Few phenomena have disrupted the collectibles market as rapidly and profoundly as the rise of tokenized Pokémon cards. What began as a niche experiment in bridging physical trading cards with blockchain technology has, by late 2025, become a multi-million dollar engine of liquidity, speculation, and global accessibility. In particular, Solana-powered platforms like Collector Crypt have transformed how collectors and investors interact with Pokémon cards, leveraging real-world asset (RWA) tokenization to create a new paradigm for ownership and trading.

Solana’s Role in the RWA Trading Card Revolution

The Solana blockchain has proven itself uniquely suited to high-volume NFT trading, and its low fees and fast transactions have made it the chain of choice for RWA trading cards. By October 2025, Collector Crypt, a Solana-based platform specializing in graded Pokémon cards, had surpassed $124.5 million in monthly trading volumes, a staggering 5.5x increase since the start of the year. This surge overtook even established DeFi exchanges like XStocks, signaling that RWA tokenization is more than a passing trend.

What sets these Solana trading card NFTs apart is their direct link to physical assets: each NFT minted on Collector Crypt represents an actual Pokémon card graded by trusted authorities such as PSA or Beckett. These cards are securely vaulted while their digital twins circulate freely on-chain, available for instant buy, sell, or trade globally. Unlike conventional NFTs that exist only digitally, these tokens offer verifiable claims on tangible collectibles, injecting newfound trust and transparency into the crypto collectibles market.

The $CARDS Token: Powering Liquidity and Marketplace Dynamics

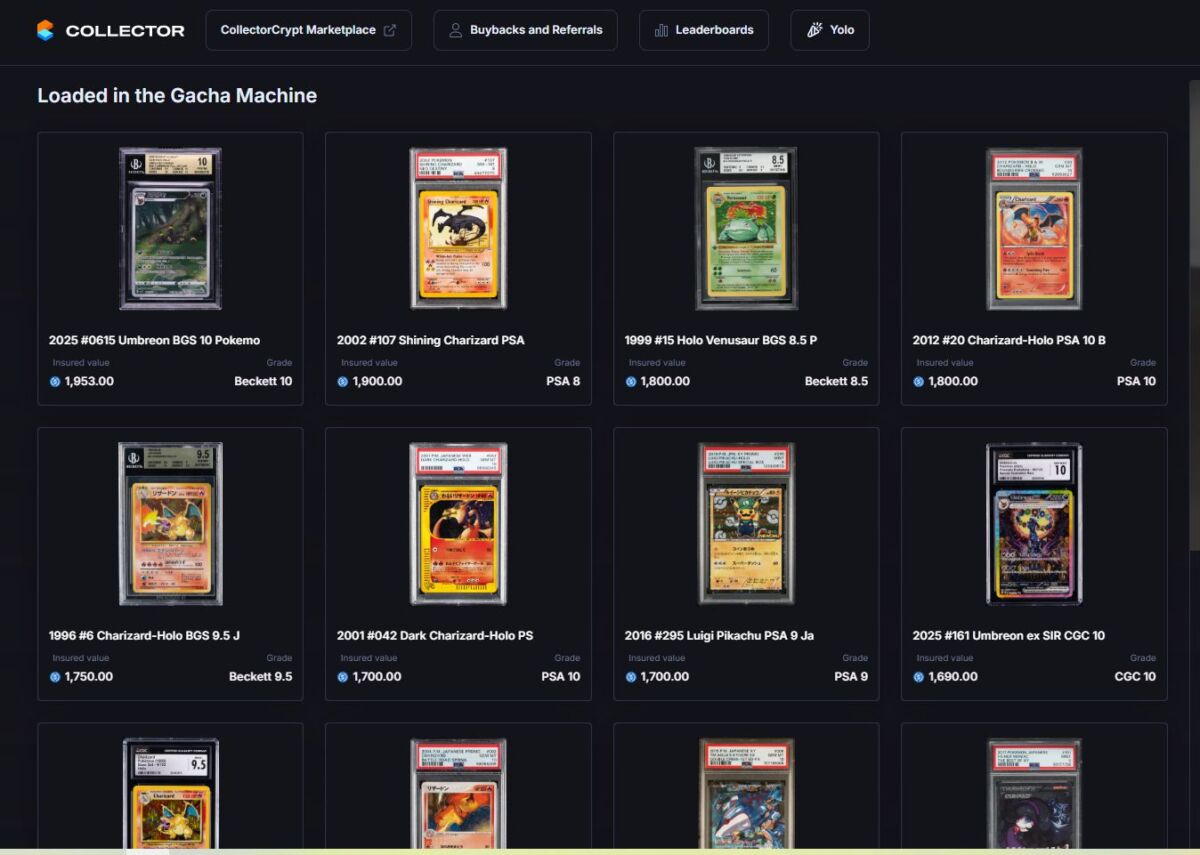

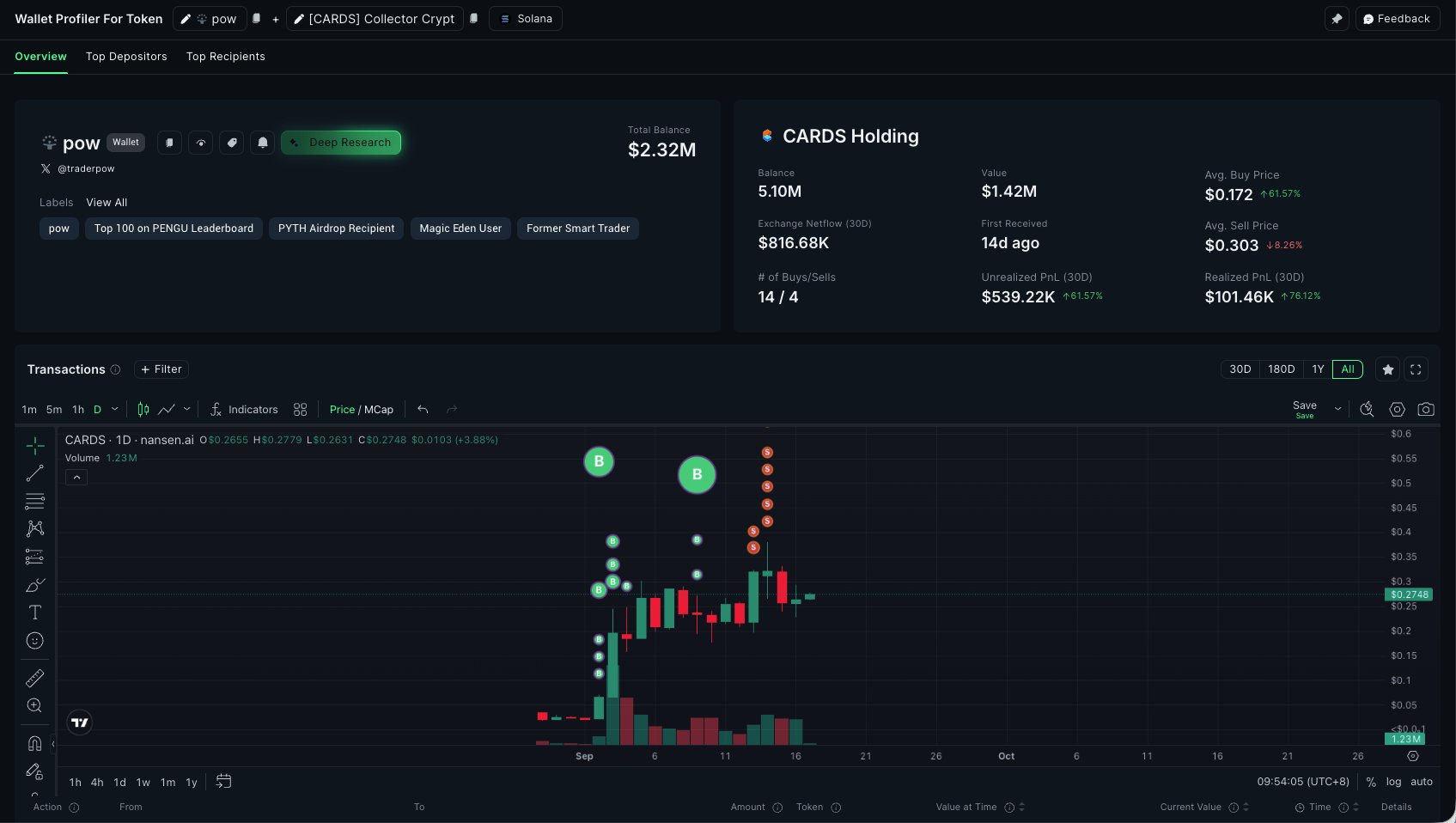

Central to this ecosystem is the $CARDS token, which currently trades at $0.223107, with recent highs at $0.300435 and lows at $0.212752. The $CARDS token underpins both Collector Crypt’s marketplace and its innovative Gacha Machine, a feature that gamifies collecting by letting users pay $SOL or $USDC for randomized NFT packs containing graded Pokémon cards valued anywhere from $30 up to over $2,000.

This Gacha system isn’t just about entertainment; it provides real-time calculation of expected value per pull and ensures instant liquidity through buyback programs that guarantee up to 90% of verified eBay resale prices. This mechanism has established a reliable price floor for rare assets, an unprecedented level of security in a space often marred by volatility.

The result? An explosion in both retail participation and institutional interest. Analyst projections now estimate annualized revenue for Collector Crypt’s marketplace at around $38 million, figures supported by surging secondary market activity and consistent demand for high-grade Pokémon card NFTs.

CARDS Token ($CARDS) Price Prediction 2026-2031

Professional outlook based on RWA adoption, platform growth, and evolving NFT market dynamics

| Year | Minimum Price | Average Price | Maximum Price | Year-over-Year Change (%) | Key Market Scenario |

|---|---|---|---|---|---|

| 2026 | $0.16 | $0.28 | $0.45 | +25% | Continued adoption, moderate regulatory clarity |

| 2027 | $0.21 | $0.37 | $0.65 | +32% | Expansion into new collectibles, improved liquidity |

| 2028 | $0.27 | $0.48 | $0.85 | +30% | Mainstream RWA trading, increased institutional interest |

| 2029 | $0.23 | $0.42 | $0.78 | -12% | Market correction, regulatory headwinds |

| 2030 | $0.30 | $0.54 | $1.12 | +29% | Global adoption, integration with physical retail |

| 2031 | $0.37 | $0.67 | $1.48 | +24% | Mature market, cross-chain interoperability |

Price Prediction Summary

The $CARDS token is positioned for significant growth as tokenized real-world assets (RWAs) and NFT-backed collectibles continue to gain traction. After initial volatility and a potential market correction, long-term trends point to steady appreciation, driven by adoption, platform innovation, and expanding use cases. However, price swings will remain pronounced due to regulatory shifts, competition, and broader crypto market cycles.

Key Factors Affecting CARDS Token Price

- Sustained growth in RWA and NFT-backed collectible trading volumes

- Platform innovation (Gacha mechanics, instant buybacks, improved user experience)

- Regulatory developments impacting tokenized assets and NFT markets

- Expansion into new physical and digital collectible categories

- Competition from other RWA and NFT platforms on Solana, Polygon, and beyond

- Market cap growth potential relative to user base and transaction volume

- Macro crypto market cycles and investor sentiment

- Resolution of IP and legal challenges in tokenizing branded collectibles

Disclaimer: Cryptocurrency price predictions are speculative and based on current market analysis.

Actual prices may vary significantly due to market volatility, regulatory changes, and other factors.

Always do your own research before making investment decisions.

Pushing Boundaries: Real-Time Trading Meets Global Collectibility

The true innovation behind RWA trading cards lies not just in digitizing collectibles but in unlocking global liquidity without sacrificing authenticity or security. On platforms like Collector Crypt, users can:

- Buy NFT packs instantly using crypto (SOL/USDC)

- Open packs for randomized graded Pokémon card NFTs

- Trade NFTs peer-to-peer or list them on secondary marketplaces like Magic Eden

- Redeem NFTs at any time for physical delivery of the actual card from secure vaults

- Access instant buybacks pegged to eBay resale values (up to 90% payout)

This seamless integration of physical provenance with digital flexibility has reinvigorated both seasoned collectors seeking liquidity and new entrants drawn by the low barrier to entry.

6-Month Price Comparison: Tokenized Pokémon Card Ecosystem vs. Major Crypto Assets

Performance of Collector Crypt ($CARDS), Solana, Polygon, and Key Crypto Assets (as of 2025-10-02)

| Asset | Current Price | 6 Months Ago | Price Change |

|---|---|---|---|

| Collector Crypt (CARDS) | $0.2240 | $0.1500 | +49.3% |

| Solana (SOL) | $227.11 | $150.00 | +51.4% |

| Polygon (MATIC) | $0.2409 | $0.2000 | +20.5% |

| Bitcoin (BTC) | $119,336.00 | $60,000.00 | +98.9% |

| Ethereum (ETH) | $4,405.35 | $3,000.00 | +46.8% |

| Tether (USDT) | $1.00 | $1.00 | +0.0% |

| Immutable X (IMX) | $0.7094 | $0.5000 | +41.9% |

Analysis Summary

Over the past six months, Collector Crypt ($CARDS) and Solana (SOL) have both posted strong gains of nearly 50%, closely tracking each other and outperforming Polygon (MATIC) and Immutable X (IMX). Bitcoin (BTC) led the market with a remarkable 98.9% increase, while Ethereum (ETH) also delivered robust growth. Stablecoins like Tether (USDT) remained stable, as expected.

Key Insights

- Collector Crypt ($CARDS) surged +49.3% in six months, reflecting strong demand for tokenized Pokémon card trading and RWA platforms.

- Solana (SOL), the blockchain underpinning Collector Crypt, outperformed $CARDS slightly with a +51.4% gain, highlighting the ecosystem’s overall momentum.

- Polygon (MATIC), home to Courtyard, saw more modest growth (+20.5%), lagging behind Solana and $CARDS in this period.

- Bitcoin (BTC) nearly doubled in value (+98.9%), setting the pace for the broader crypto market rally.

- Immutable X (IMX), another RWA/NFT infrastructure token, gained +41.9%, showing continued interest in NFT and RWA platforms.

This comparison uses real-time price data as of October 2, 2025, with 6-month historical prices sourced directly from CoinGecko and related platforms. Only verified, timestamped data was used for accuracy.

Data Sources:

- Main Asset: https://www.coingecko.com/en/coins/collector-crypt

- Solana: https://www.coingecko.com/en/coins/solana

- Polygon: https://www.coingecko.com/en/coins/polygon

- Bitcoin: https://www.coingecko.com/en/coins/bitcoin

- Ethereum: https://www.coingecko.com/en/coins/ethereum

- Tether: https://www.coingecko.com/en/coins/tether

- Immutable X: https://www.coingecko.com/en/coins/immutable-x

Disclaimer: Cryptocurrency prices are highly volatile and subject to market fluctuations. The data presented is for informational purposes only and should not be considered as investment advice. Always do your own research before making investment decisions.

[technical_chart: Technical analysis chart showing recent price action of $CARDS token against SOL]

Navigating Risks Alongside Opportunity

No market innovation comes without friction points. Intellectual property rights remain a live issue as platforms navigate licensing boundaries; regulatory clarity lags behind technological progress; redemption processes must guarantee both speed and security; liquidity risks persist despite robust buyback systems. Yet these challenges are being met head-on, often transparently discussed within collector communities, and are shaping best practices across the industry.

If you’re eager to explore how these dynamics are rewriting the rules of collectible investing, and why Solana is emerging as an RWA powerhouse, see our deep dive at How Tokenized Pokémon Cards on Solana Are Changing The Collectibles Market.

As the market matures, the convergence of blockchain transparency and traditional collecting has triggered a fundamental shift in how value is perceived and realized. The days of opaque pricing, slow peer-to-peer trades, and regional constraints are rapidly receding. Instead, tokenized Pokémon cards on Solana now offer real-time price discovery, cross-border accessibility, and verifiable ownership, all underpinned by the immutable ledger of the blockchain.

Key Benefits of Tokenized Pokémon Cards for Collectors & Investors

-

Instant Global Liquidity: Tokenized Pokémon cards on platforms like Collector Crypt enable collectors and investors to buy, sell, or trade cards instantly with participants worldwide, overcoming the traditional illiquidity of physical collectibles.

-

Real Asset Backing & Verifiable Grading: Each NFT is directly backed by a physical, graded Pokémon card (from PSA, Beckett, or CGC), securely vaulted and redeemable, ensuring authenticity and tangible value for every tokenized asset.

-

Transparent Pricing & Instant Buybacks: With features like real-time expected value calculations and 90% instant buybacks based on verified resale prices (e.g., eBay), platforms such as Collector Crypt provide price transparency and a safety net for sellers.

-

Enhanced Accessibility & Lower Entry Barriers: Tokenization allows users to participate in the Pokémon card market with as little as $50 USDC per pull, making high-value collectibles accessible to a broader audience without the need for large upfront capital or specialized knowledge.

-

Gamified Experience with Gacha Mechanics: The Gacha Machine on Collector Crypt merges the excitement of random pack openings with blockchain transparency, letting users open NFT packs for a chance at cards valued from $30 to over $2,000.

-

Market Growth & Revenue Potential: The surge to $124.5 million in monthly trading volume (as of August–September 2025) and projected $38 million in annualized revenue for Collector Crypt highlight the robust growth and investment potential of tokenized Pokémon cards.

-

Utility Token Integration: The $CARDS token (currently $0.2231 per token) powers marketplace transactions, Gacha pulls, and incentivizes participation, aligning the interests of collectors, investors, and platform stakeholders.

One of the most compelling aspects of this new paradigm is its democratizing effect. Collectors who once faced daunting hurdles, such as high shipping costs, authentication anxiety, or limited access to rare cards, can now participate with unprecedented ease. The integration of features like instant buybacks at up to 90% of eBay resale value provides not just liquidity but also a safety net that is rare in speculative markets. This model has proven especially attractive to both retail participants seeking quick entry and exit points, as well as institutional players interested in exposure to alternative assets.

The gamified Gacha experience further fuels engagement. With each $50 USDC pull offering a chance at cards valued from $30 to over $2,000, and real-time expected value calculations, Collector Crypt has succeeded in merging the thrill of pack opening with the rigor of financial transparency. This blend appeals to both nostalgia-driven collectors and ROI-focused investors alike.

The Road Ahead: What’s Next for RWA Trading Cards?

Looking forward, the trajectory for RWA trading cards appears robust yet nuanced. The current trading volume surge, now at $124.5 million monthly, is likely only a harbinger for broader adoption across other collectible verticals, from Magic: The Gathering to sports memorabilia. As regulatory frameworks begin to catch up with technological innovation, expect greater mainstream acceptance and potentially new models for fractional ownership or automated royalty payments.

However, vigilance remains warranted. The sector’s rapid growth could invite increased scrutiny from intellectual property holders or regulators seeking to define what constitutes a security versus a collectible NFT. Meanwhile, platforms must continue investing in secure vaulting solutions and transparent redemption protocols to maintain user trust.

Ultimately, what sets this movement apart is its ability to balance speculative excitement with real-world utility, a rare feat in crypto markets historically defined by hype cycles rather than fundamentals. For those willing to engage thoughtfully with both risks and rewards, tokenized Pokémon cards may represent not just a passing trend but a durable evolution in how we collect, trade, and invest in culture itself.