In 2025, the fusion of physical Pokémon cards and blockchain technology is reshaping how collectors engage with their prized assets. Tokenizing Pokémon cards as RWAs on TCGOnChain unlocks liquidity without surrendering ownership of the tangible item, backed by secure vaults and immutable ledgers. With platforms reporting massive trading volumes, like Courtyard’s $78.4 million in August alone, collectors are flocking to tokenize pokemon cards rwa for global, 24/7 trading. This guide breaks down the process, drawing on real market data to help you navigate trading card rwAs 2025 confidently.

Why Tokenize Your Pokémon Cards Now?

The Pokémon TCG market has exploded into the crypto space, with collectible pokemon nfts blockchain bridging nostalgia and investment potential. Courtyard on Polygon pioneered this, operating over two years as the first physical asset-backed NFT platform. Collector Crypt on Solana follows closely, boasting $44 million in August 2025 trading volume. These figures underscore a shift: physical cards locked in vaults become digital twins, tradeable instantly without shipping hassles.

Consider the CARDS token on Collector Crypt, which surged tenfold in a week to a $360 million fully diluted valuation. Such volatility highlights rewards, but demands caution. Tokenization verifies authenticity via services like PSA or Beckett, traces ownership transparently, and offers redemption options. For TCGOnChain users, this means accessing a pokemon crypto trading platform optimized for seamless pokemon cards nfts tcgonchain experiences.

Key Platforms Powering Pokémon Card Tokenization

Top Platforms Compared

-

TCGOnChain (Polygon): Low fees, secure authentication via PSA/Beckett grading, and vault storage. Emerging leader for accessible RWA tokenization. Site

-

Courtyard (Polygon): Proven vaults, $25/card fee. August 2025 volume: $78.4 million. Buyback guarantee enhances security.

-

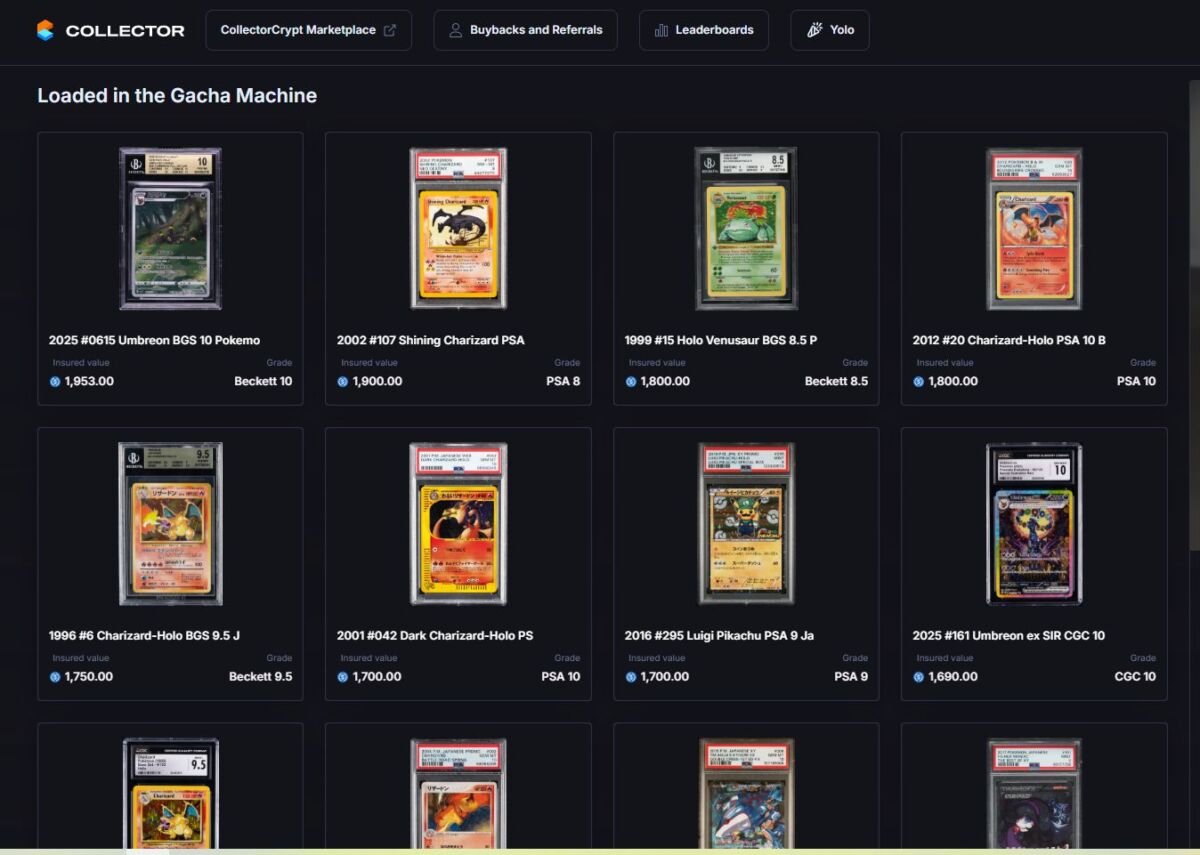

Collector Crypt (Solana): High speed, Gacha features. August 2025 volume: $44 million. CARDS token FDV hit $360 million after 10x surge.

TCGOnChain stands out by integrating these best practices, supporting both Polygon and Solana for cost efficiency. Unlike pure NFT drops, RWAs here link to vaulted cards, insured and auditable. Courtyard’s model, minting NFTs post-vaulting via smart contracts, sets the standard; TCGOnChain enhances it with user-friendly tools for collectors new to blockchain.

Step 1: Research and Select Your Platform

Start by evaluating options. TCGOnChain offers comprehensive support for tokenizing Pokémon cards, with fees competitive to Courtyard’s $25 per card. Compare security: all use professional grading, but check vault insurance and redemption policies. Solana’s speed suits high-volume traders, while Polygon’s low gas fees appeal to casual collectors. Dive into metrics; August volumes show sustained demand, signaling liquidity for your tokenized assets.

Step 2: Authenticate and Grade Your Cards

Authenticity is non-negotiable. Submit cards to PSA or Beckett for grading; a PSA 10 gem mint elevates value exponentially. Platforms like TCGOnChain require this verification pre-tokenization, ensuring buyer trust. Once graded, document slabs with high-res photos. This step, often overlooked, prevents disputes and boosts resale potential in the pokemon cards nfts tcgonchain marketplace.

Step 3: Set Up Your Account and Verify

Head to TCGOnChain, create an account, and complete KYC. This complies with regs while unlocking full features. Link a wallet like MetaMask or Phantom; back up seeds immediately. Platforms enforce this to mitigate risks, aligning with broader RWA standards for transparent ownership.

Packaging comes next: use rigid holders, bubble wrap, and tracked shipping per guidelines. TCGOnChain provides labels for their vaults, minimizing loss risks during transit.

Platforms like TCGOnChain partner with insured couriers, often covering transit insurance up to $50,000 per shipment. This layer of protection turns a potential vulnerability into a straightforward process, letting you focus on the upside of tokenize pokemon cards rwa.

Step 4: Confirm Receipt and Final Checks

After shipping, track your package religiously. TCGOnChain notifies you upon vault arrival, typically within 5-7 business days. Their team conducts a secondary inspection, cross-referencing your submitted grades and photos. Any discrepancies trigger a quick resolution, often with photos shared via secure portal. This diligence, drawn from Courtyard’s proven playbook, builds trust essential for high-value pokemon cards nfts tcgonchain.

Step 5: Review Fees, Policies, and Mint

Transparency on costs separates solid platforms from hype. Expect $25 per card on TCGOnChain, mirroring Courtyard, covering vaulting, insurance, and minting. Review buyback guarantees: most offer full redemption of physical cards post-NFT sale, minus fees. Once satisfied, approve the smart contract mint. On Polygon or Solana, this deploys your NFT in minutes, linking metadata to the vaulted asset via IPFS for tamper-proof provenance.

From my analysis of RWA flows, these fees pale against liquidity gains. August 2025 data shows Courtyard at $78.4 million volume, Collector Crypt at $44 million; TCGOnChain users tap similar depth without the wait.

Platform Comparison

| Platform | Blockchain | Fee per Card | Aug 2025 Volume | Key Feature |

|---|---|---|---|---|

| TCGOnChain | Polygon/Solana | $25 | N/A | Unified marketplace |

| Courtyard | Polygon | $25 | $78.4M | Vending Machine |

| Collector Crypt | Solana | Varies | $44M | Gacha trades |

Step 6: Secure Your Wallet and List for Trade

Your NFT lives in your wallet now, a digital twin ready for action. Use hardware like Ledger for cold storage, enable 2FA, and never share seeds. TCGOnChain’s marketplace lets you list instantly, setting floor prices informed by real-time comps. Dive into Vending Machine drops or Gacha pulls for fun, fractional upside.

Trading tokenized cards feels like Magic: instant, borderless. Sell a PSA 10 Charizard without mailing it; buyers get the NFT, redeem later if desired. This model, refined over years, powers trading card rwAs 2025 growth.

Step 7: Monitor, Trade, and Optimize

Post-mint, track via dashboards showing volume, holder count, and price floors. CARDS token’s tenfold run to $360 million FDV reminds us: volatility cuts both ways. Set alerts for trends; pair with PSA-graded tokenization guides for edge.

Opinion: Diversify across rarities and platforms. A balanced portfolio of commons for flips, holos for holds, hedges crypto swings with tangible backing.

Risks merit scrutiny. Platform risk looms if vaults falter, though audits and insurance mitigate. Regulatory shifts could impact redemptions; stick to compliant outfits like TCGOnChain. Volatility mirrors crypto: CARDS’ surge thrilled, but dips demand steel nerves. Yet, with $122.4 million combined August volume across leaders, the trend favors early movers bridging physical nostalgia to pokemon crypto trading platform innovation. Tokenize thoughtfully, trade smart, and watch your collection evolve on-chain.