Trading card collecting is experiencing a profound transformation as blockchain technology enables the tokenization of physical assets, such as Pokémon and Magic: The Gathering cards. Investors now have access to a new class of real-world asset (RWA) trading card investment opportunities, combining the tangibility of collectibles with the liquidity and transparency of digital markets. As the tokenized trading card market reached $87.2M in capitalization and continues to grow, understanding how to systematically build and manage a digital card portfolio is crucial for maximizing returns and mitigating risk.

Understanding Tokenized Trading Cards as RWAs

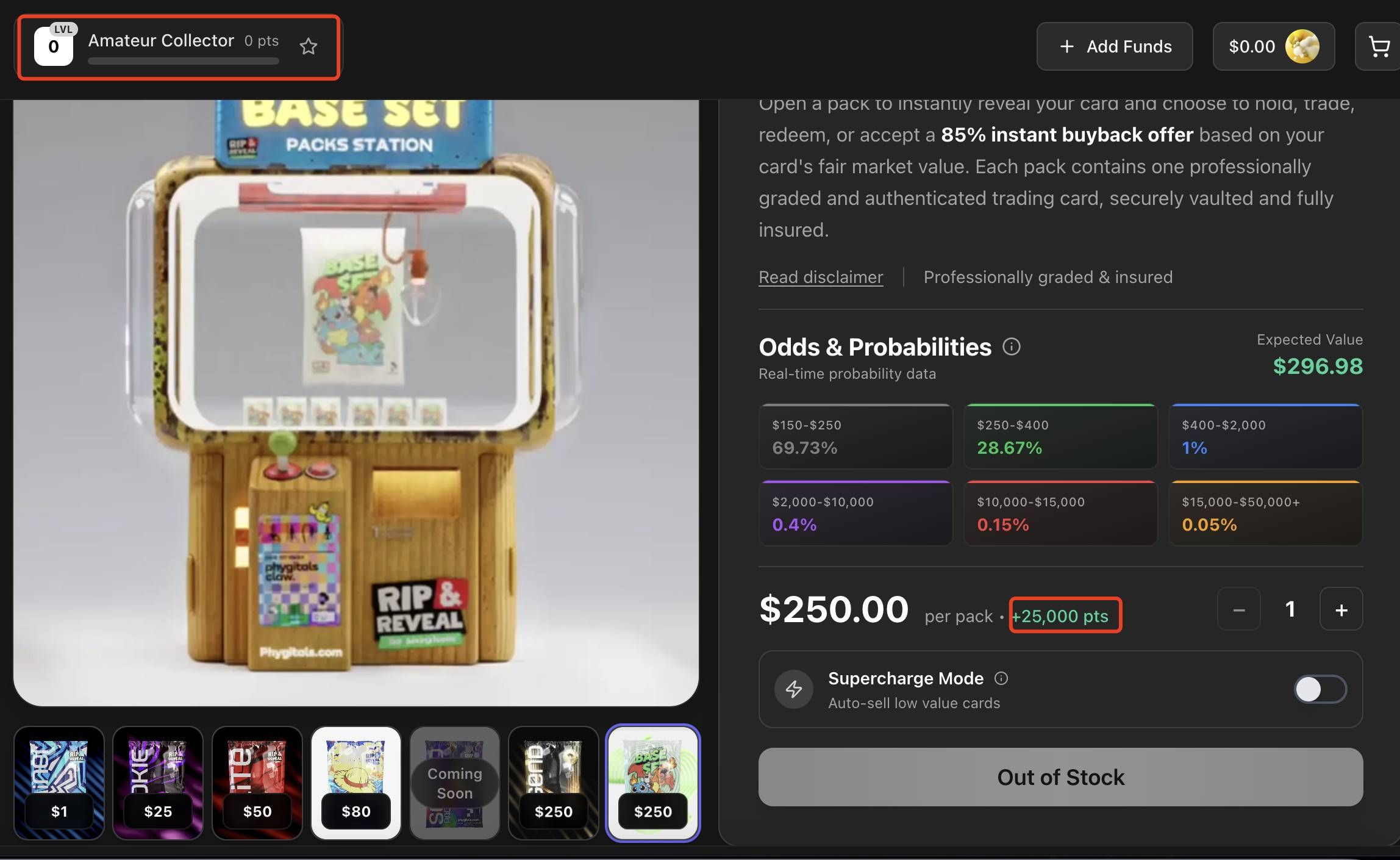

Tokenized trading cards represent physical collectibles on the blockchain through NFTs (non-fungible tokens), providing investors with verifiable ownership, enhanced liquidity, and global accessibility. Platforms like Collector Crypt and Courtyard have pioneered this approach, allowing users to buy fractions of rare cards or entire portfolios without geographic or logistical barriers. However, as with any emerging asset class, success hinges on following disciplined strategies tailored to this unique intersection of collectibles and crypto.

Five Essential Strategies for Building a Digital Card Portfolio

Top 5 Strategies for RWA Trading Card Investing

-

Prioritize Tokenized Cards with Verified Authenticity and ProvenanceChoose trading cards that have been tokenized by reputable platforms like Courtyard or Collector Crypt, which use blockchain records to verify authenticity and track provenance. This reduces fraud risk and enhances long-term value.

-

Diversify Across Card Games, Editions, and Rarity TiersBuild a resilient portfolio by investing in multiple card games (e.g., Pokémon, Magic: The Gathering), various editions, and different rarity levels. Diversification helps manage risk and capitalize on trends across the collectible card market.

-

Leverage Fractional Ownership to Access High-Value AssetsUtilize fractionalization platforms like Courtyard to buy and trade shares of high-value cards. This approach enables exposure to premium assets without requiring full purchase, broadening access for all investors.

-

Utilize NFT-Based Staking and Yield Opportunities for Enhanced ReturnsExplore NFT staking platforms like Binance NFT or Fracton Protocol that offer yield opportunities for holding or staking tokenized cards, providing potential passive income in addition to asset appreciation.

1. Prioritize Tokenized Cards with Verified Authenticity and Provenance

One of the greatest risks in collectible markets is counterfeiting or misrepresented provenance. Blockchain’s immutable ledger addresses this by recording each card’s history from grading to storage location. When investing in tokenized cards, always select platforms that offer robust authentication processes – ideally involving third-party grading services or on-chain verification tools. Verified provenance not only protects your capital but can also command higher resale values as trust becomes increasingly important in digital markets.

2. Diversify Across Card Games, Editions, and Rarity Tiers

A well-constructed digital card portfolio mirrors traditional portfolio management principles: diversification reduces unsystematic risk. Instead of concentrating solely on one franchise (e. g. , only Pokémon), consider allocating across multiple games such as Magic: The Gathering or Yu-Gi-Oh!, various editions (base set vs modern releases), and different rarity tiers (common through ultra-rare). This approach balances exposure to market trends while capturing upside from niche segments that may outperform during specific cycles.

3. Leverage Fractional Ownership to Access High-Value Assets

The emergence of fractional ownership via NFT technology means investors are no longer limited by high entry costs for premium cards like 1st Edition Charizard or Black Lotus. By purchasing fractional shares in these assets, you gain exposure to their price appreciation without needing full capital outlay – democratizing access while improving overall portfolio liquidity. Platforms facilitating fractionalization often provide transparent reporting on share distribution and current valuations.

4. Monitor On-Chain Trading Volumes and Marketplaces for Liquidity Trends

Liquidity is a defining advantage of tokenized assets, but not all digital card markets are equally active. Consistently tracking on-chain trading volumes helps investors identify which cards and platforms maintain strong secondary market demand, an essential factor if you plan to rebalance or exit positions efficiently. Analyze transaction histories, bid-ask spreads, and recent sales velocity on leading marketplaces. This data-driven approach ensures you avoid illiquid assets that could trap capital or force unfavorable sales in thin markets.

5. Utilize NFT-Based Staking and Yield Opportunities for Enhanced Returns

Innovative DeFi protocols now allow NFT holders to stake their tokenized trading cards, earning yield or rewards in native platform tokens. While these mechanisms introduce additional smart contract risk, they can also boost your portfolio’s risk-adjusted returns if approached judiciously. Evaluate the terms, lock-up periods, and historical yields before participating, and always consider staking only a portion of your holdings to maintain flexibility. As the ecosystem matures, expect more sophisticated options for passive income from blue-chip collectibles.

By systematically applying these five strategies – authenticity verification, diversification, fractional ownership, liquidity monitoring, and NFT-based yield optimization – investors can build robust digital card portfolios that capture both the cultural value of collectibles and the efficiency of blockchain finance.

The intersection of RWAs and blockchain is rapidly evolving. As regulatory clarity improves and more institutional-grade platforms emerge, the potential for trading card NFTs as an investable asset class will only grow stronger. For those willing to embrace disciplined research and leverage new tools, RWA trading card investment offers an exciting frontier at the convergence of passion, technology, and financial innovation.