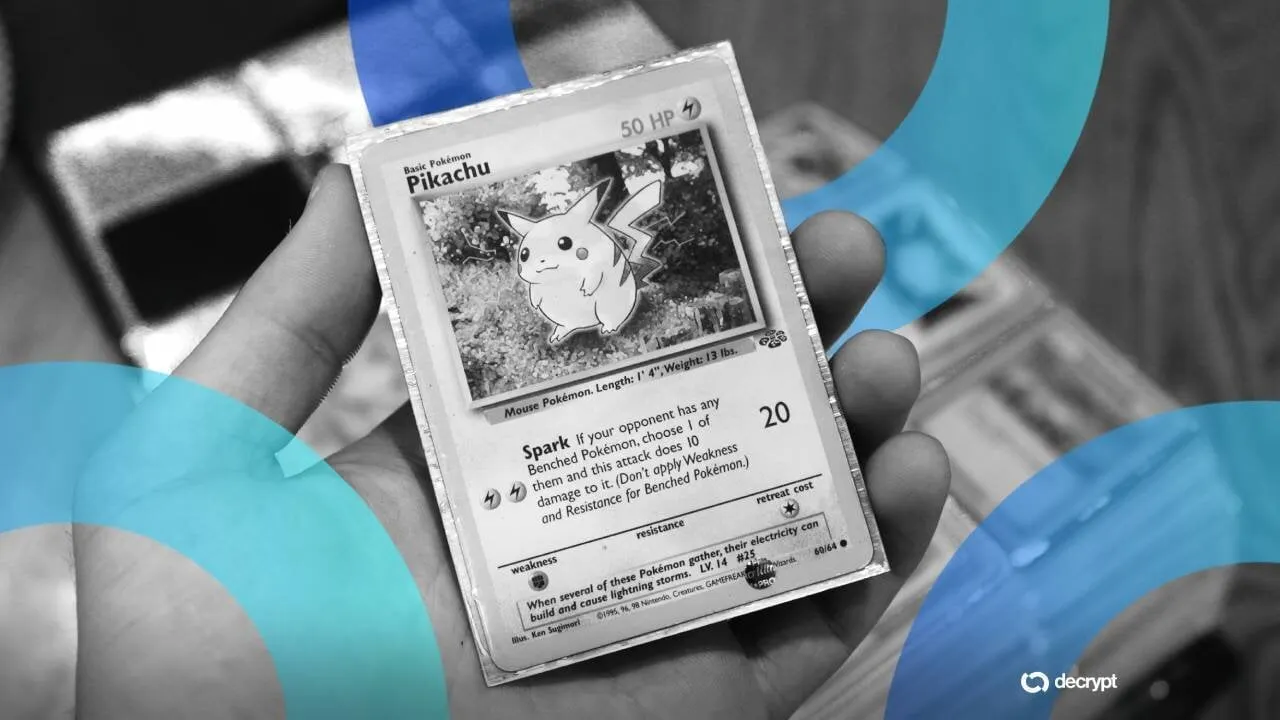

In the rapidly evolving world of trading card collectibles, a new paradigm is emerging: the seamless fusion of RFID trading card NFT technology and physical authentication. This innovation is fundamentally transforming how collectors authenticate, trade, and invest in real-world assets (RWAs) like Pokémon cards and Magic: The Gathering. By integrating RFID (Radio Frequency Identification) and NFC (Near Field Communication) chips into physical cards, platforms can securely link tangible collectibles to blockchain-based NFTs. This approach not only guarantees authenticity but also enables instant ownership verification, streamlined trading, and robust protection against counterfeiting.

How RFID and NFC Technologies Secure Physical Trading Cards

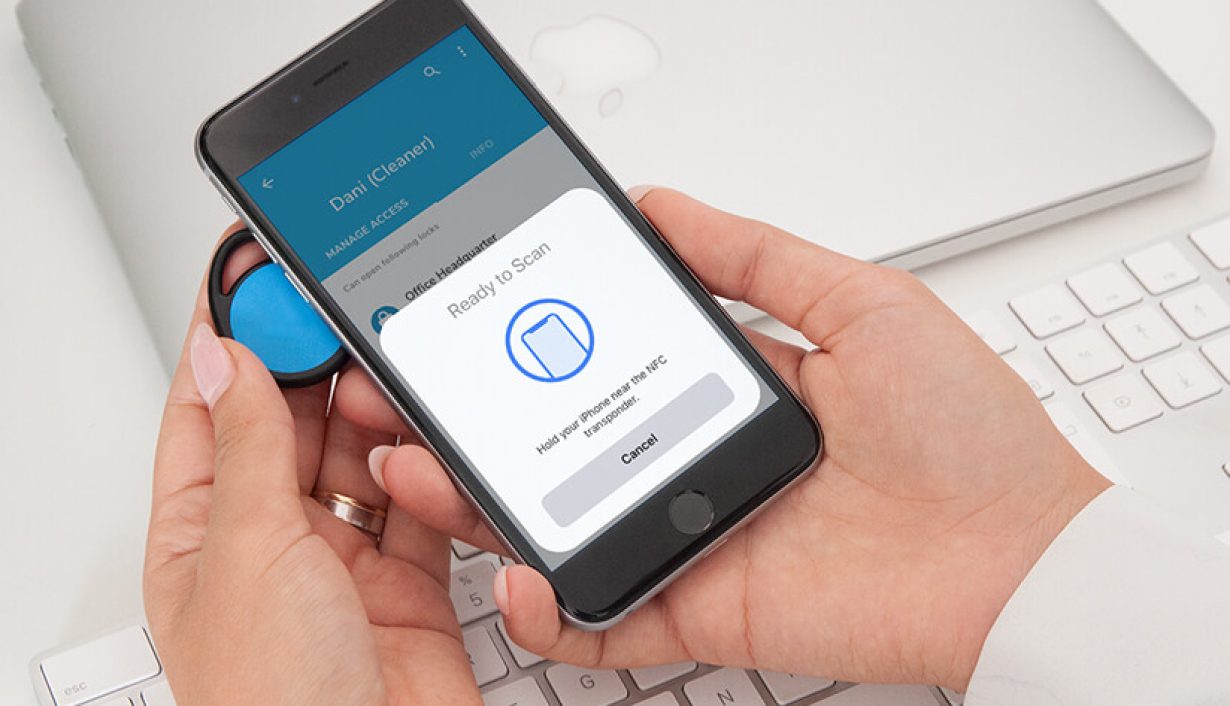

At the heart of this revolution are RFID and NFC chips discreetly embedded within collectible cards. When scanned by an NFC-enabled device, these chips transmit unique identification data that is instantly cross-verified on the blockchain. For example, PhygiCards employs this technology to enable real-time authentication; a simple tap with your phone provides irrefutable proof of both authenticity and current ownership status via immutable blockchain records (source). Collectors Universe has similarly adopted NFC tagging for coins and banknotes, offering tamper-evident solutions that make forgery virtually impossible (source).

This technological leap addresses long-standing challenges in the hobby: provenance tracking, fraud prevention, and trustless transactions. With every scan logged on-chain, buyers can trace a card’s full history from grading to vaulting to transfer, eliminating ambiguity around condition or legitimacy.

NFT Integration: Bridging Physical Assets with Blockchain Ownership

The next layer of security comes from tokenizing these authenticated cards as NFTs, a process that makes each physical item digitally tradable on global marketplaces. Platforms like Card Rival have pioneered this model: after authenticating and grading cards, they store them in secure vaults while minting corresponding NFTs on blockchains such as WAX (source). These NFTs are not mere digital images; they represent legal claims to the actual physical asset held in custody.

This system unlocks unprecedented liquidity for collectors and investors. Instead of shipping fragile cards across continents or navigating cumbersome escrow services, users can instantly buy or sell NFT representations, redeeming them for the underlying physical card at any time. Holos further extends this model by partnering with Japanese shops to source inventory directly from trusted local stores (source). The result is a frictionless ecosystem where secure trading card NFT transactions occur with confidence.

Key Benefits of RFID-Secured Trading Card NFTs

-

Unmatched Authenticity: RFID and NFC chips embedded in physical trading cards—such as PhygiCards—enable instant, tamper-proof authentication. Scanning the card verifies its legitimacy on the blockchain, protecting collectors from counterfeits.

-

Seamless Ownership Verification: Platforms like Card Rival securely store authenticated cards and issue NFTs on the WAX blockchain, allowing collectors to verify and transfer ownership instantly with full transparency.

-

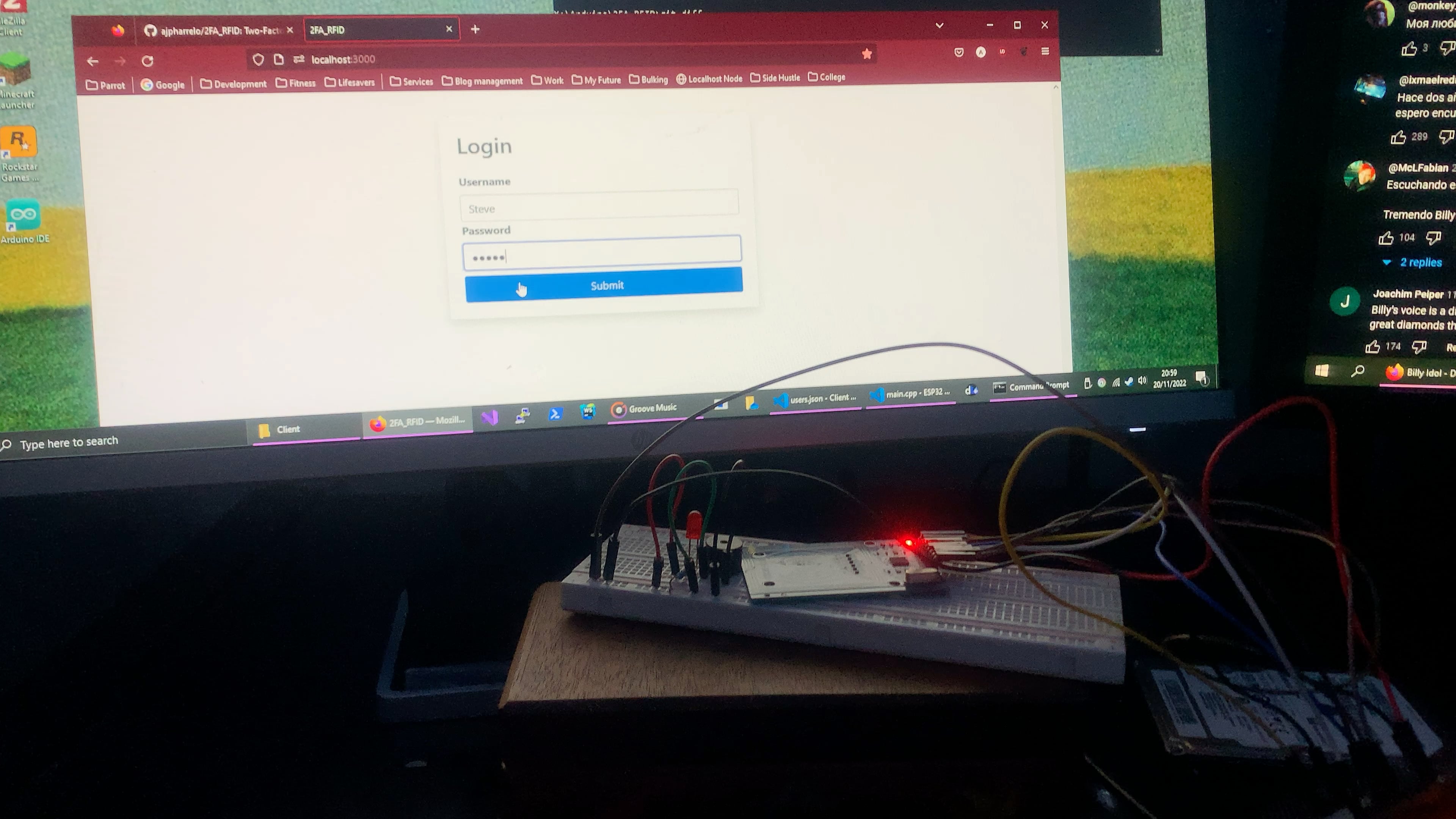

Enhanced Security with Two-Factor Authentication: Advanced protocols such as RF-Rhythm add an extra layer of protection by requiring specific tap sequences on RFID cards, significantly reducing the risk of unauthorized access or fraud.

-

Efficient and Flexible Trading: Tokenized trading cards on platforms like Holos can be traded instantly as NFTs, with the option to redeem for the physical card—bridging digital liquidity with real-world assets.

-

Transparent Grading and Provenance: Organizations such as Collectors Universe use NFC tags to link collectibles to their grading and ownership records, ensuring a verifiable chain of custody and value for each card.

Advanced Security Protocols for RWA NFT Authentication

The sophistication does not end at chip-level verification. Emerging protocols like RF-Rhythm add two-factor authentication for even greater resilience against unauthorized access (source). Here, users must perform specific tap sequences on their RFID-enabled cards, akin to entering a PIN, before any transfer or redemption is permitted. This adds another barrier for would-be attackers attempting to spoof or tamper with valuable collectibles.

Such layered security measures are crucial as tokenized RWAs gain traction among both hobbyists and institutional investors seeking exposure to alternative assets. As of September 20,2025, APENFT (NFT), a leading player in the space, trades at $0.000000441093, reflecting steady interest in blockchain-powered asset authentication despite minor daily fluctuations (-0.00399%). (All price references reflect current market data. )

Adoption of physical authentication RWA methods is not merely a technical upgrade; it marks a philosophical shift in how value, trust, and provenance are established within the collectibles market. Where once collectors relied on subjective grading and opaque supply chains, today’s blockchain-backed systems offer transparency and permanence. Every transaction, scan, or ownership transfer is immutably recorded, creating an auditable trail that is virtually impossible to forge or erase. This robust record-keeping is particularly vital as rare cards reach unprecedented valuations and attract global attention.

The integration of RFID-embedded cards with NFT platforms also democratizes access to high-value collectibles. Fractionalization becomes possible: owners can divide a single rare card into multiple NFT shares, allowing enthusiasts to invest in blue-chip Pokémon or Magic cards without needing the full capital outlay. As more platforms embrace these innovations, we are witnessing a new era where collectibles operate as both passion-driven artifacts and highly liquid financial instruments.

Challenges and the Road Ahead for Secure Trading Card NFTs

Despite remarkable progress in RWA NFT security, several hurdles remain. Standardizing RFID/NFC implementation across brands and grading agencies is essential for interoperability. Additionally, ensuring that vaulting services are trustworthy and insured against loss or damage remains a top concern for investors who entrust their prized assets to third parties.

Community education will be pivotal. Many collectors are still unfamiliar with how blockchain authentication works or why physical-digital linkage matters. User-friendly interfaces and transparent documentation can help bridge this gap, empowering more participants to benefit from secure trading card NFTs without technical intimidation.

Key Benefits of RFID-Secured Trading Card NFTs

-

Unmatched Authenticity Verification: RFID and NFC chips embedded in trading cards, as used by PhygiCards, allow collectors to instantly verify the authenticity and provenance of each card via blockchain records, eliminating counterfeiting risks.

-

Secure, Tamper-Evident Grading: Collectors Universe leverages NFC tags to authenticate and grade collectibles, providing a tamper-evident seal and enabling instant grading verification with a smartphone app.

-

Instant, Flexible Trading via NFTs: Platforms like Card Rival tokenize authenticated physical cards as NFTs on the WAX blockchain, allowing collectors to trade digital representations instantly while retaining the option to redeem for the physical card.

-

Seamless Physical-Digital Integration: Holos partners with card shops to store authenticated cards and issue NFTs, enabling users to securely trade or redeem for the physical item, bridging the gap between digital and tangible ownership.

-

Advanced Two-Factor Authentication: Security protocols like RF-Rhythm introduce two-factor tap authentication for RFID cards, adding an extra layer of protection against unauthorized access and enhancing trust in NFT-backed assets.

The regulatory landscape also continues to evolve. As tokenized RWAs gain popularity, governments and financial authorities may introduce new compliance requirements around asset custody, anti-money laundering measures, and consumer protection. Platforms that proactively address these issues will be best positioned to earn user trust in an increasingly scrutinized market.

Why Blockchain-Based Authentication Is Here to Stay

The fusion of RFID technology with blockchain-based NFTs brings a level of trustworthiness previously unattainable in the collectibles sector. For the first time, collectors can verify not only that their card is genuine but also trace its journey from pack opening to present ownership, no matter how many hands it has passed through.

This paradigm shift boosts confidence in secondary markets and paves the way for entirely new business models around lending, insurance, and even game integration using authenticated assets as verifiable collateral or in-game items.

Current Market Data: APENFT (NFT) Holds Steady at $0.000000441093

APENFT (NFT) Price Prediction 2026–2031

Professional forecast based on integration of RFID, NFC, and real-world asset tokenization trends

| Year | Minimum Price | Average Price | Maximum Price | Year-over-Year % Change (Avg) | Market Scenario Insights |

|---|---|---|---|---|---|

| 2026 | $0.00000038 | $0.00000052 | $0.00000075 | +17% | Base scenario: Gradual NFT adoption in RWA; moderate volatility |

| 2027 | $0.00000044 | $0.00000062 | $0.00000110 | +19% | Bullish scenario: Wider acceptance of NFT-backed RWAs, more trading card platforms |

| 2028 | $0.00000053 | $0.00000077 | $0.00000160 | +24% | Increased institutional involvement; improved regulatory clarity |

| 2029 | $0.00000062 | $0.00000094 | $0.00000220 | +22% | Technology improvements in RFID/NFC drive new use cases |

| 2030 | $0.00000073 | $0.00000113 | $0.00000295 | +20% | Mainstream adoption of tokenized collectibles; higher liquidity |

| 2031 | $0.00000087 | $0.00000135 | $0.00000390 | +19% | Peak integration with physical authentication; global competition intensifies |

Price Prediction Summary

APENFT is projected to see steady growth as NFT-based authentication and real-world asset tokenization gain traction, particularly in the trading card and collectibles market. New applications of RFID and NFC, along with rising mainstream adoption, could fuel price appreciation, while competition and regulatory challenges may temper extremes.

Key Factors Affecting APENFT Price

- Adoption of NFT-backed real-world assets, especially in collectibles and trading cards

- Advancements in RFID and NFC authentication technology

- Broader regulatory clarity on digital asset ownership and trading

- Increased institutional and platform-level participation

- Potential competition from specialized RWA tokenization blockchains

- Market sentiment toward NFTs and digital collectibles

- Macro crypto market cycles and investor risk appetite

Disclaimer: Cryptocurrency price predictions are speculative and based on current market analysis.

Actual prices may vary significantly due to market volatility, regulatory changes, and other factors.

Always do your own research before making investment decisions.

The current APENFT (NFT) price stands at $0.000000441093, reflecting ongoing interest in secure digital asset solutions linked to real-world collectibles. This stability underscores growing confidence among both retail collectors and institutional players seeking exposure to tokenized RWAs.

As we look ahead, continued innovation in authentic trading card blockchain technology promises not just enhanced security but an expanded universe of opportunity, where every scan unlocks both peace of mind and new possibilities for collectors worldwide.