In the ever-evolving landscape of blockchain innovation, few stories capture the zeitgeist quite like the rise of Solana RWA collectibles. The last year has seen a remarkable shift: what was once a niche pursuit for hobbyists, collecting Pokémon and Magic cards, has become a global experiment in tokenized ownership. At the heart of this transformation is Solana, whose high throughput and minimal transaction costs have made it an epicenter for trading card NFTs and other tokenized assets.

Solana’s Surge: Tokenized Collectibles Outpace DEX Volumes

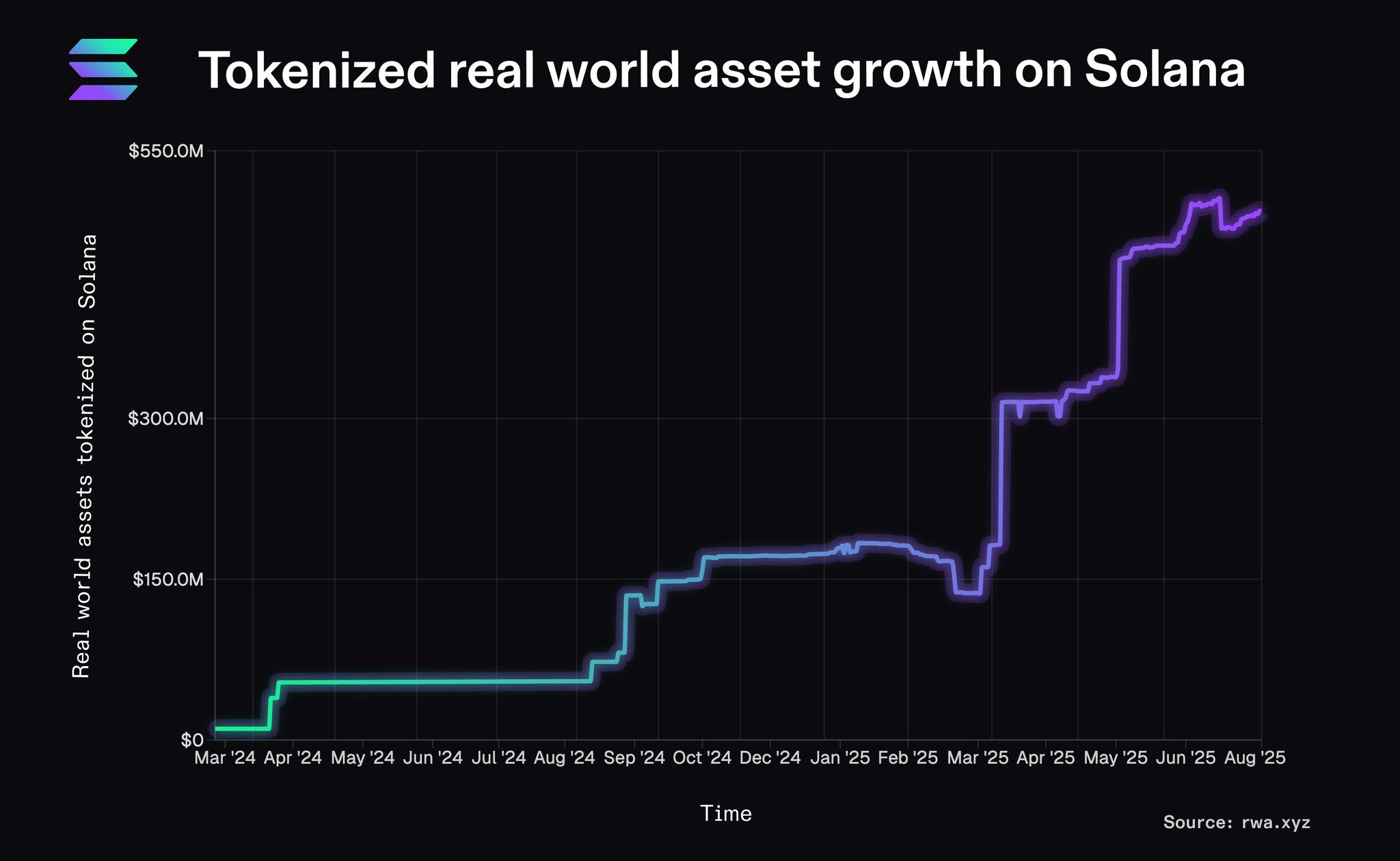

2025 has been a watershed year for Solana tokenized assets. According to recent data, the Solana RWA market has surged to over $550 million, a staggering 217% increase year-to-date. This growth not only positions Solana as a serious rival to Ethereum’s dominance in real-world asset tokenization but also signals a broader maturation of blockchain-based collectibles. Platforms like Glimmer Finance are leading this charge by bridging traditional finance and Web3, enabling fractional ownership and liquid markets for everything from real estate to rare trading cards (source).

The numbers tell a compelling story. Collector Crypt, an emerging marketplace on Solana, saw $44 million in trading volume last month, driven largely by tokenized Pokémon card trades. In August 2025 alone, platforms like Collector Crypt and Courtyard. io (on Polygon) enabled over $124 million in trades, eclipsing volumes on some decentralized exchanges (source). The platform’s native token, $CARDS, soared nearly tenfold in three days, evidence of both speculative fervor and genuine demand.

“The future will be tokenized, ” declared the Solana Foundation as Pokémon cards became consumer-grade on-chain assets rather than offline curiosities.

Pushing Boundaries: How Pokémon Cards Became Blockchain Blue Chips

The transformation is more than just financial, it’s cultural. For decades, Pokémon cards lived in binders and safe-deposit boxes. Today, they are minted as NFTs on Solana, each representing authenticated claims to physical cards held in secure vaults. This process not only guarantees provenance but also enables instant global trading without the friction of shipping or counterparty risk.

This new breed of Solana blockchain collectibles is attracting both seasoned collectors and digital-native investors. Weekly trading volumes for tokenized Pokémon cards now exceed $10 million, with randomized “pack pulls” echoing the thrill of opening physical booster packs, only now with blockchain transparency and liquidity (source). The gamification element is unmistakable; platforms allow users to pull rare digital cards that can be instantly traded or redeemed for their real-world counterparts.

The Technical Edge: Why Solana Is Winning the RWA Race

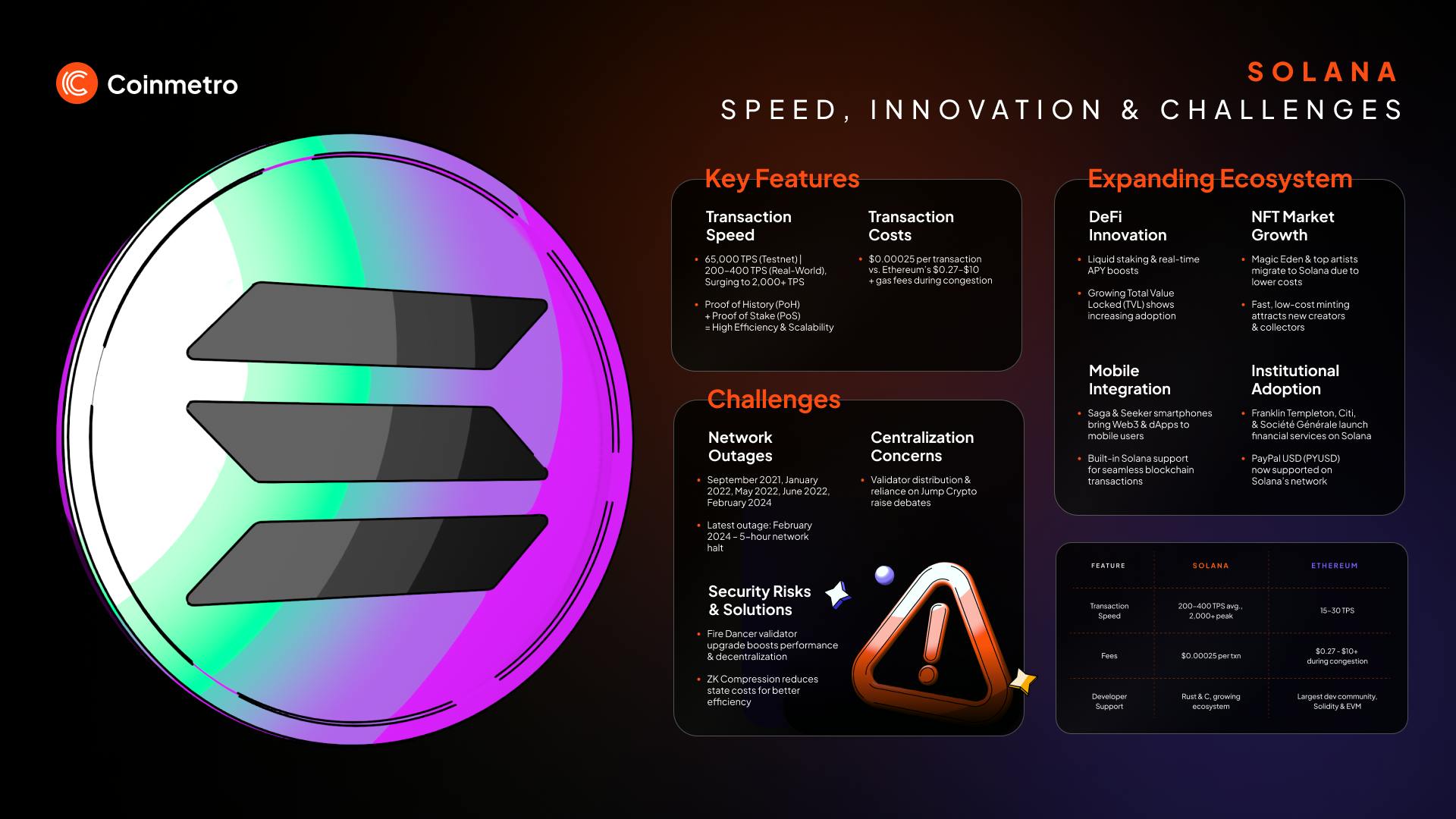

The technical foundation matters as much as market momentum. With its lightning-fast block times and near-zero fees, Solana offers an ideal substrate for high-frequency collectible trading, something Ethereum’s congestion-prone mainnet struggles to match. For projects like tcgonchain. com and Collector Crypt, this means users can mint, trade, or redeem NFTs representing physical assets without worrying about prohibitive gas costs or slow confirmations.

This isn’t just theory; it’s playing out live every day as collectors from Tokyo to Toronto participate in auctions or instant swaps using nothing more than their crypto wallets. As more trillion-dollar intellectual property, from sports memorabilia to luxury watches, explores going on-chain, Solana’s reputation as an RWA hub appears set to grow even further.

Solana (SOL) Price Prediction 2026-2031

Forecasts are based on Solana’s leading role in the RWA collectible sector, technical analysis, and evolving market dynamics as of Q4 2025.

| Year | Minimum Price (Bearish Scenario) | Average Price | Maximum Price (Bullish Scenario) | Estimated YoY Change (Avg) | Market Scenario Insight |

|---|---|---|---|---|---|

| 2026 | $190.00 | $265.00 | $350.00 | +12% | Consolidation after strong RWA-driven growth; potential for increased institutional adoption |

| 2027 | $210.00 | $320.00 | $420.00 | +21% | New RWA platforms launch; regulatory clarity boosts confidence |

| 2028 | $250.00 | $390.00 | $520.00 | +22% | Mainstream adoption of tokenized collectibles; interoperability upgrades |

| 2029 | $280.00 | $460.00 | $620.00 | +18% | Global RWA standards emerge; Solana maintains tech leadership |

| 2030 | $320.00 | $530.00 | $720.00 | +15% | Wider adoption in real estate and luxury markets; competition from other chains |

| 2031 | $350.00 | $590.00 | $800.00 | +11% | RWA market matures; Solana faces scaling challenges, but ecosystem remains robust |

Price Prediction Summary

Solana is positioned for sustained growth through 2031, driven by its dominance in RWA collectibles, rapid ecosystem innovation, and increasing mainstream adoption. While short-term volatility is expected, especially in bearish macro scenarios, the long-term trend remains positive with significant price appreciation potential. Min/max ranges reflect both conservative and optimistic market conditions.

Key Factors Affecting Solana Price

- Explosive growth in RWA collectible tokenization (e.g., Pokémon cards) on Solana

- Expansion of marketplaces like Glimmer Finance and Collector Crypt

- Solana’s high throughput and low transaction fees attract new projects

- Regulatory developments affecting tokenized assets globally

- Increasing competition from Ethereum, Polygon, and emerging L1s

- Potential for mainstream adoption of RWA platforms

- Market cycles, macroeconomic trends, and investor sentiment

- Ongoing technical upgrades and network scalability improvements

Disclaimer: Cryptocurrency price predictions are speculative and based on current market analysis.

Actual prices may vary significantly due to market volatility, regulatory changes, and other factors.

Always do your own research before making investment decisions.

Yet the story of Solana RWA collectibles is not simply a tale of technology and trading volumes. It’s a case study in how centuries-old collecting habits are being reimagined for a borderless, digital world. The move from physical to tokenized assets has unlocked new forms of participation: fractional ownership, global liquidity, and verifiable scarcity, features that were either impossible or prohibitively expensive in traditional markets.

Consider the collector who once faced logistical headaches shipping a rare Charizard card across continents. Now, with Solana trading card NFTs, ownership can change hands in seconds, verified by smart contracts and backed by transparent custody solutions. This shift is democratizing access to premium collectibles, inviting not just the wealthy or well-connected but anyone with an internet connection and a wallet.

Emerging Trends: Gamification, Community, and the Rise of Solana tcgonchain

The integration of gamification mechanics: randomized pack pulls, quests, and reward systems, has fueled engagement across platforms like Collector Crypt and tcgonchain. com. These features echo the tactile excitement of opening booster packs while leveraging blockchain’s transparency to assure fairness. The result is a hybrid experience that appeals to both traditional collectors and crypto-native speculators.

Key Trends Fueling Solana RWA Collectibles Adoption

-

Tokenized Pokémon Cards Drive Trading Volume: Platforms like Collector Crypt have made Pokémon cards tradable as on-chain assets, with weekly volumes surpassing $10 million. This signals a shift from niche collecting to mainstream digital asset trading.

-

Rapid Market Growth and Liquidity: The Solana RWA market surged to over $550 million in 2025, a 217% year-to-date increase, fueled by collectible tokenization and rising investor demand for liquid, fractionalized assets.

-

Emergence of Specialized Marketplaces: Innovative platforms like Glimmer Finance are building dedicated RWA marketplaces on Solana, bridging traditional finance and Web3 by enabling seamless conversion and trading of real-world collectibles.

-

Technical Advantages of Solana: Solana’s high throughput, near-zero transaction fees, and robust developer ecosystem make it a preferred blockchain for RWA collectible projects, supporting large-scale tokenization and trading.

-

Tokenization of Trillion-Dollar IP Assets: The movement of globally recognized intellectual property, such as Pokémon, to on-chain formats is establishing Solana as a hub for tokenizing high-value, real-world collectibles.

Community has become central to this movement. Discord channels buzz with live pack openings and trade negotiations; DAOs (decentralized autonomous organizations) are forming around rare sets or themes; governance tokens give collectors real influence over platform development. The lines between investor, fan, and creator are blurring as never before.

Risks and Opportunities: Navigating the New Frontier

No market transformation comes without risk. The rapid ascent of tokenized Pokémon cards on Solana has drawn opportunists as well as genuine collectors. Price volatility remains high, witness $CARDS’ 460% surge in a single day, and regulatory clarity around NFT-backed RWAs is still evolving.

However, these challenges are not insurmountable. As standards for authentication improve and custody solutions mature, confidence in Solana blockchain collectibles will likely deepen. Platforms like tcgonchain. com are pioneering best practices in transparency and security, a necessary step if this market is to sustain its explosive growth.

The macro backdrop also favors continued expansion. As more intellectual property holders explore tokenization, be it for sports cards, luxury goods, or fine art, the playbook written by Pokémon cards may soon be applied across countless verticals.

Looking Forward: Solana’s Place in the Collectibles Renaissance

Today’s $237.99 SOL price, despite modest 24-hour fluctuations (-0.0289% at last check), reflects both speculative activity and growing utility within the ecosystem (source). If history rhymes, as it so often does, the fusion of nostalgia-fueled collecting with cutting-edge financial rails could mark just the beginning for Solana tokenized assets.

The question for investors and enthusiasts alike isn’t whether trading card RWAs will endure, but how far this model can stretch as new assets come online. For now, Solana stands at the crossroads of culture and capital markets, a proving ground where yesterday’s hobbies become tomorrow’s investable assets.