Rare Pokémon cards, once tucked away in binders for sentimental value, now command premium prices in vaults and auctions worldwide. As the pokemon cards rwa sector heats up, with tokenized collectibles fueling an $87 million market and tokens like CARDS surging 10x, TCGOnChain stands out by offering a methodical path to transform these treasures into tradable trading card rwa blockchain assets. Collectors gain liquidity without surrendering physical ownership, tapping into 24/7 global markets while preserving authenticity through Solana’s efficient blockchain.

This shift isn’t mere hype; it’s a structural evolution. Platforms like Collector Crypt and Courtyard have popularized the model, but TCGOnChain refines it with rigorous custody and redemption options. Tokenization digitizes your card into an NFT, backed by the physical asset in secure storage, enabling fractional trades, DeFi lending, and instant settlements at minimal gas fees. For investors eyeing rare pokemon cards crypto, this bridges traditional collecting with blockchain’s transparency.

Assessing Value Before Tokenization

Success begins with disciplined evaluation. Not every Pokémon card qualifies for tokenization; focus on graded gems from PSA or Beckett, ideally scoring 8 or higher. A pristine Base Set Charizard or Shining Gyarados holds inherent scarcity, amplified by macroeconomic tailwinds like nostalgia-driven demand amid crypto’s maturation. Review recent comps on TCGOnChain’s marketplace, where tokenized cards trade at premiums reflecting vault security and liquidity.

Consider opportunity costs: holding physical cards risks damage or theft, while tokenizing unlocks yield opportunities. Platforms report lower transaction costs, often just Solana gas fees, versus traditional brokers’ spreads. Yet, patience prevails; rush into ungraded cards, and you dilute trust. TCGOnChain’s process demands verification, ensuring only verified RWAs enter circulation.

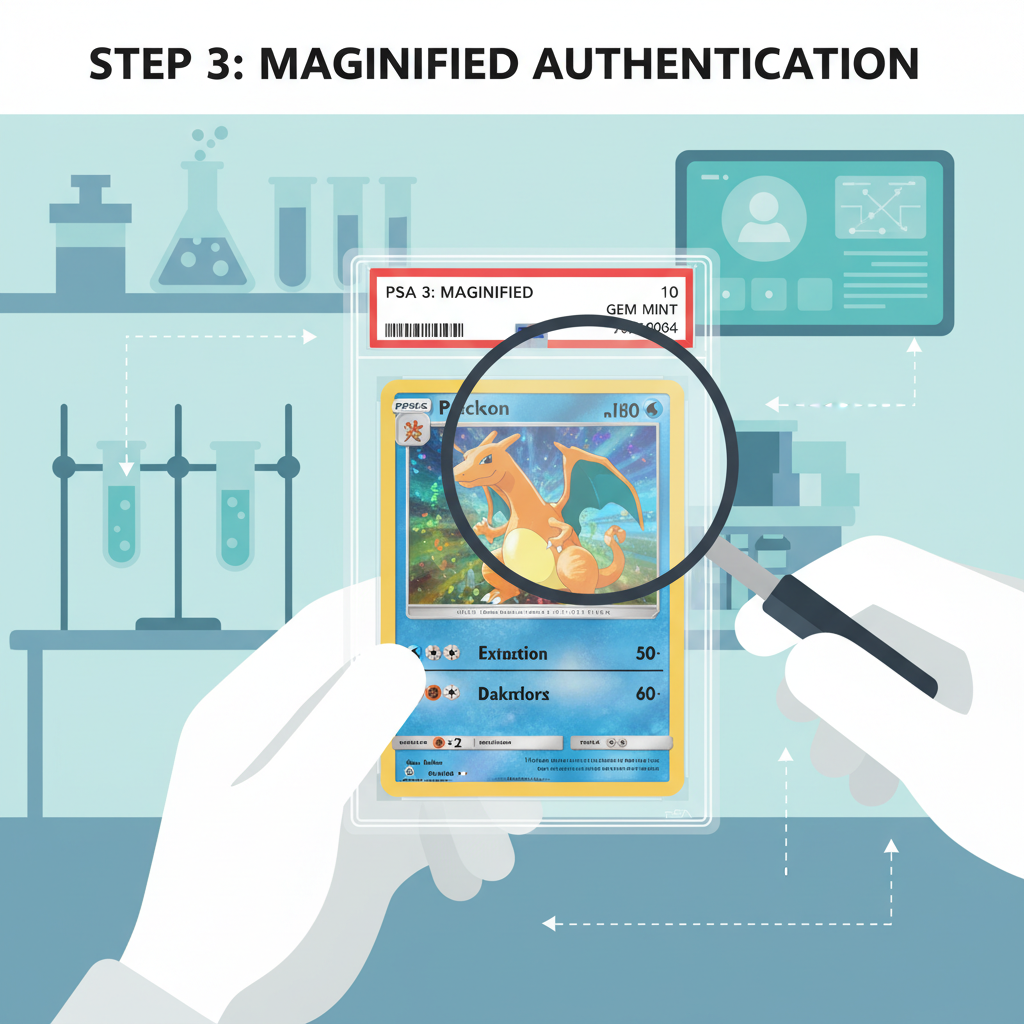

Authentication and Secure Custody Foundations

Professional grading forms the bedrock. Ship your card to PSA or Beckett for encapsulation and scoring, a step that verifies condition under magnification, embedding tamper-evident seals. This grade becomes the NFT’s digital hallmark, viewable on-chain via smart contract metadata. TCGOnChain mandates this, distinguishing it from less stringent competitors.

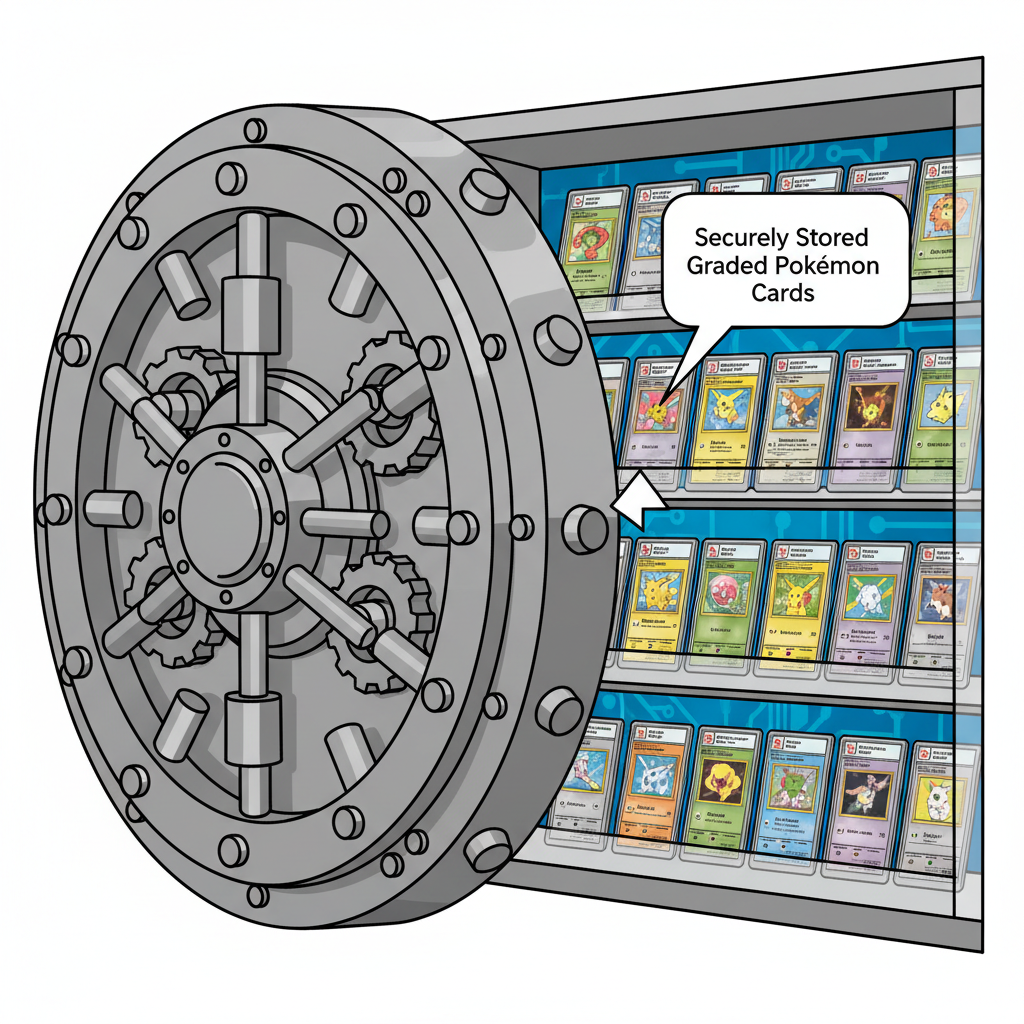

Post-grading, entrust the card to high-security vaults. These facilities, audited for climate control and 24/7 surveillance, mitigate risks that plague home storage. Each vault slot links to a unique NFT, creating an immutable audit trail. Collectors retain redemption rights, redeemable upon NFT burn, fostering confidence in the tcgonchain pokemon ecosystem.

This custody model addresses key pain points: illiquidity and verification. Unlike pure digital NFTs, RWAs tie value to tangible assets, appealing to conservative investors. Data from Chainlink and Venly highlights how such backing powers RWA trends, with trading cards leading exotic assets into DeFi.

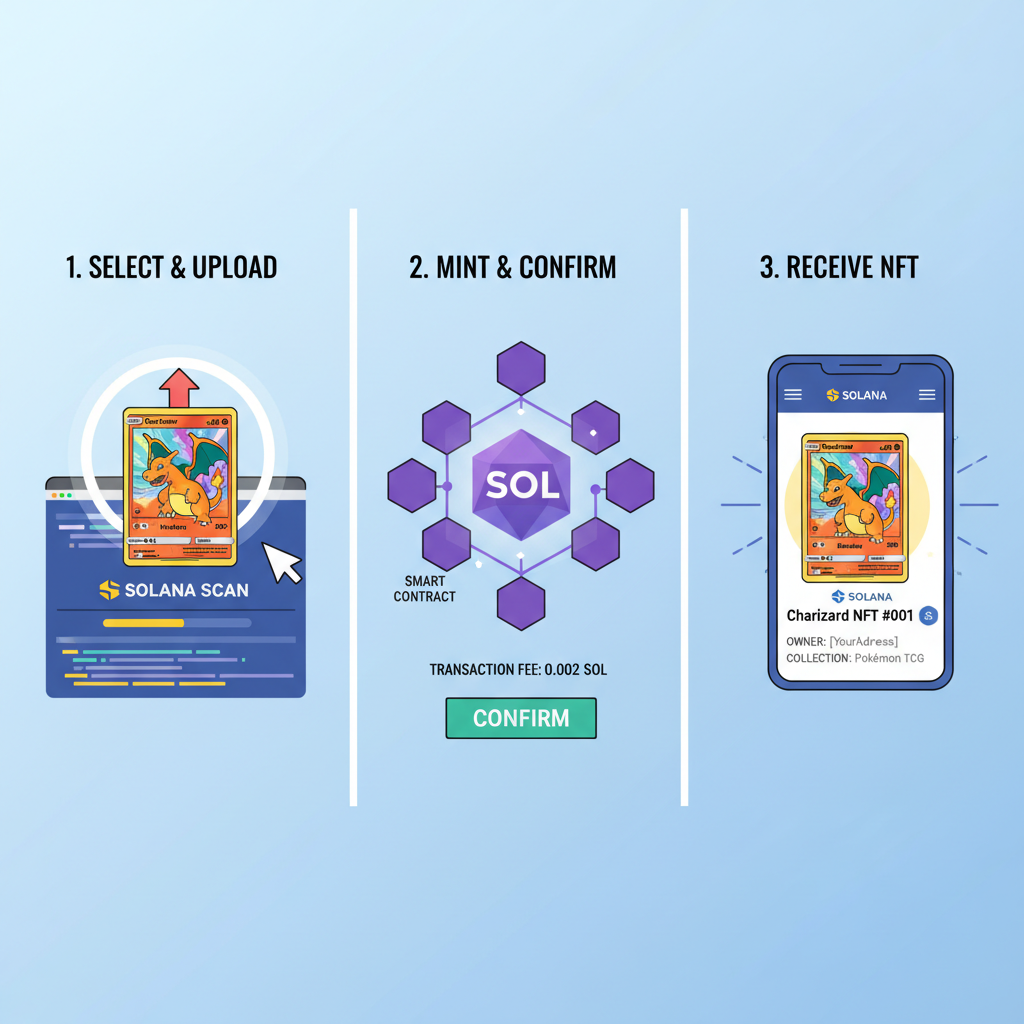

Initiating Tokenization on TCGOnChain

With grading complete, register on TCGOnChain and upload slab images alongside certificates. The platform’s interface guides submission, integrating with vault partners for seamless transfer. Here, Solana’s speed shines, minting occurs in minutes, embedding card details, grade, and provenance into the NFT.

Smart contracts enforce scarcity: one NFT per card, with royalties on secondary sales benefiting originators. This incentivizes quality submissions, curating a premium marketplace. Early adopters report 24/7 trading volumes rivaling crypto natives, per Binance insights on physical card minting surges.

Review the draft NFT preview before finalizing; metadata includes high-res scans and vault coordinates. Fees cover authentication cross-checks and minting, transparently itemized. Once live, your tokenized card enters the ecosystem, ready for listing or holding as a long-term store of value.

Fees remain competitive, often under $50 total, factoring in Solana’s negligible gas costs compared to Ethereum alternatives. This efficiency positions tokenize pokemon cards nft as accessible even for mid-tier collectors, democratizing access to high-value assets.

Navigating the Marketplace for Liquidity

Tokenization unlocks unprecedented liquidity. List your NFT on TCGOnChain’s integrated marketplace, where buyers from Tokyo to New York bid in real-time. Advanced filters let you sort by grade, set, or rarity, mirroring traditional TCG platforms but with blockchain speed. Fractional ownership emerges for ultra-rares, allowing shares in a PSA 10 Charizard without full commitment, a feature echoing DeFi innovations noted by Phemex analysts.

Trading volumes have spiked alongside broader trends; BeInCrypto reports tokenized Pokémon cards propelling an $87 million RWA sector, with Solana’s low fees enabling micro-transactions. Sellers set floor prices or auctions, earning royalties on resales that compound value over time. This creates a flywheel: higher liquidity draws more participants, stabilizing premiums over physical sales.

Monitor positions via intuitive dashboards tracking wallet balances, trade history, and yield opportunities. Integrate with DeFi protocols for lending tokenized cards as collateral, generating passive income while retaining upside. Such composability sets TCGOnChain apart, blending collectible passion with financial engineering.

Redemption: Reclaiming Your Physical Asset

Flexibility defines the model. When sentiment shifts or a collector’s itch returns, redeem your NFT effortlessly. Initiate burn on-chain, triggering vault release protocols. TCGOnChain coordinates insured shipping, often within days, complete with updated grading verification. This bidirectional flow mitigates digital-only pitfalls, reassuring skeptics wary of permanent virtualization.

Risks warrant scrutiny, however. Custodian reliability hinges on audits; TCGOnChain publishes third-party reports, yet diversification across vaults prudent. Market volatility mirrors crypto, where hype cycles amplify swings, as seen in CARDS’ 10x run. Long-term holders benefit from scarcity narratives, bolstered by Pokémon’s enduring cultural cachet amid generational wealth transfers.

From a macroeconomic lens, tokenized RWAs like these hedge inflation better than idle collectibles. Nostalgia fuels demand, while blockchain enforces provenance, curbing counterfeits plaguing physical markets. TCGOnChain’s Solana foundation ensures scalability, positioning it ahead of Ethereum-clogged rivals.

Strategic Considerations for Long-Term Holders

Approach with patience. Tokenize not for quick flips, but portfolio diversification. Allocate 5-10% to RWAs, balancing with blue-chip crypto. Track macroeconomic signals: rising interest rates favor hard assets, while crypto bull runs amplify RWA multiples. Platforms like CoinGecko highlight TCGOnChain among top tcgonchain pokemon destinations, underscoring adoption momentum.

Community forums buzz with success stories, from hobbyists funding expansions to investors stacking yields. Yet, regulatory horizons loom; evolving securities laws could reshape compliance, favoring transparent operators. TCGOnChain’s proactive KYC integrates seamlessly, future-proofing holdings.

Experienced collectors appreciate the psychological edge: digital twins preserve tactile memories via metadata-embedded scans, while unlocking capital otherwise locked in slabs. This hybrid ownership redefines hobbies as investments, inviting a new cohort to the table.

Platforms evolve rapidly; recent Binance data shows physical card minting surging, with TCGOnChain capturing share through superior UX. For those pondering entry, start small with a graded holographic, scaling as conviction builds. The bridge from binder to blockchain endures, rewarding the methodical over the impulsive.