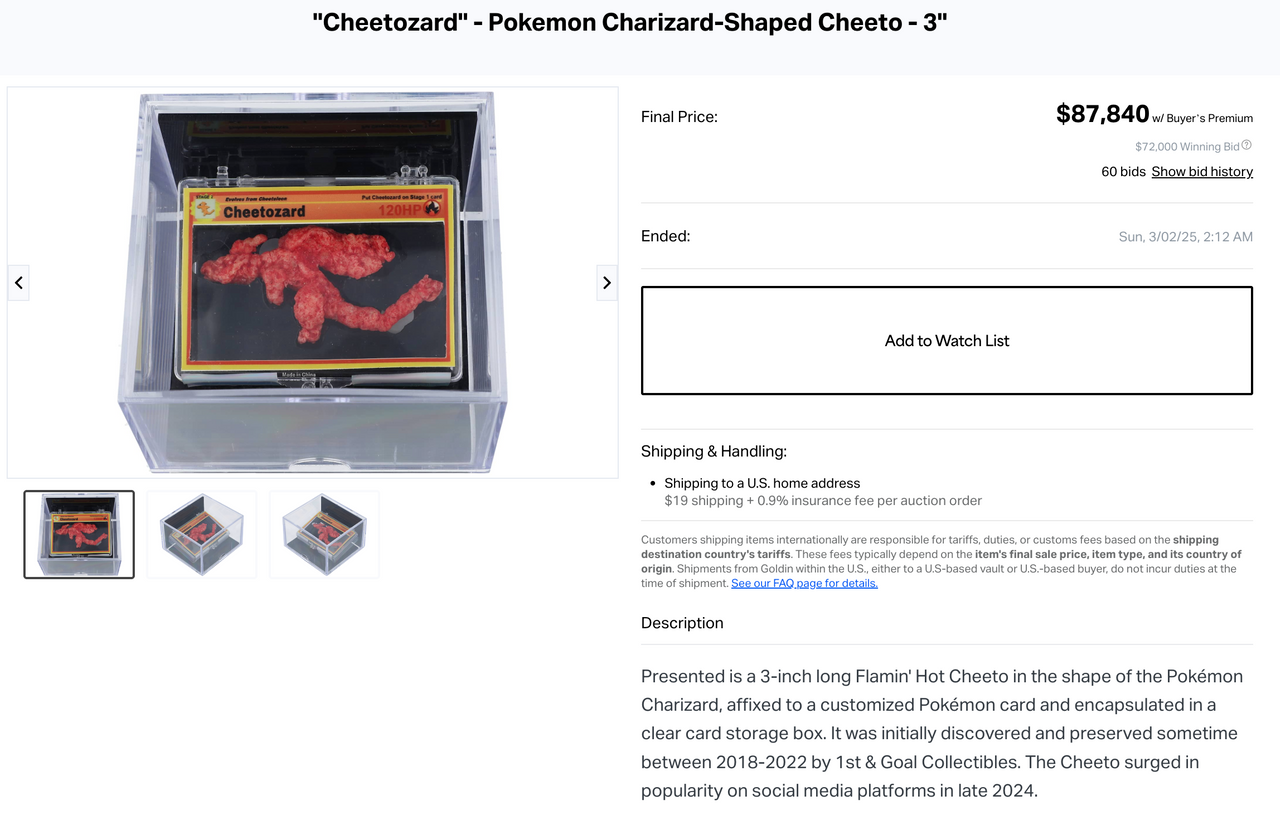

In the rapidly evolving world of trading card NFTs, Collector Crypt on Solana is setting a new standard for how collectors interact with physical Pokémon cards. By bridging the gap between real-world assets (RWAs) and blockchain technology, Collector Crypt enables users to tokenize and trade graded Pokémon cards as NFTs, offering both liquidity and security in a market traditionally plagued by counterfeiting and logistical challenges.

Collector Crypt Solana: Turning Physical Pokémon Cards into Onchain Assets

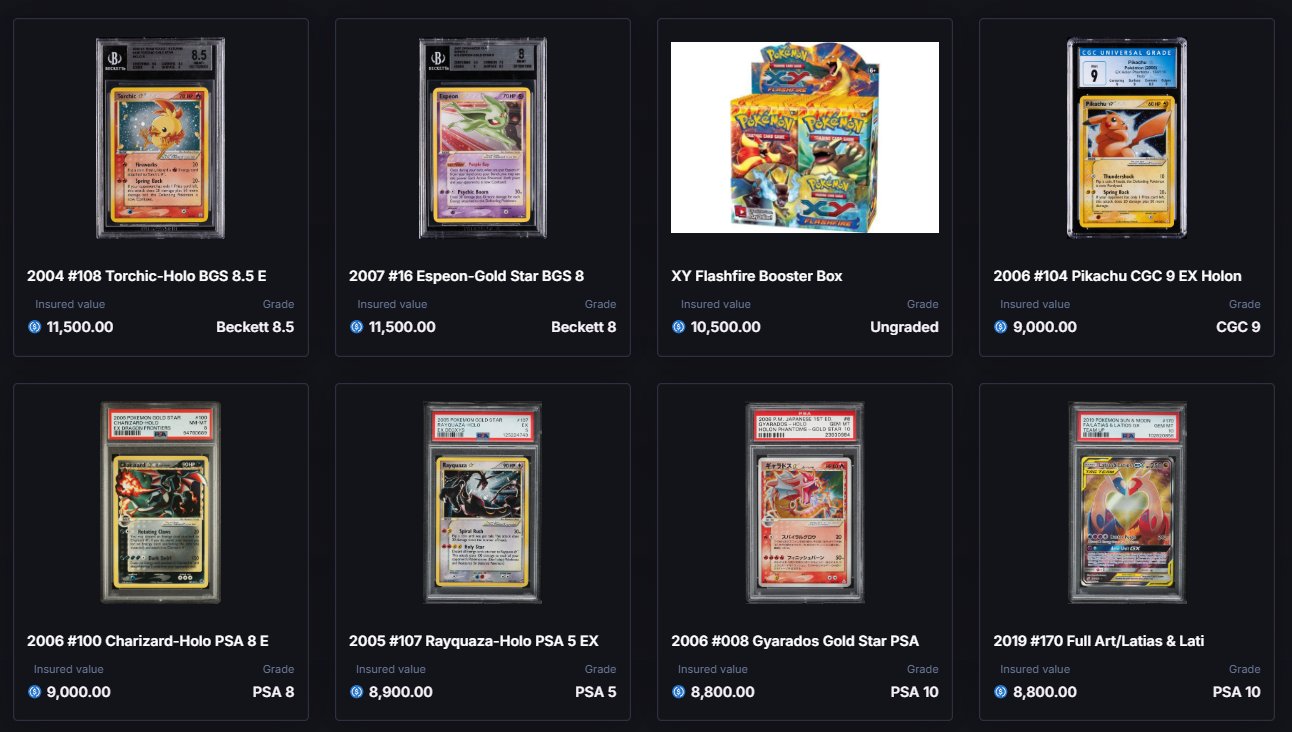

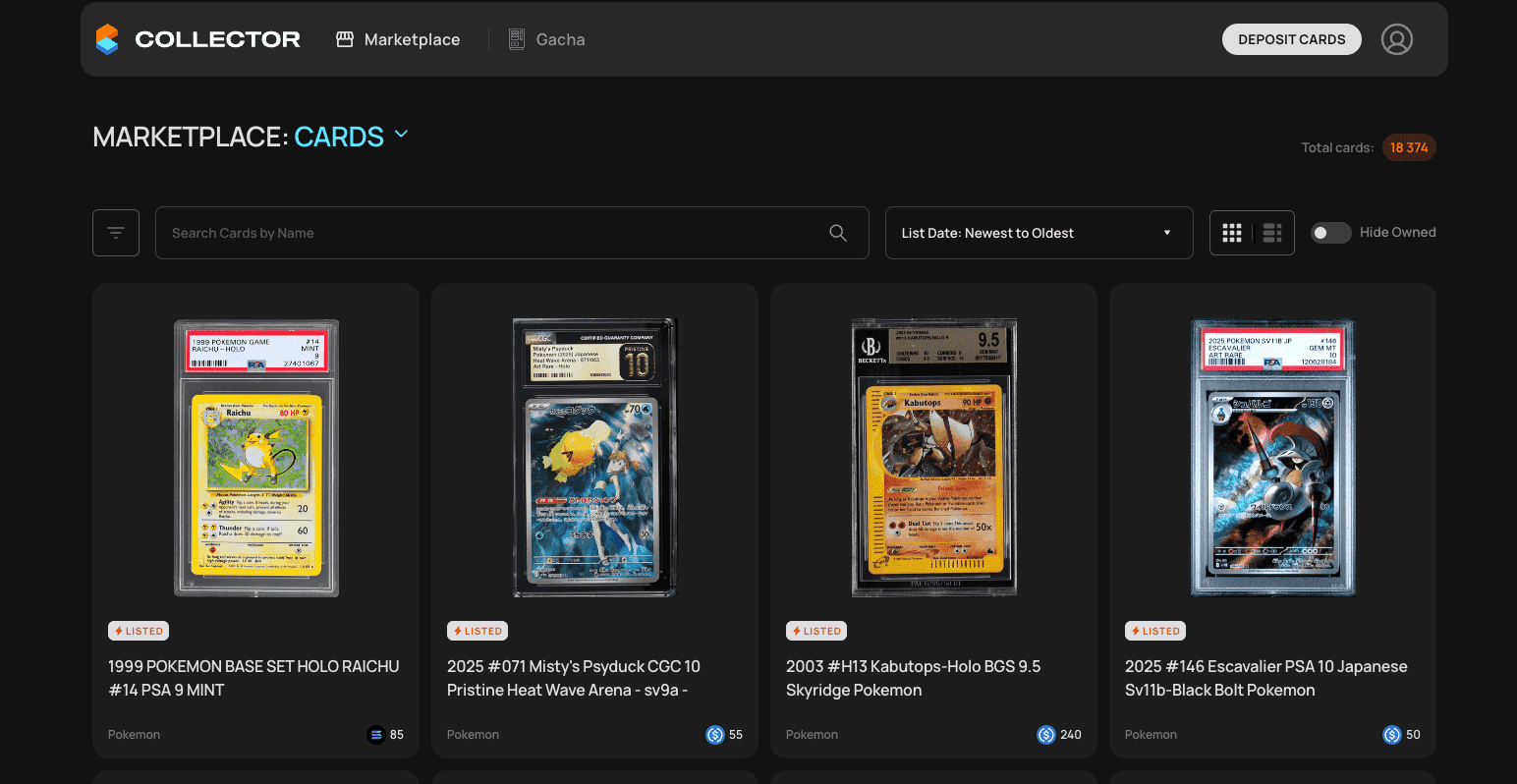

Collector Crypt’s approach is both simple and transformative. Physical Pokémon cards are securely vaulted, professionally graded, and then minted as unique NFTs on the Solana blockchain. Each NFT represents a 1: 1 claim on a physical asset, ensuring that digital ownership is always backed by real-world value. Users can trade these NFTs on secondary markets or redeem them at any time for the underlying card.

This model addresses several pain points in the collectible trading card market:

- Authenticity: Every tokenized Pokémon card is professionally graded before being vaulted, eliminating doubts about legitimacy.

- Liquidity: Instant buyback options allow users to sell their NFTs back to Collector Crypt for 85% to 90% of eBay-determined market value, providing reliable exit opportunities without waiting for peer-to-peer buyers.

- Global Access: By leveraging Solana’s fast transaction speeds and low fees, Collector Crypt makes high-value collectible trading accessible worldwide.

The Legendary Gacha Machine: Gamified Unboxing Meets Blockchain

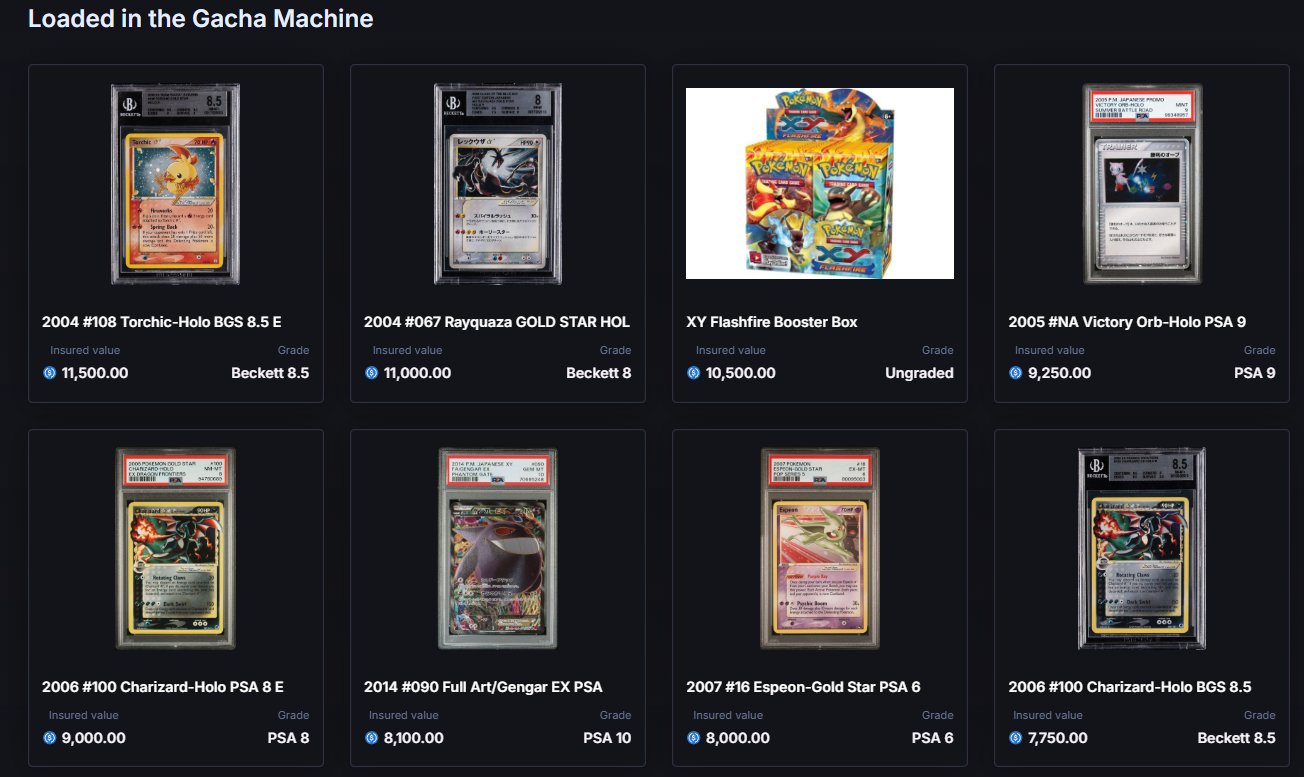

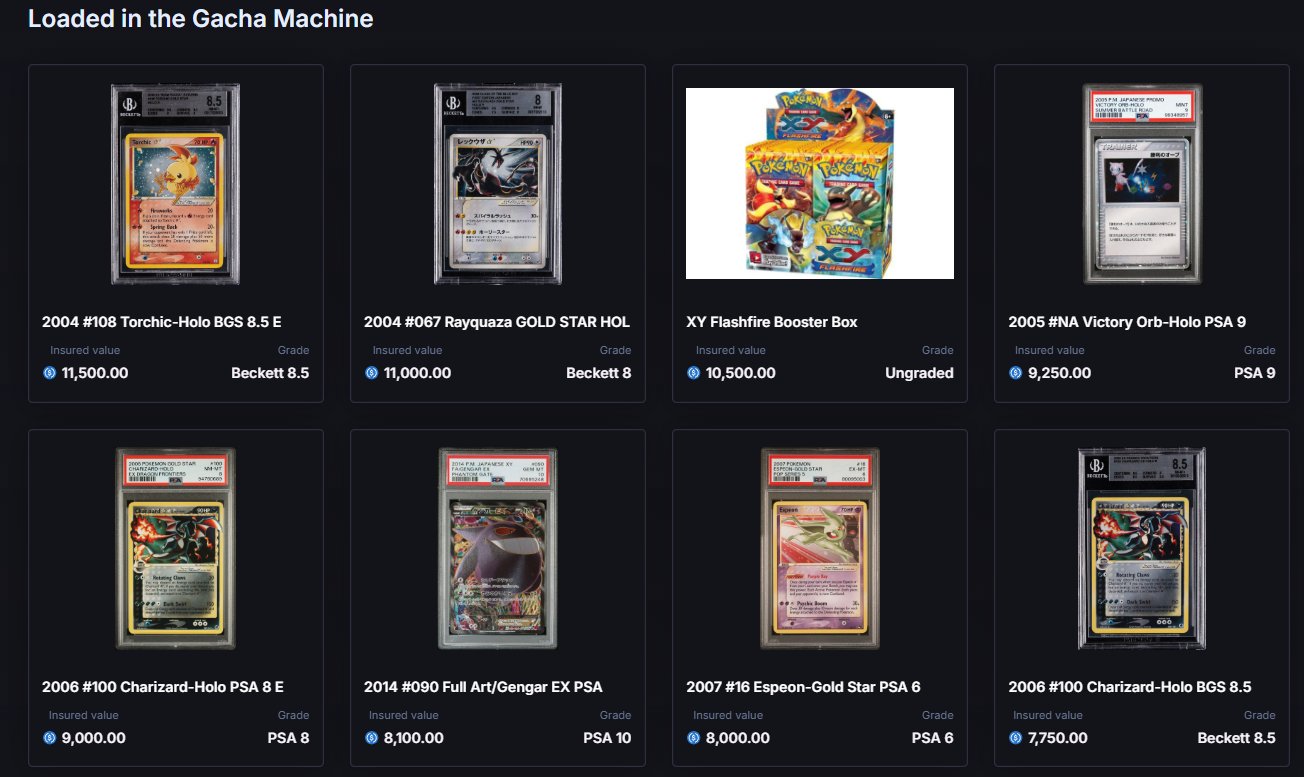

A standout feature driving Collector Crypt’s meteoric growth is its digital “Gacha machine”. For a set fee (currently 50 USDC per pull), users can draw randomized packs containing NFT representations of graded Pokémon cards. This mechanic echoes the thrill of opening physical booster packs but adds provable fairness and instant ownership transfer via blockchain technology.

The excitement around this feature is palpable – in just one week, sales from the Gacha machine topped $16.6 million, illustrating massive demand for gamified RWA trading cards (source). Prizes range from modestly valued cards to highly coveted collectibles worth over $2,000 each. Real-time expected value calculations keep participants informed about their odds and potential returns.

$CARDS Token Momentum Reflects Surging Interest in Tokenized Collectibles

The launch of Collector Crypt’s native token, $CARDS, has been nothing short of explosive. Debuting in August 2025 with a market capitalization of $67 million, $CARDS soared to over $600 million within a week – a testament to both speculative interest and genuine belief in tokenized RWAs (source). This rapid appreciation mirrors broader trends in crypto as investors seek exposure to assets that blend tangible value with digital utility.

Solana (SOL) & Collector Crypt (CARDS) Price Prediction 2026-2031

Professional outlook based on latest market context, adoption trends, and technical/fundamental analysis. All prices in USD.

| Year | SOL Minimum Price | SOL Average Price | SOL Maximum Price | CARDS Minimum Price | CARDS Average Price | CARDS Maximum Price | Market Insights |

|---|---|---|---|---|---|---|---|

| 2026 | $180.00 | $245.00 | $320.00 | $3.50 | $6.00 | $10.00 | SOL may see retracement as market cools post-2025 highs; CARDS consolidates after explosive launch. |

| 2027 | $220.00 | $295.00 | $410.00 | $4.20 | $7.80 | $13.00 | Renewed interest in tokenized assets as mainstream adoption grows; regulatory clarity boosts both tokens. |

| 2028 | $260.00 | $360.00 | $520.00 | $5.10 | $10.40 | $17.50 | Bullish cycle accelerates; NFT+RWA platforms gain traction, benefiting CARDS more than broad altcoins. |

| 2029 | $310.00 | $410.00 | $620.00 | $6.00 | $13.00 | $22.00 | Major partnerships and global expansion; SOL cemented as top L1, CARDS explores new collectibles. |

| 2030 | $275.00 | $370.00 | $580.00 | $5.60 | $11.20 | $18.00 | Possible market correction after prolonged bull run; both assets remain above previous cycle highs. |

| 2031 | $320.00 | $465.00 | $730.00 | $7.80 | $15.60 | $26.00 | Long-term adoption and integration into mainstream finance; real-world asset tokenization matures. |

Price Prediction Summary

Solana (SOL) is expected to sustain its position as a leading smart contract platform, with price volatility reflecting broader crypto market cycles. Collector Crypt (CARDS), as a new but fast-growing token, may experience higher volatility but also greater upside due to its unique real-world asset (RWA) focus. Both assets are likely to benefit from increasing adoption of blockchain for collectibles, but investors should remain aware of regulatory and market risks.

Key Factors Affecting Solana Price

- Adoption of tokenized real-world assets (RWAs) and NFT-based collectibles

- Mainstream partnerships and integration with physical collectibles markets

- Regulatory clarity and evolving global crypto legislation

- Solana’s continued technical upgrades and ecosystem expansion

- Market cycles and macroeconomic conditions (e.g., post-halving cycles, global liquidity)

- Competition from other L1s and RWA/NFT platforms

- User engagement and platform innovation (e.g., Collector Crypt’s Gacha mechanics)

Disclaimer: Cryptocurrency price predictions are speculative and based on current market analysis.

Actual prices may vary significantly due to market volatility, regulatory changes, and other factors.

Always do your own research before making investment decisions.

At present, Solana itself remains robust at $232.73, supporting the ecosystem’s scalability as more collectors migrate from traditional platforms into onchain Pokémon trading (source). As more users experience seamless redemption mechanics and transparent pricing models tied directly to eBay valuations, trust in tokenized trading continues to grow.

Collector Crypt’s model is not just about digitizing assets; it’s about redefining user experience for card collectors and crypto enthusiasts alike. The platform’s instant buyback feature, where users can liquidate their Pokémon card NFTs for 85% to 90% of the eBay market value, introduces a level of liquidity that was previously unheard of in physical collectibles. This mechanism ensures that collectors can efficiently manage risk and seize opportunities without being locked into illiquid positions.

Security is paramount in the world of high-value collectibles. By vaulting the physical graded cards and recording every transaction on Solana’s fast, low-fee blockchain, Collector Crypt provides a transparent audit trail. This reassures both seasoned investors and newcomers that their assets are safe, traceable, and redeemable at any time. For collectors accustomed to the risks of counterfeits or damaged shipments, this onchain solution is a game changer.

Expanding Horizons: Beyond Pokémon to RWA Trading Cards

The success of tokenized Pokémon cards has set the stage for broader adoption across other collectible verticals. With Solana’s network handling transactions at $232.73, platforms like Collector Crypt are well positioned to expand into Magic: The Gathering, sports cards, and other high-value RWA trading cards. Each new category brings fresh communities into the fold, further increasing marketplace liquidity and network effects.

Top Benefits of Redeemable Pokémon NFTs for Collectors

-

1:1 Redeemability for Physical Cards – Each NFT on Collector Crypt corresponds directly to a securely vaulted, graded Pokémon card, allowing collectors to redeem their NFT for the real-world asset at any time.

-

Instant Liquidity via Buyback Options – The platform offers instant buyback for NFTs at 85%–90% of the card’s market value (benchmarked by platforms like eBay), providing collectors with quick and transparent exit opportunities.

-

Global, 24/7 Trading on Solana – By tokenizing cards as NFTs on the Solana blockchain, Collector Crypt enables seamless, borderless trading at any time, eliminating traditional market limitations and delays.

-

Gamified Unboxing with Legendary Gacha Machine – The platform’s digital Gacha machine offers randomized NFT packs, creating an engaging, game-like experience and boosting collector excitement—reflected in $16.6 million in weekly sales.

-

Secure Storage and Authenticity – Physical cards are professionally graded and securely vaulted, ensuring authenticity and protecting against loss or damage until redemption.

-

Transparent Market Valuation – NFT values are linked to real-time market data from sources like eBay, giving collectors confidence in fair pricing and asset value.

-

Access to a Booming Ecosystem – The native $CARDS token and integration with major NFT marketplaces (like Magic Eden and OpenSea) provide collectors with enhanced liquidity, rewards, and a rapidly growing community.

Gamification remains central to Collector Crypt’s appeal. The Gacha machine injects excitement into collecting while maintaining provable fairness, every pull is verifiable onchain. This blend of entertainment and transparency is drawing in younger demographics who might never have participated in traditional card collecting but are comfortable with digital ownership and NFT mechanics.

Challenges Ahead: Navigating Regulation and Market Volatility

No innovation comes without hurdles. As tokenized trading cards gain traction, regulatory scrutiny will intensify, especially around redemption processes and cross-border asset transfers. Platforms like Collector Crypt must continue prioritizing compliance while educating users about risks inherent to both crypto assets and physical collectibles.

Market volatility also presents challenges. While $CARDS’ surge from $67 million to over $600 million market cap reflects massive demand (source), investors should remain cautious as price discovery unfolds in these early stages. Diversification across multiple RWAs remains prudent for those looking to balance upside with risk.

Collector Crypt Solana stands as a compelling case study in how blockchain can unlock real-world value from collectibles once confined by geography or trust barriers. As more users embrace onchain Pokémon trading, expect further innovation, from fractionalization options to DeFi integrations, cementing tokenized RWAs as a core pillar of both collecting culture and digital asset investing.