In the ever-evolving landscape of real-world assets (RWAs), vintage Pokémon cards have carved out a surprising yet compelling niche. These childhood treasures, once tucked away in binders or albums, are now powering a $124.5 million tokenized market as of August 2025, with trading volumes surging 5.5 times year-to-date. Platforms like Solana-based Collector Crypt and Polygon’s Courtyard are at the forefront, blending nostalgia with blockchain utility to create vintage Pokémon cards RWA that appeal to collectors and crypto treasuries alike.

What makes this trend resilient? Unlike volatile meme coins or fleeting NFTs, tokenized vintage Pokémon cards represent tangible value backed by graded, authenticated physical assets. Think Base Set Charizards or holographic Venosaurs; their scarcity and cultural cachet endure market cycles, much like blue-chip art or rare wines. As a fundamental analyst, I’ve long advocated for undervalued assets with intrinsic worth, and these trading card RWAs as resilient assets fit the bill perfectly.

The Explosive Growth of Tokenized Pokémon Trading

The numbers tell a story of explosive adoption. Tokenized Pokémon card trades hit $124.5 million in August 2025 alone, fueled by innovative mechanics on Collector Crypt. Users there enjoy random pack openings, instant buybacks via the CARDS token, and a gamified entry point that has drawn in both degens and serious investors. Meanwhile, Courtyard on Polygon emphasizes security with graded card storage, 1: 1 minting, and redemption options, ensuring owners can reclaim their physical cards at any time.

This surge isn’t hype; it’s a structural shift toward tokenize Pokémon cards blockchain for liquidity and accessibility.

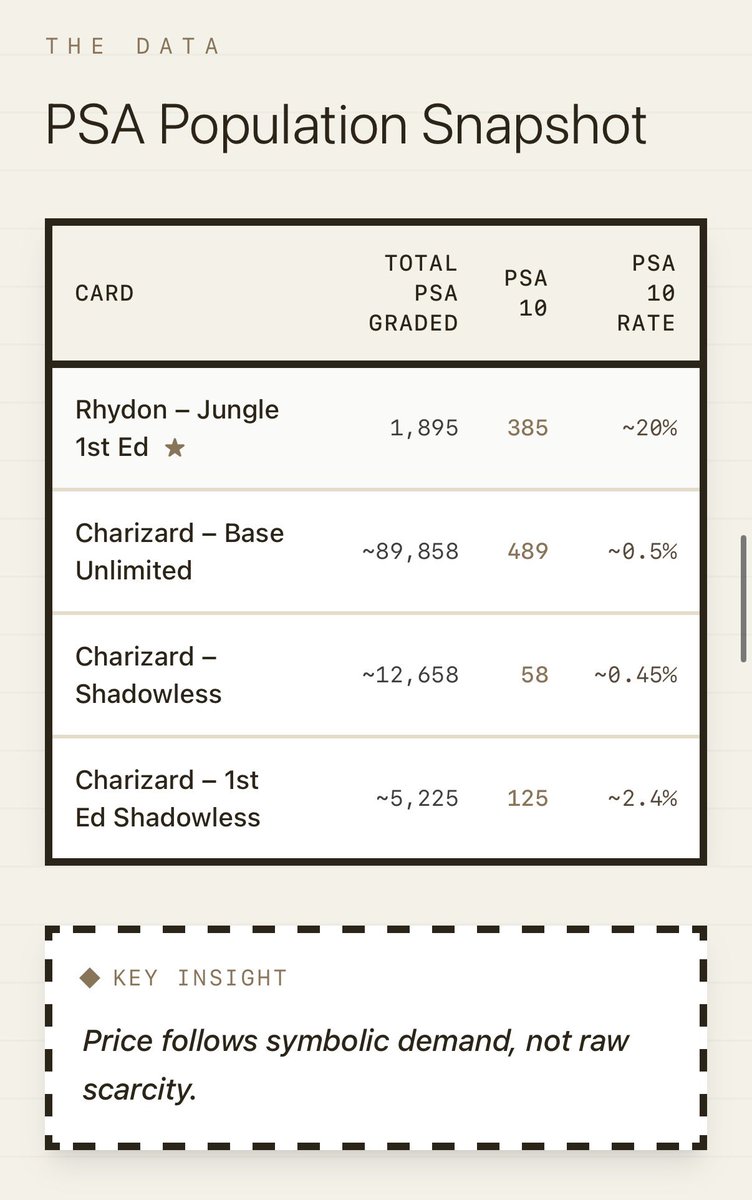

Collector Crypt’s CARDS token, for instance, rocketed amid this momentum, spotlighting the entire sector. Reports from Messari peg tokenized collectibles at $124.5 million, democratizing access to high-value cards previously locked in vaults for whales only. Yet, this isn’t reckless speculation. Vintage cards have proven appreciation over decades, with PSA 10 examples multiplying in value through economic downturns.

Why Vintage Cards Excel as Crypto Treasury Holdings

For building Pokémon cards crypto treasury portfolios, vintage issues shine brightest. Their resilience stems from limited supply; Wizards of the Coast and The Pokémon Company ceased production on early sets, creating natural scarcity. Tokenization amplifies this by enabling fractional ownership, where a $100,000 Black Star Promo can be split into shares accessible to retail investors.

Consider the risk management angle: physical cards weather crypto winters better than pure digital assets. During the 2022 bear market, Pokémon card auctions still fetched premiums, underscoring their role as a hedge. Platforms mitigate custody risks through insured storage and on-chain verification, turning collectibles into programmable money. I’ve seen similar patterns in equity research; assets with real-world utility and provenance outperform in the long run.

Courtyard’s model exemplifies this: deposit a graded card, mint a 1: 1 NFT, and trade globally 24/7. Redemption keeps the physical link intact, addressing a key NFT pitfall. This fusion of RWA and NFT dynamics is reviving a stagnant market, with exotic RWAs like Pokémon cards joining yachts and fine art on-chain.

Unlocking Fractional Ownership and DeFi Yields

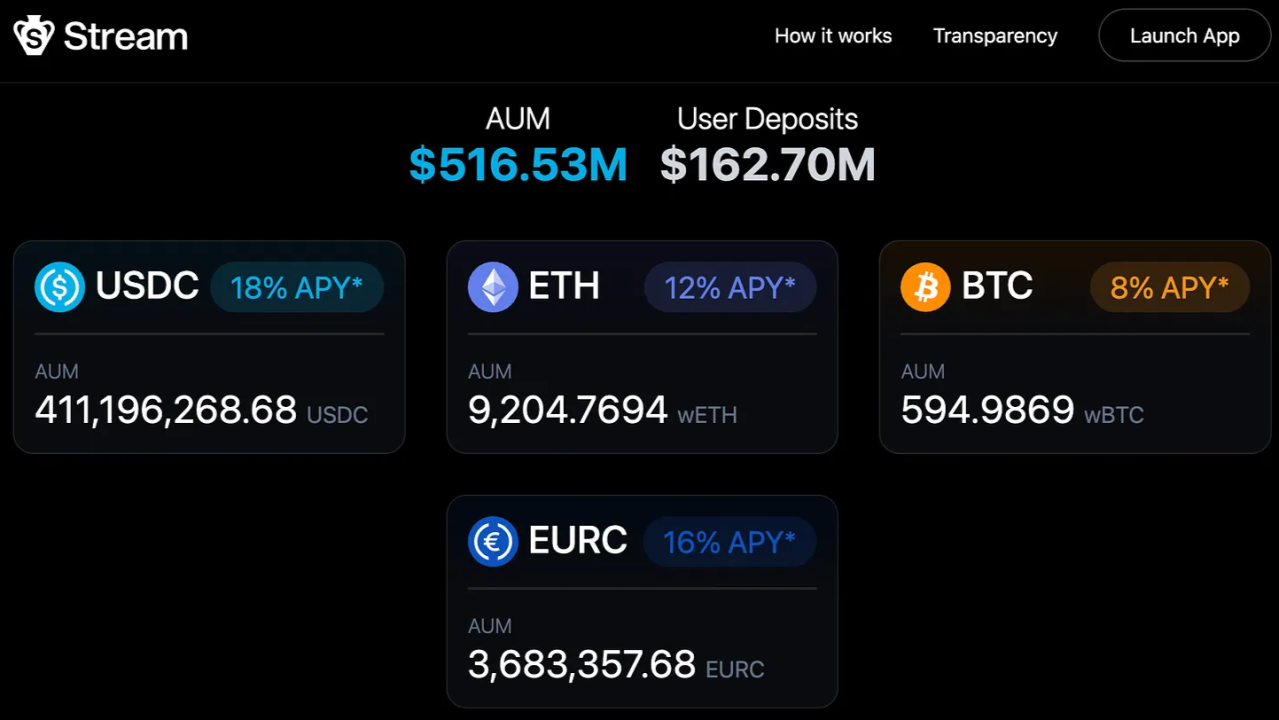

Collectible cards NFT fractional ownership opens doors previously shut. Imagine yielding on your vintage Blastoise via lending protocols or collateralizing it for DeFi loans. Phemex highlights how such tokenization taps fractionalization for broader participation, while Polygon Labs notes efficiency gains like cost reductions and constant liquidity.

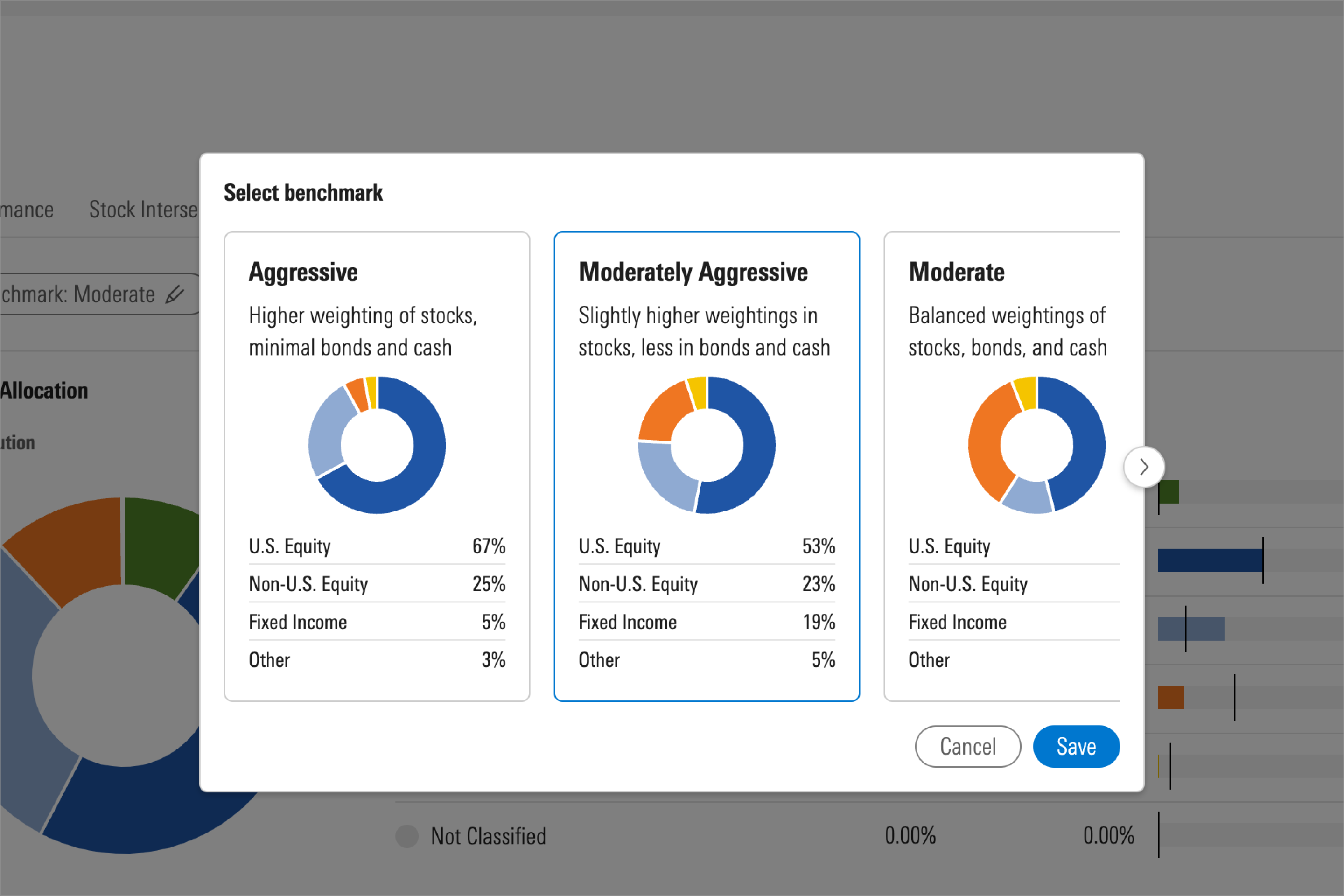

From a treasury perspective, these RWAs diversify beyond stables or treasuries. Allocate 5-10% to tokenized vintage Pokémon, and you gain uncorrelated returns with crypto’s upside. Challenges persist, including IP concerns and regulatory hurdles, but platforms are navigating them adeptly. For patient investors, this is the sweet spot: nostalgia-backed scarcity meets blockchain scalability. Check out our step-by-step guide to get started on tcgonchain. com.

Tokenization isn’t just a fad; it’s redefining ownership. As volumes climb, vintage Pokémon cards position themselves as cornerstone holdings in sophisticated crypto treasuries.

While the momentum is undeniable, seasoned investors know that no asset class is without hurdles. Intellectual property disputes loom large, as The Pokémon Company guards its brands fiercely, potentially challenging widespread tokenization. Regulatory scrutiny could intensify, especially around fractional ownership and redemption processes. Liquidity risks persist if secondary markets thin out, and redemption logistics demand flawless execution to maintain trust. Yet, these aren’t deal-breakers; they’re opportunities for platforms to differentiate through compliance and transparency.

Risk Management Strategies for Tokenized Vintage Pokémon

Approaching trading card RWAs as resilient assets requires discipline. Start with verified grading from PSA or BGS to anchor value. Diversify across sets and conditions, avoiding overexposure to a single icon like Charizard. Platforms like Collector Crypt counter volatility with buyback guarantees, while Courtyard’s insured vaults provide peace of mind. Monitor on-chain metrics for trading depth, and always factor in storage fees against appreciation potential. BlockApps emphasizes this measured strategy, noting high returns come to those who prioritize preservation over speculation.

Comparison of Key Platforms: Collector Crypt vs. Courtyard

| Platform | Chain | Key Features | Volume Contribution | Pros | Cons |

|---|---|---|---|---|---|

| Collector Crypt | Solana | CARDS token, pack openings, buybacks | Primary driver of $124.5M August 2025 volume; CARDS token 10x surge | Engaging pack openings, instant buybacks for liquidity 🚀 | Token volatility, gambling-like pack risks |

| Courtyard | Polygon | Graded storage, 1:1 minting, redemption | Primary driver of $124.5M August 2025 volume | Secure graded storage, true 1:1 backing & redemption 🔒 | Potentially higher fees, less gamified |

This table underscores why blending platforms strengthens a Pokémon cards crypto treasury. Collector Crypt drives hype and volume, contributing heavily to the $124.5 million August surge, while Courtyard ensures institutional-grade custody. Together, they offer a balanced ecosystem for collectible cards NFT fractional ownership.

Steps to Build Resilient Tokenized Pokémon Portfolio

-

Research vintage sets with proven scarcity, like Base Set 1st Edition (1999) or Shadowless Jungle, valued for limited print runs and high demand in RWA tokenization.

-

Verify platform security and redemption policies on established sites like Collector Crypt (Solana, with CARDS token buybacks) and Courtyard (Polygon, 1:1 minting).

-

Allocate by risk tolerance: e.g., 60% blue-chip (PSA 10 Base Set Charizard) and 40% mid-tier (Fossil holos) to balance growth and stability.

-

Track RWA yields via DeFi integrations on tokenization platforms, monitoring metrics amid the $124.5M August 2025 trading surge.

-

Rebalance quarterly against market cycles, adjusting for trends like the 5.5x volume growth driven by Collector Crypt and Courtyard.

Following this blueprint mirrors my equity research playbook: patience yields compounding gains. Vintage cards have historically outpaced inflation by double digits annually, and tokenization supercharges that with global reach.

The Road Ahead for Vintage Pokémon RWAs

Looking forward, expect deeper DeFi composability. Tokenized cards could collateralize loans on Aave or generate yields in liquidity pools, blending collectible passion with passive income. Messari’s analysis points to tokenized collectibles expanding beyond $124.5 million, as blockchain bridges physical rarity to digital efficiency. Platforms will likely integrate AI for authenticity scans, further slashing fraud risks.

Challenges like IP clarity will resolve through partnerships, much as music royalties tokenized successfully. For crypto treasuries, this means a new diversification tool: uncorrelated to BTC drawdowns, resilient through cycles. I’ve allocated modestly to similar RWAs in my portfolio, watching values hold firm amid volatility.

At TCGONChain, we’re pioneering this space with seamless tokenization for Pokémon, Magic, and beyond. Explore how tokenized Pokémon cards are changing the RWA landscape, and position your treasury for the long haul. Vintage Pokémon cards aren’t just relics; they’re the bridge to enduring wealth in crypto’s wild frontier.