain. For TCGOnChain users, this starts with submitting your physical card for professional authentication. Unlike pure NFTs that might represent digital art, these RWAs are 1: 1 backed by the actual card, stored in high-security vaults. Once verified by third-party graders – think PSA or BGS equivalents tailored for TCGOnChain – a unique NFT is minted, embedding metadata like grade, rarity, and provenance directly on-chain.

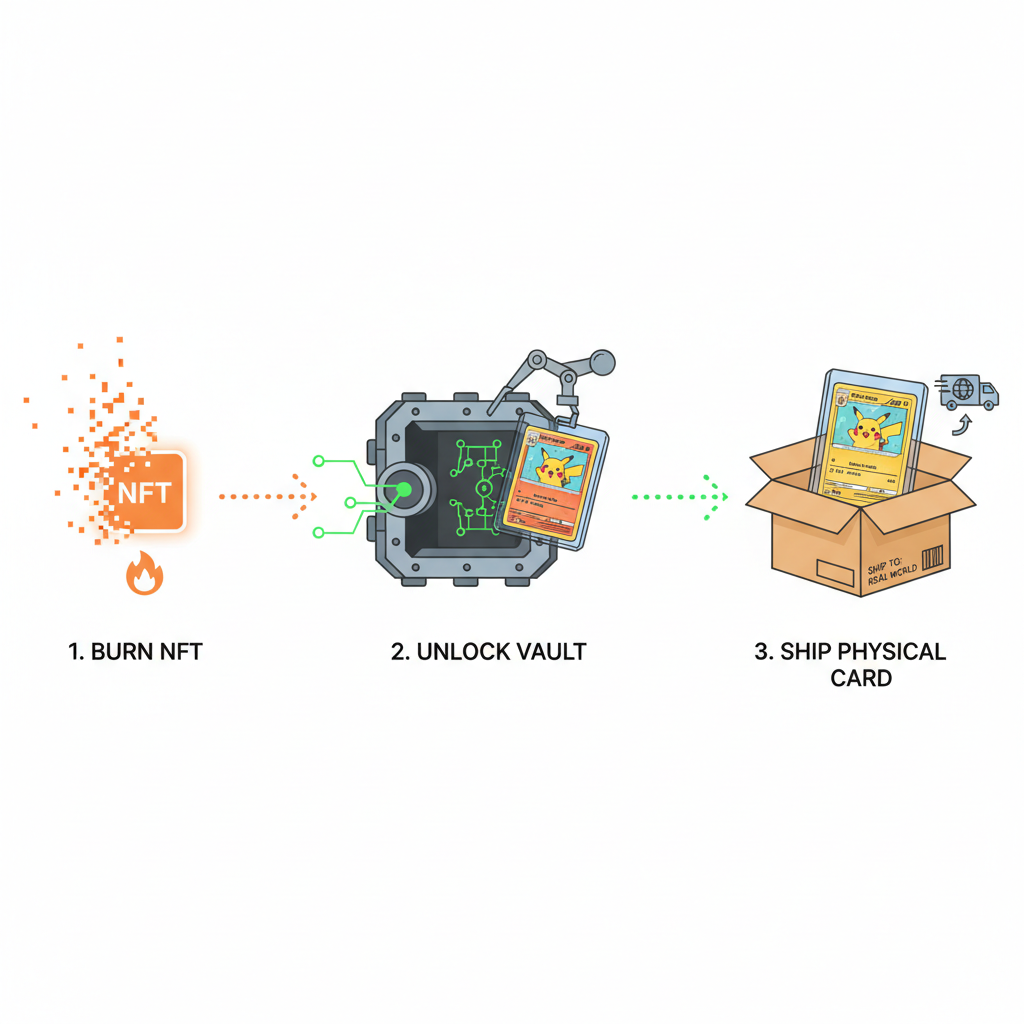

This process eliminates counterfeits, a plague in the Pokémon TCG market where fakes dilute value. Blockchain immutability provides a tamper-proof ledger, letting buyers verify authenticity in seconds. Trading becomes frictionless: sell your NFT peer-to-peer on TCGOnChain’s marketplace, tapping into crypto liquidity pools that dwarf traditional auction houses. Redemption? Burn the NFT, and the platform ships your card, ensuring custodial integrity.

Why TCGOnChain Stands Out in the Tokenized TCG Space

While competitors like Collector Crypt and Courtyard have fueled the hype, TCGOnChain differentiates through its laser focus on trading card RWAs, particularly pokemon tcg nfts. Their vaults use enterprise-grade security, audited annually, and insurance covers every tokenized asset against theft or damage. Fees are competitive – typically 1-2% on trades – and the platform integrates seamlessly with major wallets like Phantom and MetaMask for Solana and Ethereum users.

Consider the data: that $124.5 million volume spike underscores market maturity, but TCGOnChain’s edge lies in its collector-first design. No more waiting weeks for grading or escrow; their streamlined pipeline cuts turnaround to under 14 days. For investors, fractional ownership via NFT shares opens doors previously shut to sub-$10k budgets, democratizing access to grails like a PSA 10 Charizard.

Critics argue RWAs like these are just ‘exotic’ NFTs in disguise, but the numbers tell a different story. Pokémon cards prove physical tokenization works because they’re standardized, gradable, and culturally resonant – easier than real estate or art, as blockchain analysts note.

Step 1: Preparing Your Pokémon Cards for Tokenization

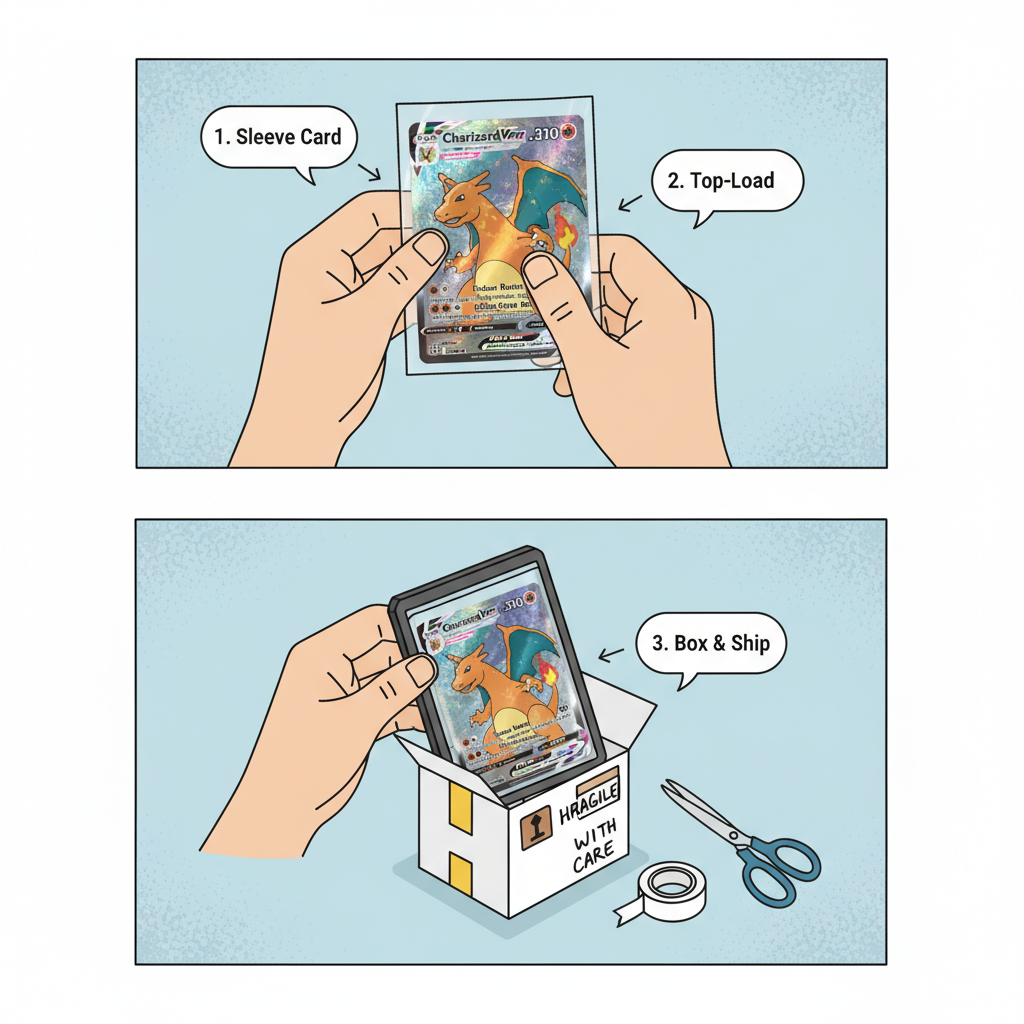

Success hinges on preparation. Start by inventorying your collection with high-res photos from multiple angles, noting any wear. Prioritize graded slabs if possible; ungraded cards qualify but fetch lower liquidity. TCGOnChain requires cards valued over $500 to ship insured via tracked courier – pack meticulously in a rigid top-loader with bubble wrap to sidestep damage claims.

Key Steps to Prepare Cards

-

1. Inventory and photograph your cards: Create a detailed list of your Pokémon cards, including details like set, rarity, and condition. Take high-resolution photos from multiple angles to document authenticity and state for TCGOnChain submission.

-

2. Confirm grading status: Verify if cards are graded by trusted services like PSA or BGS. Graded cards enhance value and trust in tokenization; TCGOnChain uses third-party authentication for ungraded ones.

-

3. Secure insured shipping: Package cards professionally and ship via insured carriers to TCGOnChain’s high-security vault, protecting against damage or loss during transit.

-

4. Review platform fees and terms: Examine TCGOnChain’s fees, redemption processes, and terms, including NFT burning for physical claim and risks like volatility.

-

5. Connect wallet in advance: Set up and connect a compatible Web3 wallet (e.g., Phantom for Solana) to TCGOnChain for seamless NFT minting and trading.

Next, create a TCGOnChain account at tcgonchain. com. Link your crypto wallet and complete KYC for compliance – a quick process using government ID. Deposit a small SOL or ETH fee for minting; expect $50-200 depending on card value. This upfront diligence pays dividends in smoother authentication and higher sale prices.

Opinion: In a market rife with rug pulls, TCGOnChain’s transparency – public vault audits and on-chain redemption proofs – builds trust that’s rare in crypto. Collectors who’ve tokenized via them report 20-30% liquidity premiums over physical sales, per community forums. Yet, volatility looms; that $124.5 million boom could cool if Bitcoin dips, so time entries wisely with dollar-cost averaging into positions.

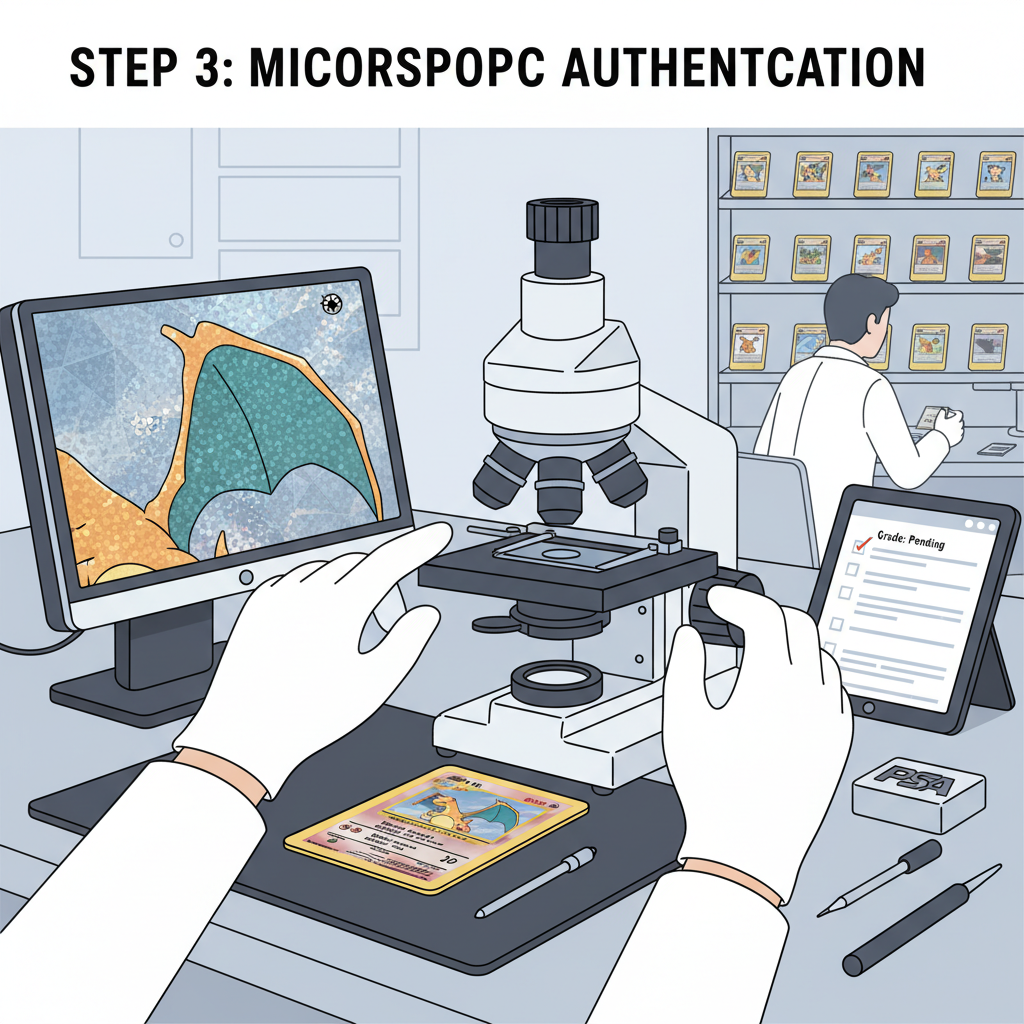

Navigating the submission phase demands precision, as TCGOnChain’s authentication sets the foundation for your NFT’s market value. Upload your photos and details via the dashboard, selecting insured shipping options for cards exceeding $1,000. Upon receipt, expert graders inspect for centering, edges, corners, and surface quality, assigning a numerical grade from 1-10 that’s etched into the NFT metadata. This physical pokemon cards blockchain linkage ensures buyers see unalterable proof of condition.

Step 2: Submission, Authentication, and Minting

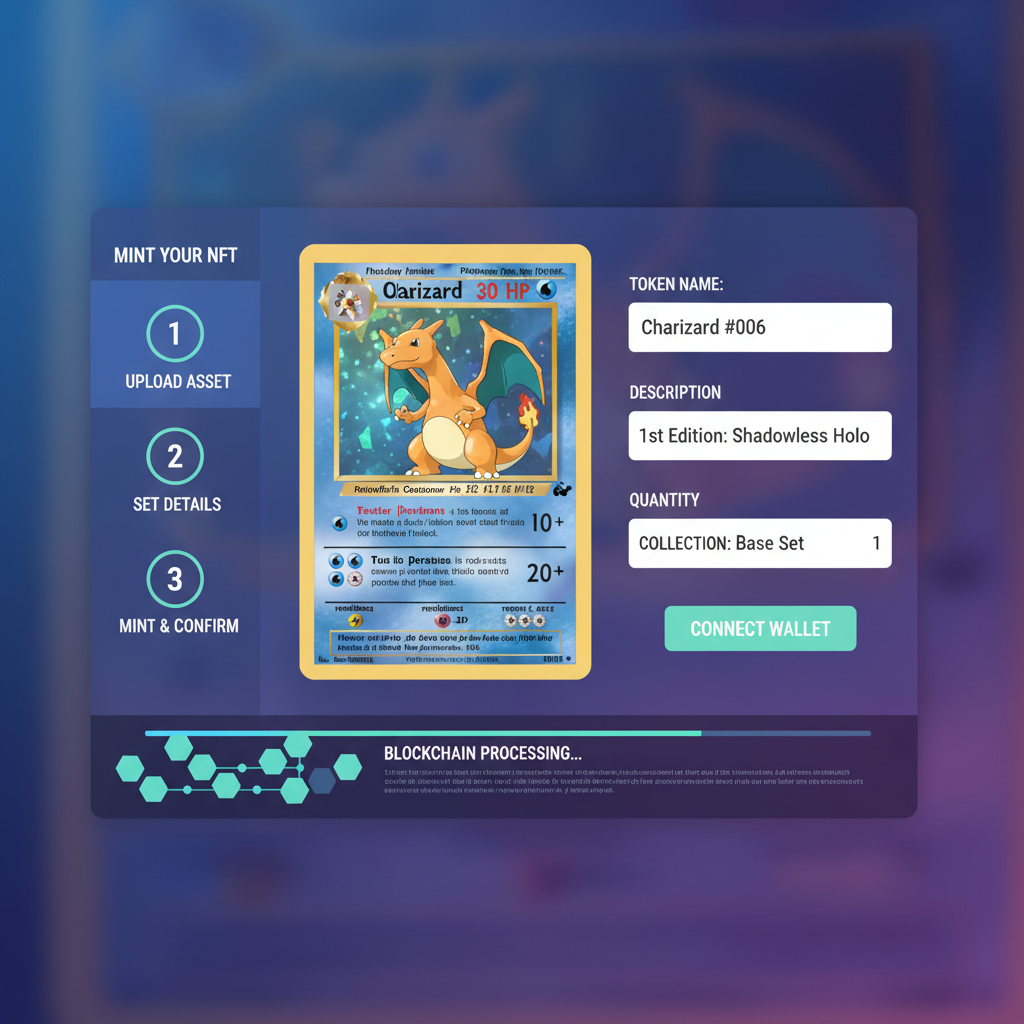

Expect 7-10 days for grading post-arrival. TCGOnChain partners with vetted services mirroring PSA standards, but optimized for speed. Once approved, you approve the mint: a one-click transaction deploys your tcgonchain pokemon nfts on Solana for low fees or Ethereum for broader DeFi access. The NFT contract includes redemption clauses, vault coordinates, and insurance details, all verifiable via Etherscan or Solscan explorers. Gas fees? Under $5 on Solana during normal congestion.

This minting bridges trading card rwAs pokemon to crypto natives seeking blue-chip alternatives. Data shows tokenized cards trade at 15-25% premiums over eBay comps, thanks to 24/7 liquidity and no shipping risks during flips.

Trading and Liquidity Unlocked

With your NFT live, dive into TCGOnChain’s marketplace. List with fixed price, auction, or liquidity pool integration for passive yields. Advanced filters let you target pokemon tcg nfts by set, grade, or rarity – think Base Set holos or modern chase cards. Analytics dashboards track floor prices, volume, and holder distribution, empowering data-driven trades. In August 2025’s $124.5 million surge, savvy users captured 3x returns on mid-tier lots by timing hype cycles around Pokémon anniversaries.

Fractionalization adds nuance: split a high-value card into 100 shares, selling slices to retail investors while retaining control. This model, rare among competitors, amplifies accessibility without diluting provenance. Yet, watch slippage in thin markets; pair trading volumes with on-chain metrics to avoid overpaying.

Redeeming flips the script back to physical. Burn the NFT via wallet, trigger vault release, and receive insured shipping within 5 business days. No middlemen, pure on-chain finality. This redeemability crushes pure NFT skepticism, proving RWAs deliver tangible utility.

Risks, Rewards, and Strategic Plays

No innovation sidesteps pitfalls. Platform risk exists – though TCGOnChain’s audits and $100M and insurance mitigate it. Market volatility mirrors crypto: that $124.5 million peak followed Solana pumps, hinting at correlation. Regulatory fog around RWAs could impose taxes on redemptions or custody rules; consult a tax advisor versed in crypto collectibles. Counterparty risk? Minimal, as blockchain enforces rules.

Rewards skew bullish for long-term holders. Provenance boosts resale values 10-20%, per vault redemption logs. Diversify across grades and eras – pair vintage with scalps on promo waves. My take: allocate 5-10% of portfolios here for uncorrelated alpha, hedging equities with pop culture resilience. Pokémon’s 30-year IP moat endures recessions better than most alts.

Platforms evolve fast; TCGOnChain’s roadmap hints at multi-chain bridges and AI grading previews. As tokenize pokemon cards rwa matures, expect institutional inflows chasing that $124.5 million momentum. Collectors, future-proof now: tokenize strategically, trade analytically, redeem selectively.