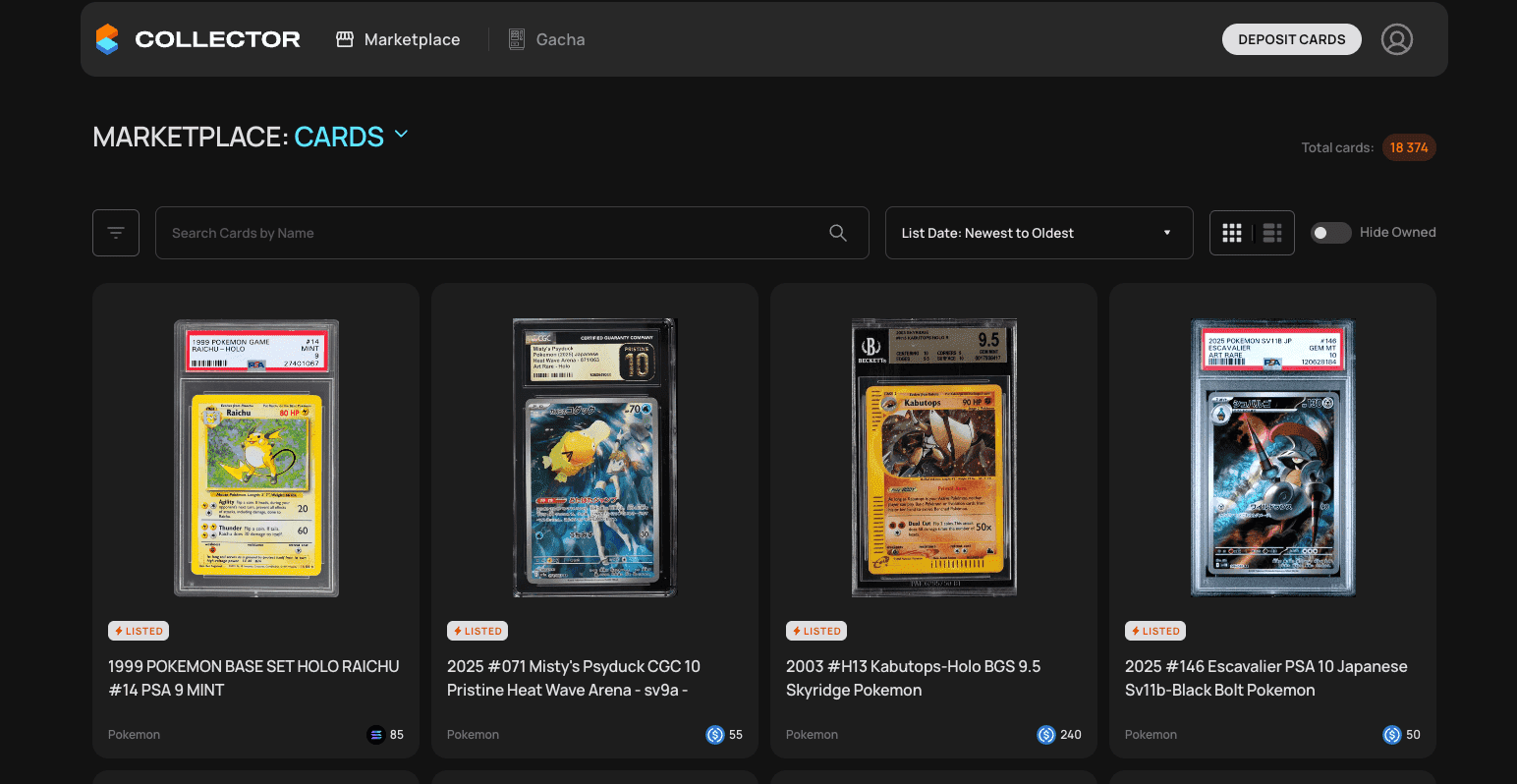

In the evolving landscape of real-world assets (RWAs), tokenize pokemon cards rwa has emerged as a compelling frontier, particularly for PSA graded Pokémon cards. Platforms like Collector Crypt and Courtyard are at the vanguard, transforming authenticated physical cards into NFTs backed 1: 1 by the originals stored in secure vaults. Collector Crypt’s CARDS token, for instance, surged tenfold in under a week to a fully diluted valuation of $360 million, fueled by Gacha-style digital pack openings on Solana. This isn’t mere hype; it’s a methodical shift addressing core pain points in collectibles: illiquidity, verification risks, and geographic barriers. At TCGOnChain. com, we pioneer this for Pokémon, Magic: The Gathering, and beyond, enabling collectors to trade psa graded pokemon nfts with blockchain precision.

The process bridges tangible rarity with digital efficiency. You retain ownership rights, including redemption, while the NFT trades globally 24/7 at fractions of traditional auction fees. Recent data underscores the momentum: between August and September, redeemable Pokémon NFT minting spiked, per Binance insights. Collector Crypt exemplifies this on Solana, vaulting graded cards and minting tradeable tokens. Courtyard mirrors it on Polygon, emphasizing redemption flexibility. These models power the RWA narrative, introducing uncorrelated assets to crypto portfolios, as noted in Aurpay’s analysis of TCG cards hitting $5M valuations.

Decoding the Tokenization Process for Physical Pokémon Cards

Tokenization fundamentally redefines physical pokemon card blockchain ownership. Start with a PSA-graded card, say, a pristine PSA 10 Base Set Charizard, verified for authenticity via slab and certification number. The card ships to a custodian vault, audited for security. A smart contract then mints an ERC-721 or SPL NFT, embedding metadata like grade, population report, and images. This token represents fractional or whole ownership, tradeable on marketplaces. Unlike speculative JPEGs, these NFTs link irrevocably to the asset, with legal wrappers ensuring redemption. Cwallet outlines it crisply: post-storage, the blockchain mints the unique token, powering secondary markets.

Core Tokenization Benefits

-

Instant Liquidity: Enables 24/7 global trading on platforms like Collector Crypt (Solana) and Courtyard (Polygon), bypassing auction delays for PSA-graded Pokémon cards.

-

Immutable Provenance: Blockchain ledgers ensure tamper-proof authenticity and ownership history, verifying PSA grades via secure, transparent records.

-

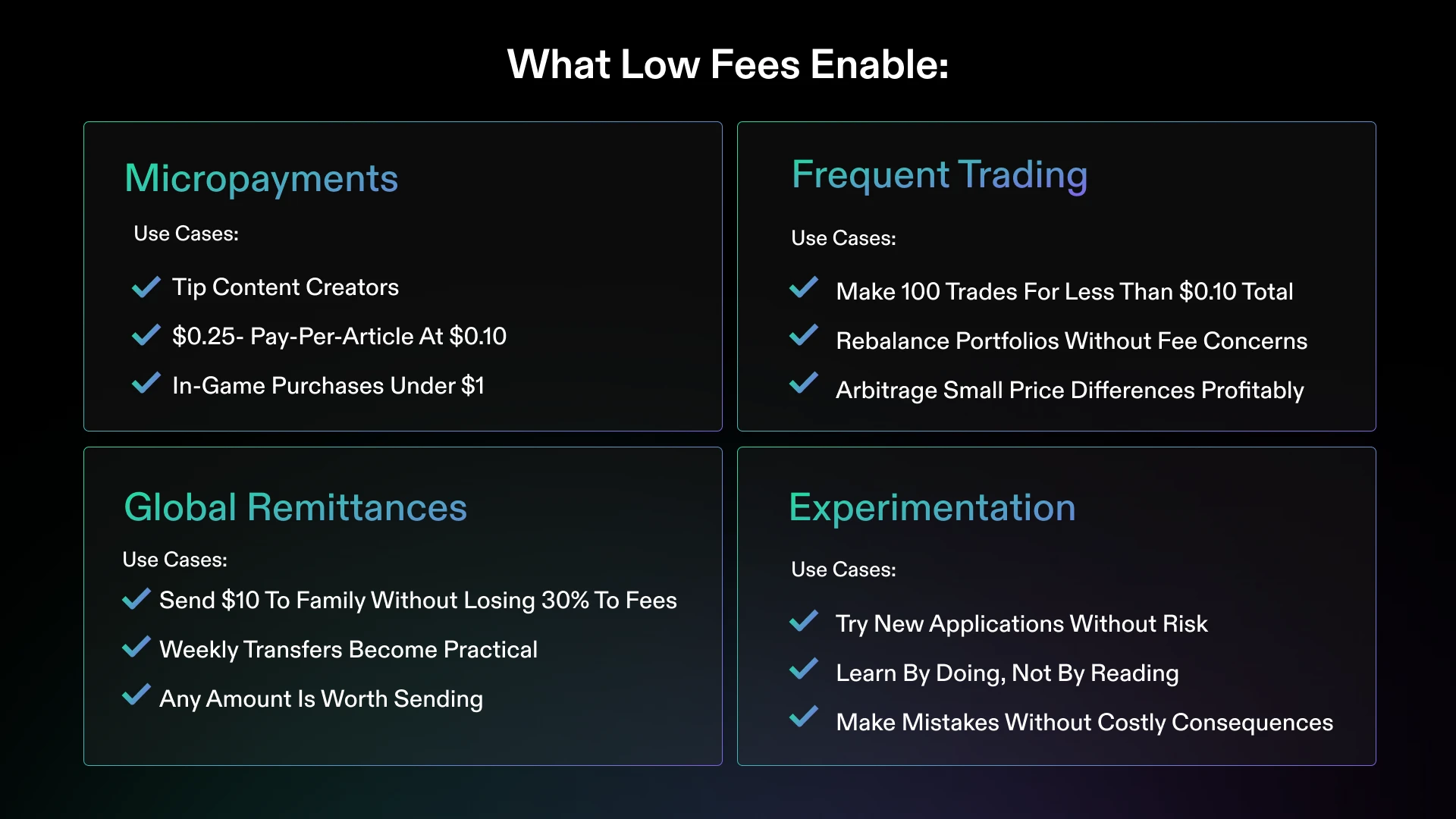

Reduced Fees: Cuts costs versus traditional auctions, with efficient on-chain transactions on Solana or Polygon blockchains.

-

Fractional Ownership: Allows splitting high-value PSA-graded cards into tradeable shares, democratizing access to rare collectibles.

-

Redemption Options: Owners can reclaim physical cards from audited vaults, preserving 1:1 backing on platforms like Collector Crypt.

This hybrid model outperforms traditional holding. Collectors sidestep eBay’s 13% fees and weeks-long sales; instead, Solana’s sub-cent transactions enable rapid flips. Platforms like Collector Crypt add buy-back guarantees, mitigating downside risk, a feature Alea Research highlights alongside Phygitals and Emporium. Opinion: for macro investors, this uncorrelated alpha rivals bonds in stability while echoing crypto’s upside.

Evaluating Leading Platforms for TCG RWA Tokenization

Choosing where to trading card rw as tokenize demands scrutiny of blockchains, fees, and redemption policies. Collector Crypt dominates Solana with Gacha mechanics driving virality; its CARDS token’s $360 million FDV reflects network effects. Users ship cards, receive NFTs, trade online, simple, per Reddit’s r/CryptoCurrency thread. Courtyard on Polygon appeals for Ethereum compatibility, vaulting cards with easy physical redemption. Bitrue and Bitget Wallet guides emphasize secure storage and Solana speed.

TCGO nChain. com stands out for multi-TCG support, optimizing for pokemon cards crypto nfts. We prioritize low-gas mints, insurance-wrapped vaults, and API integrations for seamless trading. Cross-platform liquidity pools amplify this; Unchained’s YouTube deep-dive notes on-chain Pokémon trading’s takeoff via such innovations. Platforms offering instant liquidity, like Collector Crypt’s model, outpace legacy auctions, where a $100K card might languish months.

Essential Preparations Before Tokenizing Your Card

Success hinges on meticulous prep. First, confirm PSA grading: only slabs 8 and typically qualify for premium platforms, ensuring buyer confidence. Document everything, serial numbers, photos under varied lighting, population rarity via PSA site. Select insured shipping; platforms often provide labels. Review terms: custody duration, redemption fees (typically 1-2%), insurance caps. For high-value cards, demand third-party audits. CoinGecko frames it as hybrid efficiency: physical backing meets digital speed. At this stage, simulate ROI: a PSA 10 card at $50K might yield 20% annualized via on-chain yields, far surpassing storage costs.

Once prepared, executing the tokenization demands precision. Platforms streamline this, but understanding the sequence fortifies your position. High-value collectors often layer insurance and legal reviews here, treating it as a portfolio allocation rather than a novelty.

Step-by-Step Tokenization on Leading Platforms

Post-minting, your psa graded pokemon nfts integrate into DEXs or specialized marketplaces. Collector Crypt’s Solana efficiency shines for Gacha enthusiasts, while TCGOnChain’s multi-chain approach suits diversified TCG portfolios. This process, detailed in our step-by-step collector guide, unlocks liquidity without surrendering control. Expect 24-hour turnaround from receipt to NFT issuance, per Bitget Wallet protocols.

Trading these RWAs mirrors crypto natives yet anchors to tangible value. List on platform AMMs, set limit orders, or fractionalize for accessibility. Yields emerge via staking or lending protocols, where NFTs collateralize stablecoin loans at 5-10% APY, uncorrelated to BTC volatility. Platforms enforce oracles for real-time pop report updates, preserving pricing integrity.

| Platform | Blockchain | Key Features | Fees | Redemption |

|---|---|---|---|---|

| Collector Crypt | Solana | Gacha packs, buy-back | 1-2% | 1:1 physical |

| Courtyard | Polygon | Easy redeem, vaults | 1.5% | Flexible |

| TCGOnChain | Multi | Multi-TCG, low gas | <1% | Instant |

This table distills choices: TCGOnChain edges with sub-1% fees and broad TCG support, positioning it for scale. Collector Crypt’s $360 million FDV underscores adoption risks tied to tokenomics; diversify accordingly.

Navigating Risks in Pokémon RWA Tokenization

No innovation escapes scrutiny. Custodial risk looms if vaults falter, though audited facilities like those at Courtyard mitigate via Lloyd’s syndicates. Smart contract exploits, rare on mature chains like Solana, demand platform track records; Collector Crypt’s rapid rise invites caution. Regulatory haze persists, yet RWAs sidestep securities labels through utility wrappers, as PhoenixONE observes in Web3 collectibles evolution.

Market risk? Pokémon hype cycles, but PSA grades provide floor values, outperforming pure NFTs. Simulate downturns: a PSA 10 card holds 80% and value post-bubble, per historical data. Counter with hedging via platform buy-backs or on-chain derivatives. For methodical investors, allocate 5-10% portfolio here, balancing illiquid alpha against crypto beta.

Tax implications vary; track basis meticulously, as NFT trades trigger events distinct from physical sales. Consult advisors versed in RWAs. Platforms furnish 1099s, easing compliance.

Trading Strategies for Tokenized Pokémon RWAs

Approach trading with discipline. Arbitrage pop report discrepancies across platforms; a card undervalued on Solana versus Polygon flips profitably. Momentum plays suit Gacha launches, riding CARDS token surges. Long-term, hold rares amid scarcity narratives, as tokenized supply fragments physical markets.

Advanced: pair with yield farms. Stake NFTs for CARDS rewards, compounding at 15-25% amid bull phases. Monitor via Dune dashboards for volume spikes signaling entry. TCGOnChain’s API feeds enable bots, automating alpha capture without constant vigilance.

Explore our 2025 tokenization roadmap for TCGOnChain specifics, where we optimize for trading card rw as tokenize across Pokémon and Magic.

Fractionalization democratizes icons: slice a $1M Charizard into 1,000 shares at $1K each, drawing retail inflows. Liquidity providers earn fees, echoing DeFi primitives applied to cardboard gold.

The Macro Case for Pokémon RWAs in Portfolios

Beyond tactics, tokenized Pokémon cards fortify diversification. RWAs comprise uncorrelated returns; TCG indices trail equities yet beat bonds in inflation hedges. With $360 million CARDS FDV signaling institutional curiosity, expect ETF wrappers by 2026.

Solana’s throughput and Polygon’s scaling propel this; TCGOnChain’s interoperability bridges them. Collectors reclaim agency from opaque auctions, trading transparently. As macro strategist, I see RWAs evolving from niche to staple, with Pokémon as canary in the collectibles coal mine. Platforms refining redemption and yields will dominate.

Tokenize deliberately: prep slabs, select custodians, trade strategically. This fusion of nostalgia and blockchain maturity redefines ownership, blending patience with precision for enduring gains. Platforms like ours at TCGOnChain await your high-grade assets.