Pokémon card tokenization on the Solana blockchain is rapidly redefining what it means to be a collector or investor in the digital age. By transforming physical Pokémon cards into on-chain assets, platforms like Collector Crypt and Phygitals are not only making rare cards more accessible, but also introducing new forms of liquidity and gamification that were previously unimaginable in the traditional collectibles market. With Solana’s robust ecosystem and low transaction fees, the landscape for pokemon card tokenization is evolving at a blistering pace, opening doors for both seasoned collectors and crypto-native investors alike.

Solana-Powered Surge: $124.5 Million in Tokenized Pokémon Card Trades

In August 2025, the trading volume for tokenized Pokémon cards soared to $124.5 million, a 5.5x increase since the start of the year. This explosive growth is largely attributed to Solana-native platforms like Collector Crypt and Phygitals, which have brought instant settlement, global accessibility, and new investment models to a once-niche market. With Binance-Peg SOL (SOL) trading at $201.53, the ecosystem’s robust infrastructure is helping drive the adoption of solana trading card NFTs across the globe.

“Tokenized Pokémon cards are gaining popularity, driven by projects like Collector Crypt, which offers NFTs redeemable for physical graded cards. ”. Reddit · r/CryptoCurrency

Collector Crypt: Gamification and Instant Liquidity for Pokémon Card RWAs

Collector Crypt has positioned itself as a pioneer in the onchain pokemon collectibles space, leveraging Solana’s speed and efficiency. The platform enables users to mint their graded Pokémon cards as NFTs, stored securely in vaults and tradable at any time. Its unique Gacha machine offers randomized pulls for 50 USDC each, with prizes ranging from $30 to over $2,000 in value. This gacha mechanic introduces a thrilling element of chance, while the platform’s instant liquidity means users can immediately sell rare pulls without waiting for a buyer. The $CARDS token, now with a market cap of $70 million just five days after launch, further incentivizes participation and underpins the platform’s treasury-backed buyback system.

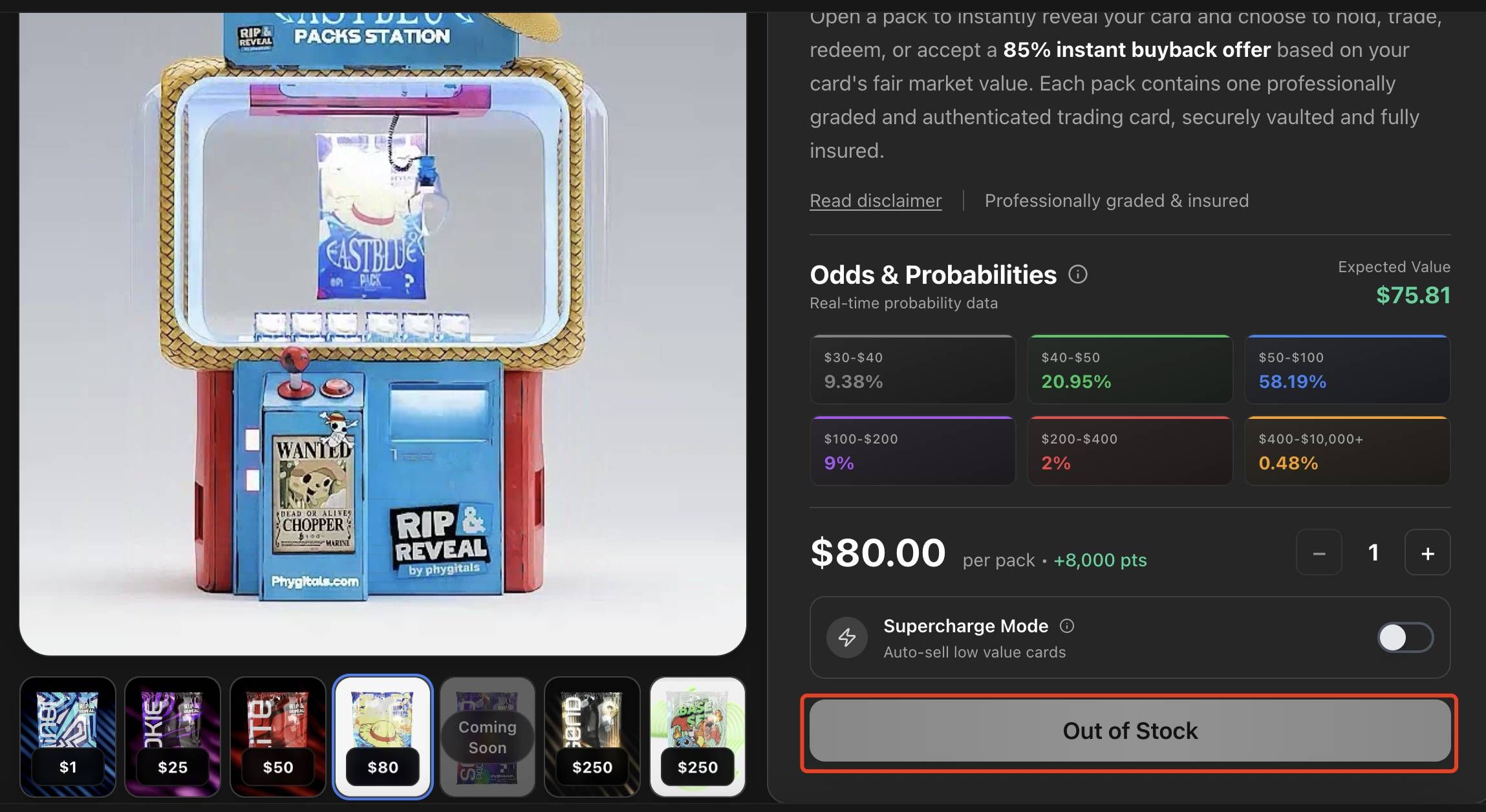

Phygitals: Bridging Physical and Digital with Gamified Collecting

Phygitals takes a slightly different approach by allowing users to scan and tokenize their physical cards, instantly listing them on the market as NFTs. The platform’s digital packs can be opened for a chance to receive both digital and physical assets, creating a seamless bridge between traditional collecting and blockchain-powered ownership. In August 2025, Phygitals generated $1.29 million in revenue, reflecting surging demand for this hybrid experience. Their social and gamified features are helping to attract a new generation of collectors who value both digital convenience and the nostalgia of physical cards.

Key Investment Opportunities & Risks in Pokémon Card Tokenization on Solana

-

Fractional Ownership of High-Value Cards: Platforms like Collector Crypt enable investors to purchase fractional NFT shares of rare Pokémon cards, making high-value collectibles more accessible to a broader audience.

-

Enhanced Liquidity and Instant Trading: By tokenizing physical cards on the Solana blockchain, users can trade Pokémon card NFTs instantly, reducing transaction times and costs compared to traditional marketplaces.

-

DeFi Integration for Tokenized Assets: Tokenized Pokémon cards can be used as collateral in decentralized finance (DeFi) platforms, allowing investors to access loans or earn yield from their collectibles.

-

Gamified Investment Experiences: Platforms such as Phygitals and Collector Crypt offer features like digital pack openings and gacha machines, creating engaging, lottery-like investment opportunities with real-time value calculations.

-

Intellectual Property and Licensing Risks: Most tokenized Pokémon card projects, including Collector Crypt, operate without official licensing from Nintendo or The Pokémon Company, exposing investors to potential legal disputes.

-

Regulatory Uncertainty: The evolving regulatory landscape for blockchain assets and NFTs means platforms and investors may face sudden changes in compliance requirements or restrictions.

-

Market Volatility and Speculative Trading: The value of tokenized Pokémon cards can fluctuate dramatically, driven by market demand, rarity, and speculative trading, as seen in the $124.5 million monthly trading volume surge in August 2025.

As the market matures, these innovations are not just transforming how we collect Pokémon cards, they’re fundamentally changing how we think about pokemon cards crypto investment. The next section will explore the unique investment opportunities this new ecosystem offers, as well as the risks that come with such rapid evolution.

For collectors and investors, the rise of tokenized Pokémon cards on Solana offers a fresh spectrum of strategies. Fractional ownership of high-value cards, instant trading, and the ability to use NFTs as collateral in DeFi protocols are just the beginning. Platforms like Collector Crypt and Phygitals are not only making it easier to access rare cards but also providing tools for tracking real-time value and liquidity. This is a significant shift from the days of slow, opaque secondary markets, and it’s fueling a surge in both trading volume and mainstream attention.

Navigating Volatility and Regulation

Yet, as with any new frontier, the path is not without its hazards. Market volatility remains a core concern. The value of tokenized Pokémon cards can swing dramatically based on collector sentiment, rarity, and broader crypto market trends. While the current price of Binance-Peg SOL (SOL) is $201.53, providing a stable and efficient backbone for these platforms, investors should be mindful that both asset and token prices can shift rapidly.

Legal and regulatory questions also loom large. Most tokenized Pokémon cards are not officially licensed by Nintendo or The Pokémon Company, leaving platforms and users exposed to potential intellectual property disputes. The evolving landscape of blockchain regulation adds another layer of complexity, with compliance and legal clarity still works in progress for many operators.

The Changing Face of Collecting: Community, Gamification, and Transparency

What sets Solana-based platforms apart is their commitment to community engagement and transparency. Features like real-time expected value calculations, treasury-backed buybacks, and social leaderboards are making collecting more interactive and data-driven. Gamified mechanics, such as Collector Crypt’s Gacha machine or Phygitals’ digital pack openings, inject excitement reminiscent of opening booster packs, except now, every pull is instantly verifiable and tradeable on-chain.

Transparency is further enhanced by on-chain authentication and secure vaulting of physical assets. This not only reassures investors about provenance and condition but also sets a new standard for trust in the collectibles market. As the ecosystem matures, expect to see even deeper integration of analytics, insurance, and lending products built on the foundation of tokenized RWAs (real-world assets).

Looking Ahead: Will Tokenized Pokémon Cards Become a Mainstream Asset Class?

The question now is whether tokenized Pokémon cards will break out from their niche and become a recognized alternative asset class. With trading volumes hitting $124.5 million in August 2025 and platforms like Collector Crypt achieving $70 million in market cap for their $CARDS token within days, the momentum is undeniable. The combination of nostalgia, digital innovation, and new financial utilities is attracting both veteran collectors and crypto investors seeking exposure to unique RWAs.

Still, success will depend on how these platforms navigate regulatory hurdles and intellectual property issues while continuing to innovate in user experience and asset security. For those willing to embrace calculated risk, the Solana-powered Pokémon card market represents a dynamic intersection of culture, technology, and finance, one where true value will ultimately stand the test of time.